MainePERS makes $200m alternatives commitment

Private Equity Wire

NOVEMBER 19, 2024

of its total assets. Alternative investments make up a substantial portion of MainePERS’ portfolio, accounting for 57.5%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Private Equity Wire

NOVEMBER 19, 2024

of its total assets. Alternative investments make up a substantial portion of MainePERS’ portfolio, accounting for 57.5%

Private Equity Wire

NOVEMBER 28, 2024

Grifols shares tumbled 10% on Wednesday after sources revealed that Canadian private investment giant Brookfield Asset Management is planning to abandon its takeover bid for the Spanish pharmaceutical company, according to a report by Bloomberg. Both Grifols and Brookfield declined to comment on the latest developments.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Motley Fool

AUGUST 26, 2024

What better place to find it than the portfolios of billionaire asset managers? It's a strategy that makes sense as long as you, of course, do your own due diligence as well. After all, your strategy and allocation will likely look different than Warren Buffett's. Here's why. It offers growth, but it's not very risky.

The Motley Fool

NOVEMBER 8, 2024

We'll also provide an update on our asset management activities, our recent dividend declarations, our expectations for dividends going forward, our recent investment activities and current investment pipeline, and several other noteworthy updates. We've also continued to produce positive results for our asset management business.

The Motley Fool

AUGUST 27, 2023

Investors still need to do their due diligence to determine which fallen stocks represent strong businesses. broadband, property and casualty insurance, and asset management. million 52% Asset management revenue $0 $145,493 - Data source: Boston Omaha Of particular interest is the asset management revenue.

XY Planning Network

JUNE 13, 2022

Outside investment managers—such as TAMPs and robo-advisors—are a popular solution for advisors seeking to offer clients expert asset management services without needing to hone that expertise themselves or simply spend the time doing it (as in financial planning-only firms). 5 MIN READ.

The Motley Fool

JANUARY 5, 2024

Moreover, the company's balance sheet strength and disciplined approach to due diligence provides Ares with some differentiated product offerings. In fact, even Warren Buffett owns a position in Ares through Berkshire Hathaway 's subsidiary New England Asset Management. The company's 9.6%

Private Equity Wire

MARCH 27, 2025

Decarbonisation is a sector known well to Infranity a specialist asset management company with 11bn AUM, formed as a strategic partnership between three Managing Partners and the Generali Group. Still, during due diligence, Infranity had other factors to consider regarding the acquisition’s long-term viability.

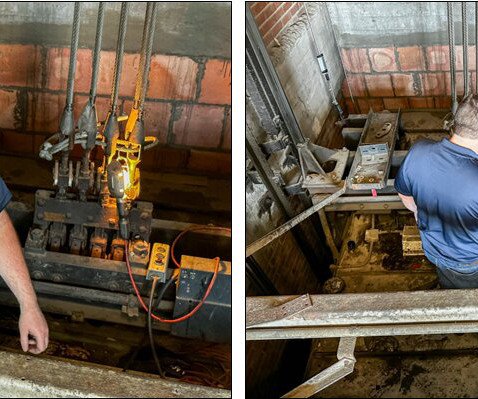

Private Equity Professional

SEPTEMBER 26, 2024

Source: ATIS ATIS also offers a range of specialized services, such as due diligence assessments for real estate investors, door lock monitoring, and hydraulic oil testing, which are essential for maintaining the safety and efficiency of elevator systems.

Private Equity Insights

DECEMBER 11, 2023

An investor group consisting of Arkhouse Management and Brigade Capital has made a $5.8bn offer to take department store chain Macy’s (M.N) read more Arkhouse and Brigade Unveil $5.8bn Bid to Take Macy’s Private An investor group consisting of Arkhouse Management and Brigade Capital has made a $5.8bn offer to.

Private Equity Insights

NOVEMBER 2, 2023

An agreement could be reached in the coming months depending on the outcome of the due diligence, the people said. Read more Brookfield closes infrastructure debt fund at $6bn Brookfield Asset Management closed its Brookfield Infrastructure Debt Fund III at over $6bn, which. and Avic Trust Co.

Private Equity Wire

MARCH 12, 2025

Global alternative investment firm HIG Capital has acquired a majority stake in Protos, an Italy-based independent technical consulting firm for the financial sector, in partnership with the companys existing management team.

