History Says This 7%-Yielding Stock Will Pay You a Bigger Dividend Next Year, Even If There's a Recession

The Motley Fool

AUGUST 25, 2024

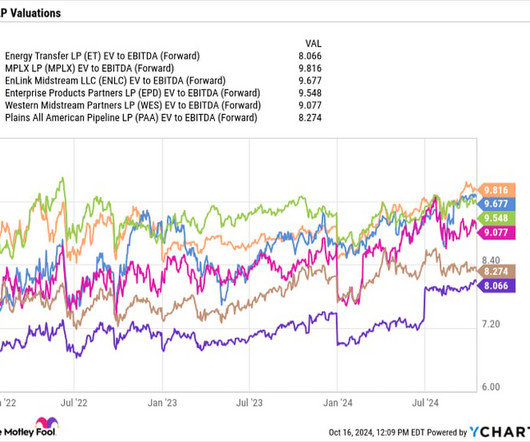

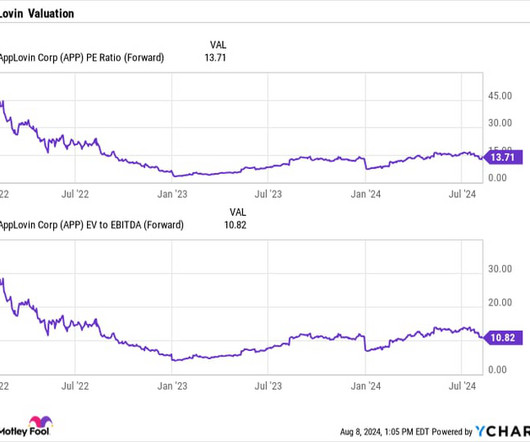

The leading North American pipeline and utility operator generates very durable cash flow and has very visible growth prospects. Enbridge currently gets 98% of its earnings before interest, taxes, depreciation, and amortization (EBITDA) from stable cost-of-service or contracted assets. times target range.

Let's personalize your content