Blackstone taps Goldman Sachs leveraged finance head to lead European private credit origination

Private Equity Insights

MARCH 27, 2025

Based in London, Ashcroft steps into the role previously held by Jurij Puth, who leaves the firm after 18 years.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Private Equity Insights

MARCH 27, 2025

Based in London, Ashcroft steps into the role previously held by Jurij Puth, who leaves the firm after 18 years.

Private Equity Insights

FEBRUARY 19, 2025

This marks one of the few significant acquisitions in Europes leveraged finance market amid a scarcity of M&A activity in recent years. This marks one of the few significant acquisitions in Europes leveraged finance market amid a scarcity of M&A activity in recent years. Capitals acquisition of Kantar Media. Can`t stop reading?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Private Equity Wire

JANUARY 14, 2025

Major transactions included a $6.9bn consortium deal for investment platform Hargreaves Lansdown, a $5.5bn buyout of cyber security company Darktrace by Thoma Bravo, and Brookfield’s $3.8bn investment in French renewable energy developer Neoen. Smaller deals saw faster growth globally than in Europe.

Private Equity Insights

FEBRUARY 2, 2024

are in talks to provide as much as $8 billion in financing for a buyout of DocuSign Inc. and Deutsche Bank AG are also among the lenders considering a role in funding what would be the largest leveraged buyout of the year so far, according to the people, who asked not to be identified discussing the transaction. KKR & Co.

Private Equity Insights

JANUARY 13, 2025

Private equity firms have driven buyout activity to $133bn in 2024, a 78% increase compared to the previous year. US-based PE firms have been particularly active, leveraging the strong dollar to acquire undervalued assets. This growth outpaced the global rate of 29%, highlighting Europes appeal for opportunistic investments.

Private Equity Insights

MARCH 27, 2025

Despite the reduced fund size, the firm remains confident in its ability to attract long-term limited partners, leveraging its strong track record and sector expertise. Founded in 1992, Madison Dearborn has long focused on investments across healthcare, financial services, technology, and government-related sectors. Can`t stop reading?

Private Equity Insights

MARCH 12, 2025

Lower interest rates are expected to further fuel leveraged buyouts, setting the stage for an active 2025, Deloitte reported. Large buyouts accounted for 42% of total transactions in 2024, while smaller deals comprised 30%. increase from the previous year. Bolt-on acquisitions have become a key strategy, representing 27-31.5%

Private Equity Insights

JANUARY 14, 2025

Directional Capital, which already manages Pizza Huts operations in Denmark and Sweden, is expected to leverage its expertise to revitalise the UK business. HWS has a complex ownership history, including a 2018 management buyout led by UK chief executive Jens Hofma, backed by Pricoa Capital Group.

Private Equity Wire

OCTOBER 9, 2024

Investment banks, which faced significant losses on risky merger and acquisition (M&A) loans due to a spike in global interest rates, are now aggressively returning to the leveraged buyout (LBO) market — one of the most profitable sectors in finance, according to a report by Bloomberg. Lending limits have also increased.

Private Equity Insights

FEBRUARY 27, 2025

The firms acquired Adevinta in 2023 in one of Europes largest leveraged buyouts backed by private credit. The private equity firms aim to refinance or reprice Adevintas existing 4.5bn debt and may raise an additional 2bn, potentially for a shareholder dividend, according to sources familiar with the matter.

Private Equity Wire

NOVEMBER 11, 2024

The loosening of credit conditions is likely to help private equity by easing borrowing constraints, which have slowed deal-making, while lower credit costs could also relieve pressure on portfolio companies that had taken on costly leverage amid high borrowing costs, smoothing the path for exits.

Private Equity Insights

JUNE 8, 2024

Ultra-rich individuals and families worth more than $150bn are helping drive a resurgence in private equity buyouts, providing capital for some of the year’s biggest acquisitions to overcome a tough dealmaking environment. read more The post Wealthy Families Fuel $20bn Private Equity Buyout Wave appeared first on Private Equity Insights.

Private Equity Wire

JANUARY 9, 2025

Buyout firm Energy Capital Partners (ECP) and its co-investors are edging closer to agreeing a deal for the $30bn sale of Calpine to Constellation Energy, according to a report by Reuters citing unnamed sources familiar with the matter.

Private Equity Professional

FEBRUARY 14, 2025

“Jewett Automation has an outstanding reputation for leveraging cutting-edge technical expertise and delivering custom automation solutions across diverse industries,” said Shirish Pareek , an industry partner at McNally Capital. McNally Capital is currently investing out of its committed buyout fund, McNally Capital Fund II LP.

