This Little-Known, Small-Cap Company Might Be the Safest 11%-Yielding Dividend Stock on the Planet

The Motley Fool

JUNE 20, 2024

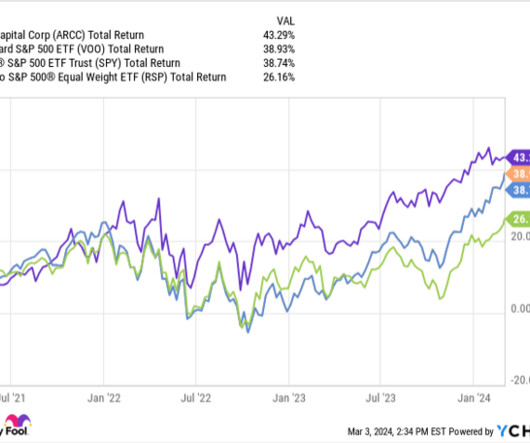

Companies that are profitable on a recurring basis, have proven they can navigate economic downturns, and are capable of providing transparent long-term growth outlooks are precisely the type of businesses that investors expect to increase in value over the long run. For instance, the company depends on a strong U.S.

Let's personalize your content