3 High-Yield Dividend Stocks You Can Buy Now and Hold Forever

The Motley Fool

AUGUST 23, 2023

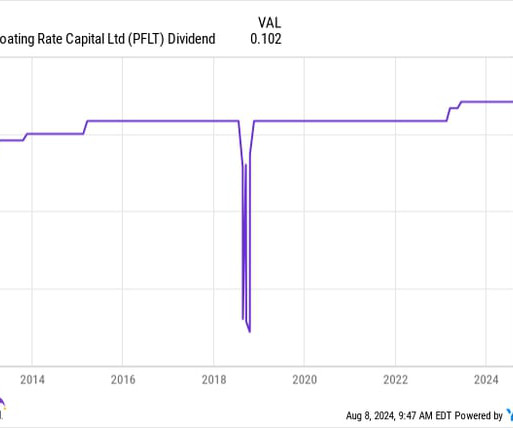

With a steadily growing telecom business, though, its payout could rise at a low single-digit percentage throughout your retirement years. PennantPark Floating Rate Capital PennantPark Floating Rate Capital (NYSE: PFLT) is a business development company. The Motley Fool has positions in and recommends Bank of America.

Let's personalize your content