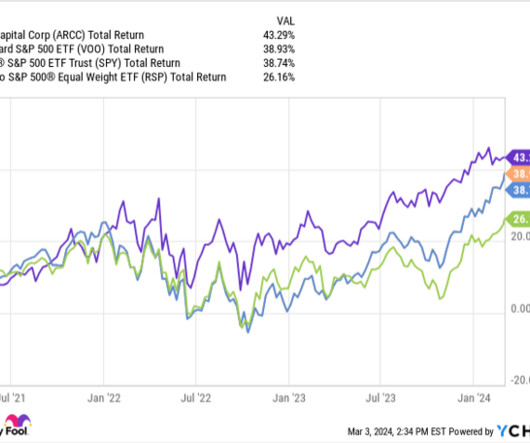

Investing $100,000 in These 3 Ultra-High-Yield Dividend Stocks Could Bring $10,000 in Passive Income to Your Portfolio in 2024

The Motley Fool

JANUARY 5, 2024

One of the best ways to create wealth is by investing in companies that pay a dividend. While many different types of companies pay dividends, business development companies (BDCs) represent a unique opportunity. BDCs are required to pay out 90% of their taxable income to investors each year.

Let's personalize your content