Alphi Capital invests in K2 Fasteners

PE Hub

MARCH 5, 2024

The post Alphi Capital invests in K2 Fasteners appeared first on PE Hub. K2 Fasteners is a distributor of stainless steel and other corrosion resistant fasteners.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Capital Investments Related Topics

Capital Investments Related Topics

PE Hub

MARCH 5, 2024

The post Alphi Capital invests in K2 Fasteners appeared first on PE Hub. K2 Fasteners is a distributor of stainless steel and other corrosion resistant fasteners.

PE Hub

FEBRUARY 20, 2024

Stacker Holdings and Salem Investment Partners also participated in the transaction. The post Tecum Capital invests in manufacturer CM Industries appeared first on PE Hub.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PE Hub

MARCH 7, 2024

ICG Capital served as financial advisor to ORC on the transaction. The post Carousel Capital invests in O.R. Colan Associates appeared first on PE Hub.

PE Hub

SEPTEMBER 14, 2023

The post Audax Strategic Capital invests in B2B company EverService appeared first on PE Hub. EverService is a portfolio company of Sunstone Partners.

PE Hub

MARCH 11, 2024

Monroe has allocated approximately $250 million of additional capital to Second Avenue through a mix of debt and equity capital. The post Monroe Capital invests in single-family rental platform Second Avenue appeared first on PE Hub.

PE Hub

NOVEMBER 28, 2023

The post LFM Capital invests in SisTech Manufacturing appeared first on PE Hub. SisTech manufactures PCBAs for defense, aerospace, industrial and consumer applications.

PE Hub

MARCH 1, 2024

The investment will be used by Wolter for growth and expansion. The post BBH Capital invests in manufacturer Wolter appeared first on PE Hub.

PE Hub

FEBRUARY 13, 2024

Tecum, alongside Hilltop Opportunity Partners, provided capital to support the growth of the Five Point led by Casla Partners, the founders, and the management team. The post Tecum Capital invests in Five Point Dental Specialists appeared first on PE Hub.

PE Hub

JANUARY 30, 2024

The post Arlington Capital invests in injectable drugs maker Afton Scientific appeared first on PE Hub. Tom Thorpe, founder and CEO of Afton, will continue to lead the company and remain a material shareholder going forward.

PE Hub

AUGUST 10, 2023

The post Northleaf Capital invests $200m in Tillman FiberCo appeared first on PE Hub. Tillman FiberCo is a broadband network builder and operator.

PE Hub

DECEMBER 5, 2023

The post Hudson Hill Capital invests in software company MarketTime appeared first on PE Hub. Winston & Strawn LLP acted as legal advisor to Hudson Hill.

PE Hub

OCTOBER 31, 2023

The post Boyne Capital invests in film manufacturer ProFusion appeared first on PE Hub. Alex Williamson serves as CEO of ProFusion.

PE Hub

FEBRUARY 15, 2024

The post Walter Capital invests in Charcoal Group of Restaurants appeared first on PE Hub. Charcoal Group of Restaurants is a Kitchener, Ontario-based operator of restaurant brands.

PE Hub

AUGUST 16, 2023

Freedom 3 Capital is an existing Examinetics shareholder. The post Coalesce Capital invests in compliance firm Examinetics appeared first on PE Hub.

PE Hub

JULY 24, 2023

Baird served as financial advisor to Smartlinx while Triple Tree, LLC served as financial advisor to Lone View The post Lone View Capital invests in healthcare workforce platform Smartlinx appeared first on PE Hub.

PE Hub

AUGUST 17, 2023

Based in Toronto, Arcadea Capital is a private equity firm focused on investing in founder-led vertical software companies. The post Arcadea Capital invests in software company Flight Vector appeared first on PE Hub.

PE Hub

FEBRUARY 15, 2024

The post Clarion Capital invests in public affairs firm Narrative Strategies appeared first on PE Hub. Narrative’s executive partners will maintain a significant ownership stake in the company and continue leading operations, with founding partner Ken Spain serving as CEO.

PE Hub

SEPTEMBER 18, 2023

The post SPX Capital invests $45m in Brazilian energy company Combio Energias Renováveis appeared first on PE Hub. As a result of the deal, SPX will acquire a 15.5 percent stake in Combio Energias Renováveis.

PE Hub

MARCH 11, 2024

The post CAI Capital invests in DWB Consulting Services appeared first on PE Hub. DWB is a consultancy providing environmental, forestry and engineering services.

PE Hub

JANUARY 26, 2024

The investment will be used to enable OnPoint to accelerate its product development roadmap, bolster its sales and marketing efforts, and strengthen the company’s customer service. The post Peloton Equity and Fort Maitland Capital invest in medical tech company OnPoint appeared first on PE Hub.

PE Hub

OCTOBER 11, 2023

Citation Capital is backing snacking firm Cibo Vita. The post Ronin brews up craft beverage equipment platform; new shop Citation Capital invests in smart snacking appeared first on PE Hub.

PE Hub

NOVEMBER 21, 2023

The post BlackGold Capital invests in growth of Northbase Finance appeared first on PE Hub. Northbase Finance is a Calgary-based asset-backed financing service provider to underserved markets.

PE Hub

JANUARY 17, 2024

Godspeed Capital invested in MOREgroup in 2022. The post Wind Point acquires brands provider MOREgroup from Godspeed appeared first on PE Hub.

The Motley Fool

JANUARY 10, 2024

Fool.com contributor Parkev Tatevosian describes why capital investment made to this company's asset base can propel it forward. Should you invest $1,000 in Target right now? Stock prices used were the afternoon prices of Jan. The video was published on Jan. and Target wasn't one of them.

