1 Ultra-High Dividend Yield Stock to Buy Hand Over Fist in 2024

The Motley Fool

DECEMBER 15, 2023

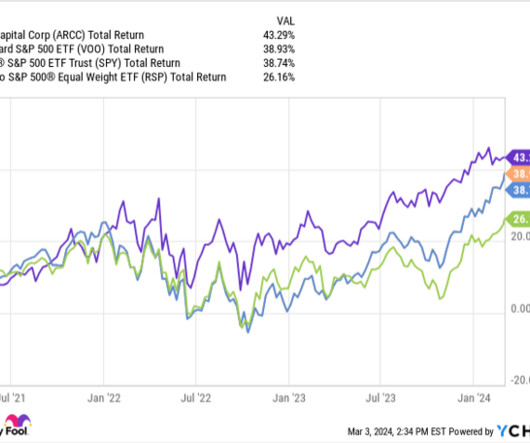

Business development companies (BDCs) can be a great source of dividend income, in part because they are required to pay out at least 90% of their taxable income each year as dividends. One leading BDC that has consistently outperformed the S&P 500 is Ares Capital (NASDAQ: ARCC). What makes Ares Capital different?

Let's personalize your content