3 Midstream Stocks to Buy With $5,000 and Hold Forever

The Motley Fool

NOVEMBER 26, 2024

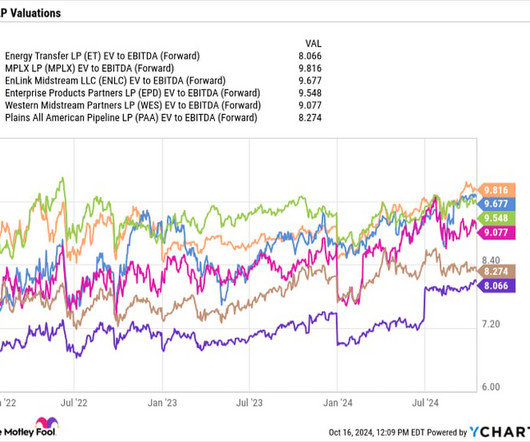

The sector has gone through a transformation in the past decade, with midstream companies reducing leverage and being more disciplined when it comes to funding growth projects. Even better, the company has said it could pay excess distributions once its leverage is below 3 times and it has excess free cash flow.

Let's personalize your content