Is Ares Capital Stock a Buy?

The Motley Fool

OCTOBER 24, 2024

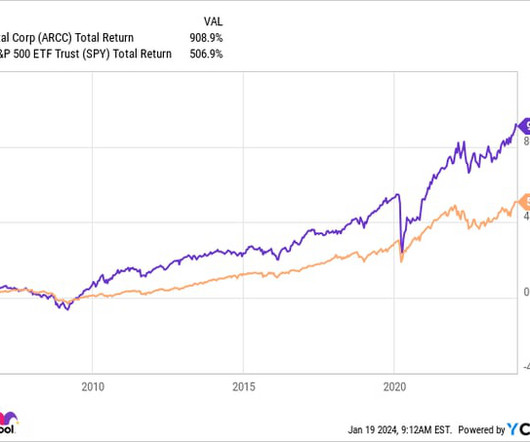

One such stock that has been attracting a lot of attention is Ares Capital (NASDAQ: ARCC) , which at its current share price yields a massive 8.9%. Why does Ares Capital pay such a high dividend? At its current price of $21.65, Ares Capital only trades at a 10% premium to its net asset value. Should you invest in it today?

Let's personalize your content