Private Equity Wire

DECEMBER 12, 2024

As large buyout firms face growing pressure to return capital to investors, sellers are expected to adjust their price expectations, making transactions more feasible. A rebound in leveraged buyout volumes is expected to be driven by falling interest rates, an improved financing landscape, and the rising influence of artificial intelligence.

Financial Times M&A

APRIL 20, 2022

Plus, the powerful government officials standing between Toshiba and Japan’s largest buyout, and Just Eat considers selling Grubhub less than two years after buying it

Private Equity Insights

DECEMBER 9, 2023

is leading a €950m ($1bn) loan package to back Permira’s buyout of Gossler, Gobert & Wolters, people with knowledge of the matter said. trillion private credit market is increasingly winning out over bank syndicates that had traditionally financed large buyouts with leveraged loans. Blackstone Inc.

Private Equity Wire

DECEMBER 20, 2024

While the size of the offering has not been finalised, sources suggest the IPO could raise up to $5bn, presenting a lucrative exit opportunity for its private equity owners who acquired Medline in a $34bn deal in 2021, one of the largest leveraged buyouts of the past decade.

Private Equity Wire

NOVEMBER 6, 2024

Alperovich has extensive experience advising private equity sponsors and their portfolio companies on a broad range of transactions, including mergers and acquisitions, leveraged buyouts, minority and growth investments, joint ventures, carve-outs and divestitures, restructurings, SPACs and de-SPACs, and investments in general partners.

Private Equity Insights

JULY 10, 2023

Over the past 18 months, financial data providers Reorg and Leveraged Commentary and Data have both also traded hands in big money deals. Buyout group Permira took a majority stake last August in Reorg which valued the distressed debt and bankruptcy information provider at about $1.3bn.

Private Equity Wire

MAY 9, 2024

Hastings, who joins from Eversheds Sutherland, is a finance lawyer focused on leveraged and acquisition financing. His experience covers complex domestic and international transactions in support of M&A activity, leveraged buyouts, refinancing and distressed or opportunistic investments.

Private Equity Wire

DECEMBER 16, 2024

Initially, Carlyle explored using a traditional leveraged buyout bank loan for the acquisition, but ultimately opted for private credit, the source added without providing further details. Australias leveraged buyout activity has been gaining traction, driven by narrowing valuation gaps between buyers and sellers.

Private Equity Wire

JANUARY 13, 2025

Buyout firms have long relied on controversial loans backed by equity stakes to enhance fund returns, but growing investor criticism has triggered a slowdown, according to a report by Bloomberg UK. Many firms borrowed against their portfolio companies to sustain the private market boom while dealmaking dwindled.

Private Equity Wire

JULY 29, 2024

The buyout attracted interest from the likes of MetLife and Todd Boehly’s Eldridge Industries. Hayfin’s management had previously considered selling the entire business but ultimately decided to explore a self-funded buyout as BCI sought to exit. Hayfin manages over €30bn in assets.

Private Equity Wire

AUGUST 9, 2024

Private equity buyout activity made a resurgence in the first half of the year, with direct lending emerging as a crucial component in the current market topography, according to the latest data from Mergermarket and Debtwire. As in the US, the technology sector topped the table with buyouts totaling €36.5bn.

AltAssets

APRIL 17, 2024

Energy transition buyout specialist Magnesium Capital has scored a €135m hard cap close of its debut fund, well above its €100m target. The post Magnesium Capital leverages deal-by-deal success to hit €135m debut fund hard cap first appeared on AltAssets Private Equity News.

The Motley Fool

AUGUST 7, 2023

After about a year of being weighed down by roughly $80 billion of leveraged loans, banks are starting to offload some of that debt again, a sign that investors are starting to believe in the sweet spot of lower inflation without a recession to follow.

Private Equity Wire

OCTOBER 15, 2024

Banks are at risk of losing out on significant underwriting fees from two of Europe’s largest buyout deals, as private-equity firms are adjusting debt terms mid-process, affecting their ability to generate revenue, according to a report by Bloomberg. This clause would otherwise require new debt to be issued after the acquisition closes.

Private Equity Professional

DECEMBER 18, 2024

Sun Capital invests from $50 million to $300 million in leveraged buyouts, equity, and debt in companies with more than $32 million in EBITDA that can benefit from its in-house operating professionals and experience. Sectors of interest include business services, consumer, healthcare, industrial, and technology.

Private Equity Wire

MARCH 6, 2024

Leverage levels in private credit will increase as alternative asset managers’ rapid capital deployment in turn increases their share of the private credit market, according to a private credit research report by Moody’s Investor Services.

