Could Buying Opendoor Stock Today Set You Up for Life?

The Motley Fool

NOVEMBER 3, 2024

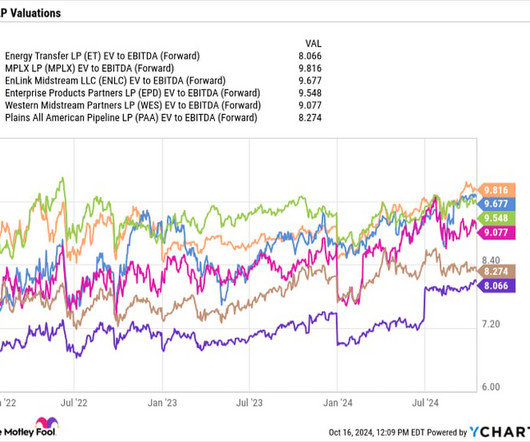

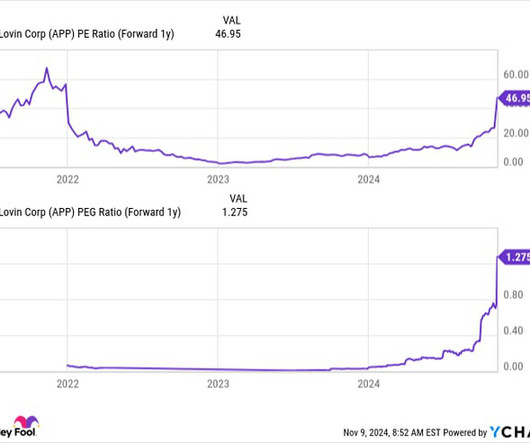

That momentum continued in 2022, but the pressure of renovating and reselling those homes boosted its operating expenses, squeezed its adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) margins, and caused its net losses to widen. Metric 2021 2022 2023 1H 2024 Revenue $8.0

Let's personalize your content