Pension Pulse

FEBRUARY 10, 2025

billion deal: Canadas BCI, one of the countrys largest asset managers, will buy BBGI Global Infrastructure S.A. With this take-private deal, BCI will grow its global infrastructure portfolio and use BBGI's experienced management team to add more assets as they come available. billion ($1.32-billion),

Private Equity Wire

DECEMBER 14, 2023

Our due diligence process, surpassing industry norms, mitigates bias, and notably, 30% of our portfolio has at least one woman co-founder. PEW: What steps are you taking to ensure ESG factors are effectively managed within portfolio companies? She started her career at the hedge fund BlueCrest and holds an MSc in Chemistry.

Private Equity Insights

JUNE 28, 2023

The three-person leadership team will be led by co-managing partner Danny Graham, a manager research and due diligence head who left Bear Sterns & Co. About five years ago, the Samsons picked out their successors from within Landmark’s ranks. Trip Samson said he and Allyson have sold about 18.5%

Private Equity Wire

FEBRUARY 13, 2025

The winners are: Managers Emerging Fund Raising of the Year: Buyout – 21 Invest (21 Invest Continuation Fund) Emerging Fund Raising of the Year: Co-invest – Qualitas Funds (Qualitas Funds Direct II) Emerging Fund Raising of the Year: Direct Lending – Foresight Group Holdings (Midlands Engine Investment Fund II) Emerging Fund Raising (..)

The Motley Fool

AUGUST 9, 2024

We're also providing updates on our asset management activities, our recent dividend declarations, our expectations for dividends going forward, our recent investment activities and current investment pipeline, and several other noteworthy updates. We've also continued to produce positive results in our asset management business.

Private Equity Wire

NOVEMBER 28, 2023

Starting her career in environmental due diligence for mergers and acquisitions (M&A), Laura now works with investors, asset managers, and their portfolio companies to develop meaningful ESG strategies with a focus on data collection, reporting, and value creation.

Insight Partners

DECEMBER 5, 2024

Regulatory regimes like MIFID II require banks, asset managers, hedge funds, etc., In recent years, several startups have emerged to streamline search and knowledge management, leveraging AI for front-office research, analysis, and decision-making.

Private Equity Wire

JUNE 20, 2023

Collaborating to achieve excellence in compliance Submitted 20/06/2023 - 1:54pm PARTNER CONTENT Emerging managers are facing a developing regulatory landscape which places an ever-growing burden on their operations. Are there upcoming regulatory changes which could affect your business and that of your clients?

Private Equity Wire

SEPTEMBER 6, 2023

Cibus Capital sells Innoliva to Fiera Comox Submitted 06/09/2023 - 11:16am Cibus Capital's (Cibus) Cibus Fund I has signed a share purchase agreement to sell the Iberian extra virgin olive oil producer and processor, the Innoliva Group (Innoliva), to the global private asset manager, Fiera Comox Partners (Fiera Comox).

The Motley Fool

AUGUST 3, 2023

Jim Connolly -- Executive Vice President, Asset Management Thanks Jeff. We're not getting into a lot of detail on that asset sale. It is the contract, still subject to some final due diligence. We have -- I talked about in the past of a handful of assets. Good morning. We had a 19.3%

The Motley Fool

NOVEMBER 3, 2023

We'll also be providing updates on our asset management activities, our recent dividend declarations, our expectations for dividends going forward, our current investment pipeline, and several other noteworthy updates. We've also continued to produce attractive results in our asset management business.

Pension Pulse

JULY 3, 2024

Sarah Rundell of Top1000funds reports AIMCo talks total portfolio approach, private credit, and risk: Alberta Investment Management Corporation, AIMCo, the $160 billion asset manager for pensions, endowments and insurance groups in Canada’s western province, is developing a total portfolio approach in private assets.

Pension Pulse

FEBRUARY 18, 2025

Last week, BCI issued a press release that it and Macquarie Asset Management offered to take Renewi PLC private: BCI and Macquarie Asset Management, through Earth Bidco B.V., Renewi agreed to give Macquarie access to confirmatory due diligence and said the offer is at a value that it would be inclined to recommend.

Private Equity Wire

JUNE 27, 2023

Among the 27% of respondents to integrate AI, all were doing so to improve deal sourcing, 92% portfolio management, and 85% deal due diligence (see fig. Green was formerly Partner and Head of Asset Management at AnaCap Financial Partners before taking over the helm following its Equipped AI’s spinout from Anacap in 2021.

Pension Pulse

SEPTEMBER 18, 2024

The IMCO is pursuing private asset investments exclusively through collaboration deals with general partners, she says, adding these arrangements require increased speed and nimbleness on the part of institutional investors.