Private Equity Insights

AUGUST 18, 2023

Get the week’s top news delivered directly to your inbox – Sign up for our newsletter Sign up Source: Private Equity Wire Can’t stop reading?

Private Equity Wire

NOVEMBER 15, 2024

The potential move comes as private equity firms look to exit older investments after a period of slowed deal-making, largely due to high interest rates that have increased the cost of financing leveraged buyouts.

Financial Times M&A

MARCH 16, 2023

Specialist buyers may not get massive returns but high management fees can make up the difference

Private Equity Wire

OCTOBER 24, 2024

The highly anticipated €16bn ($17.36bn) acquisition of Sanofi’s consumer health unit by buyout firm Clayton, Dubilier & Rice (CD&R) could signal a surge in large private equity deals across Europe, according to a report by Bloomberg citing comments from investors and analysts.

Private Equity Wire

OCTOBER 4, 2024

K2 Insurance Services has joined the growing list of companies looking to reduce borrowing costs by swapping private credit debt for leveraged loans by initiating $500m refinancing deal, according to a report by Bloomberg.

Private Equity Wire

MAY 22, 2024

At a time when leveraged buyouts have been subdued — with the few progressing deals witnessing intense competition between banks and private credit lenders — private credit firms have been pushed to reduce pricing and improve terms.

The Motley Fool

SEPTEMBER 24, 2023

She also sees Tesla as a platform company that can leverage its expertise and infrastructure to open up new sources of revenue, such as robotaxis and renewable energy services. An approval may also open the door to a buyout.

Private Equity Wire

JANUARY 24, 2024

Private equity firm CVC Capital Partners has shunned the private credit markets in favour of loans from investment banks to finance two of its latest buyouts – restaurant group La Piadineria and vitamin manufacturer Sunday Natural – according to a report by Bloomberg.

Private Equity Professional

JANUARY 8, 2025

Banks have also taken the plunge to offer product and garner revenue lost within their traditional lending and leveraged finance practices (most notably broadly syndicated loans or BSL). From 2022 through 2024, private-credit-financed buyouts outnumbered BSL financed deals 6 to 1. hedging, treasury), fund financing, and more.

The Motley Fool

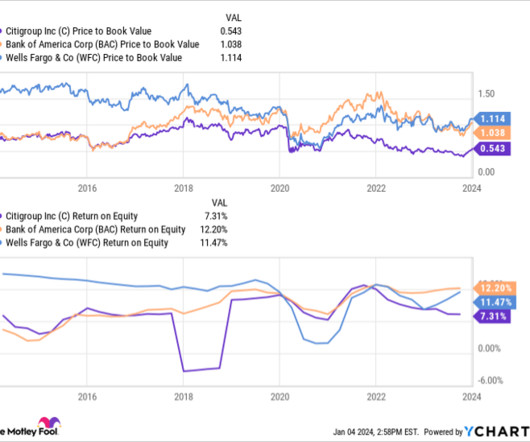

JANUARY 5, 2024

In 2023 alone, around $1 billion was dedicated to restructuring efforts, covering costs like buyout packages and early severance. At their core, banks are essentially leveraged bets on a lending portfolio. Banks typically use debt, or leverage, to boost those returns. Every quarter, it seems, more disruptions are revealed.

Private Equity Insights

DECEMBER 15, 2023

Polaris Capital Group, a Tokyo-based private equity fund, had taken Sogo Medical private in a management buyout worth nearly $850m just last year. By leveraging its expertise and resources, CVC aims to position the pharmacy chain for further success and capitalize on the lucrative pharmaceutical sector in Japan.

The Motley Fool

OCTOBER 28, 2023

This buyout also sets the stage for Microsoft to leverage Activision's gaming community and creative firepower to build out an expansive metaverse. Well, let's talk about Microsoft's recent $69 billion acquisition of Activision Blizzard. This isn't just about getting your hands on the Call of Duty or World of Warcraft game franchises.

Private Equity Insights

MARCH 28, 2025

While fundraising for private credit strategies has remained more robust than for traditional buyout funds, the market is becoming more competitive. Institutional investors are showing signs of allocation fatigue, and the growing number of private credit players has intensified the battle for capital.

The Motley Fool

JANUARY 5, 2024

What I mean by that is the company has the flexibility to work with much larger enterprises and even assist in more complex financing transactions such a leveraged buyouts. Moreover, the company's balance sheet strength and disciplined approach to due diligence provides Ares with some differentiated product offerings.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content