Pension Pulse

SEPTEMBER 12, 2023

Our job is due diligence, and for deals that require a level of speed that makes the due diligence difficult, well, we won’t do the deal. focus on Quality in a challenging Market Kim is also preparing for tougher returns in the asset class ahead. I like to be able to sleep at night.”

Pension Pulse

OCTOBER 11, 2024

after the asset manager reported that its assets under management had hit a record high for the third straight quarter. That's a good start to earnings season," said Evan Brown, Portfolio Manager and Head of Multi-Asset Strategy, UBS Asset Management, adding that it bodes well for the economy.

Sara Grillo

AUGUST 25, 2023

Please conduct your own due diligence and come to your own decision. I wrote a bunch of consumer advocacy blogs here to protect people from all the BS. Also, please understand that this is not an endorsement of any particular company or person.

Pension Pulse

SEPTEMBER 6, 2023

The Managed Funds Association industry group said it continues to have concerns that the new requirements will hike costs and curb investment opportunities. Castle Hall has identified 10 likely outcomes as investors - large and small - receive new levels of transparency over their alternative asset investments.

The Motley Fool

NOVEMBER 3, 2023

Michele Reber -- Senior Director, Asset Management Thank you and good morning. At this point, Omega is in discussions with a potential new tenant with the goal of a year-end close, subject to the normal due diligence, satisfactory documentation, and regulatory approvals. You may begin. Have a great day.

Trivest Partners

NOVEMBER 1, 2022

With its larger team, Seneca can lead or assist the other independent sponsor(s) in model building, CIM and management presentation development, conducting due diligence, and other important execution items.

Pension Pulse

AUGUST 8, 2023

At OMERS he will have accountability and oversight for our global infrastructure investment and asset management programs. OMERS Infrastructure manages approximately C$34 billion in assets and had a 5-year average net return of 10.2% to the end of 2022.

The Motley Fool

JANUARY 13, 2024

So overall, I would say it's a supplement, not a replacement for some good old due diligence. It has further growth potential in expanding some of its asset management services. Vinci has a solid track record doing what it does well. It has impressive returns on capital, significant growth.

Pension Pulse

JANUARY 23, 2024

Our extensive presence in this asset class and our local resources enable us to support the expansion of our logistics portfolio in the APAC region, said Pallavi Bhargava, Senior Director, Investments and Asset Management, Asia-Pacific, Ivanhoé Cambridge.

Pension Pulse

MAY 17, 2023

The 77-year-old billionaire told the Financial Times that big asset managers had competed aggressively to lend to the largest private equity groups as money poured into their coffers in 2020 and 2021, raising questions over the due diligence the funds conducted when they agreed to provide multibillion-dollar loans.

Sara Grillo

MAY 16, 2022

Please conduct your own due diligence and come to your own decision. Evanson Asset Management. Please subscribe to my newsletter to receive updates that raise awareness of consumer financial issues, so you can avoid being taken advantage of by the financial services industry. 450 start up. 139 per month.

The Big Picture

OCTOBER 31, 2023

For, for hedge fund or for, 00:06:29 [Speaker Changed] So that was actually Montgomery Asset Management. But they started an asset management division and I, my family and I moved out to California and that was my first job in being a portfolio manager, was running a small cap fund for them back in 1996.

The Big Picture

JANUARY 9, 2024

But I do think that like if you are a broadly diversified, enormous asset manager, you do have to think about your portfolio primarily in systemic ways and not in like competitive decisions that your individual companies are making. How, how indexing works and how big asset managers like BlackRock or Vanguard or State Street work.

The Big Picture

FEBRUARY 28, 2023

And I went to pitch this asset management guy on why he should come be a part of that process. When I came up in the industry, when a company would come up for sale, we would have four or five months to research that business, and to do due diligence, and to meet the management team, to build our models.

Private Equity Professional

MARCH 11, 2025

Keppel Capital is the asset management arm of Keppel Corporation , a Singapore-based multi-business company that specializes in managing investments in infrastructure, real estate, and communications. We are excited to build on our successes with our new partners at Keppel Capital.

The Motley Fool

JUNE 26, 2023

Crypto investors and enthusiasts envision lighting-fast, low-fee payment alternatives, digital banking apps with ultra-personalized feature sets, and radically different solutions for copyright, asset management, and automated contracts. Many of the leading cryptocurrencies make sense as investments in this rapidly evolving market.

Pension Pulse

JUNE 1, 2023

A unique collaboration to build sustainable finance Innocap, a global leader in managed account platforms, will act as the investment fund manager for the Investi Fund and will provide a rigorous institutional framework for due diligence, risk management, and ongoing monitoring.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content