PE Hub

MARCH 6, 2024

Based in Houston, Rock Hill Capital invests in the lower middle market. The post Rock Hill and Cynosure invest in Service Truck Depot appeared first on PE Hub.

PE Hub

OCTOBER 16, 2023

Godspeed Capital invests in an architecture and interior design firm. The post Ardian’s Audiotonix eyes large add-ons; RedBird-backed Obra attracts Aquarian investment appeared first on PE Hub.

The Motley Fool

APRIL 20, 2024

The heavy investments that built AT&T's 5G network are finally subsiding. Management expects capital investments to shrink from $23.6 More revenue from subscribers and less capital investment is a formula for increasing profits that can be used to raise AT&T's dividend payout.

The Motley Fool

APRIL 11, 2024

billion worth of capital investment projects. Should you invest $1,000 in Enterprise Products Partners right now? But there are also price increases built into Enterprise's contracts. And then you have to consider the cash flows that will come on line as the MLP completes its $6.8

The Motley Fool

MAY 20, 2024

Moreover, while the downside to launching these new models would be a substantial upfront capital investment -- for retooling the factory, for product-development costs, etc. -- it could result in a lower unit-production cost since these new models would be produced with more advanced materials, tools, and operational technologies.

The Motley Fool

MARCH 16, 2024

How many flights will it take to recoup that capital investment? Without more data, it's impossible to be certain, but with five spaceplanes flying fully loaded flights, and 400 or more total flights per year, it seems likely the company could make back its capital investment within one year of completing its fleet.

The Motley Fool

OCTOBER 27, 2024

Alphabet continues to ratchet up capital investment in its cloud business. The company's capital expenditures have accelerated to $44 billion over the last four quarters. Coincidentally, Microsoft's capital expenditures were almost identical to Alphabet's -- $44 billion -- over the last four quarters.

The Motley Fool

SEPTEMBER 14, 2023

billion worth of capital investment projects to support future growth, with some not expected to be completed until 2026. Enterprise expands its business via large capital investment projects. Add in the 7.5% distribution yield and you can see why dividend investors would find this MLP attractive.

The Motley Fool

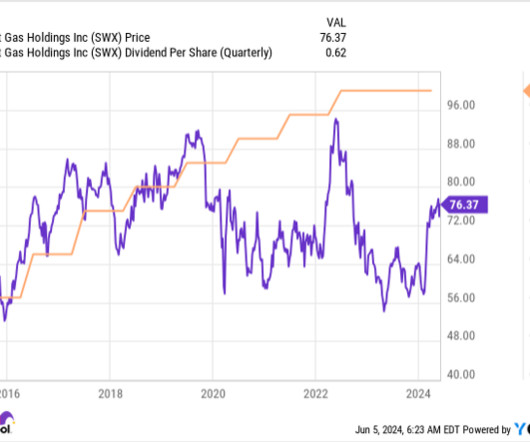

JUNE 9, 2024

That basically suggests that Southwest Gas will sell shares of Centuri over time (though it could also just distribute Centuri shares to Southwest Gas shareholders) to raise capital for its own capital investment needs. between 2024 and 2029 in the regions it serves of Arizona and 2.6% in Nevada, relative to 2.4%

The Motley Fool

SEPTEMBER 2, 2023

Investors are no longer quite as positive about funding capital investments in the midstream sector despite the still vital nature of the services it provides to the global economy. The end goal was for Enterprise to replace its use of issuing equity with internal cash flow to fund more of its own capital investment projects.

The Motley Fool

SEPTEMBER 17, 2023

This capital investment involves the construction of two large-scale nuclear power plants. Some of that money will probably go to debt reduction and some to other capital investment projects. The dividend yield, meanwhile, is around 4.1% What's most interesting about this giant U.S.

The Motley Fool

JUNE 5, 2024

At the same time, O'Malley predicts semiconductor companies will spend "aggressively" on capital investment in the U.S. as they rake in subsidies from the U.S. What's good for Applied Materials should be just as good for its competitor ASML -- so both stocks are rising side by side this morning.

Private Equity Insights

AUGUST 31, 2023

KSL has focused on travel and leisure businesses, deploying about $21bn of capital across its equity, credit, and tactical opportunities funds since 2005. Read more Bain Capital Invests in Sales Tech Startup Apollo.io read more KSL Capital acquires in a $1.4bn deal the owner of 25 U.S.

The Motley Fool

AUGUST 5, 2024

It's a win for Kinder Morgan because it collects predictable cash flows and a win for its customers so that they don't have to shell out multibillion-dollar capital investments to transport fuels from areas of production to areas of consumption and export. But it wasn't always this way.

The Motley Fool

SEPTEMBER 8, 2023

But when Wheaton provides upfront cash, the check can represent a fairly large percentage of the capital investment. The payment it made covered around 78% of the capital investment Vale was making in the Salobo mine. Wheaton provided a concrete example based on a deal it inked with Vale (NYSE: VALE).

The Motley Fool

DECEMBER 3, 2024

The growth from that deal and its capital investments should enable Verizon to continue pushing its high-yielding payout even higher. It's using its financial strength to buy Frontier Communications in a $20 billion deal that will expand its fiber network and earnings.

The Motley Fool

AUGUST 10, 2023

The optical transceiver market has been competitive and highly cyclical, with telecom operators under pressure and therefore making inconsistent capital investments. Infinera's stock has struggled in recent years as it has not been able to parlay its modest revenue growth into sustainable profits. As of July 31, about 18.5%

The Motley Fool

MAY 7, 2024

Hercules Capital Hercules Capital is a business development company ( BDC ) that allows anyone with a brokerage account to participate in exciting venture capital investments. For example, Hercules invested in Palantir Technologies a few years before it began trading publicly.

The Motley Fool

MARCH 15, 2024

Until then, the big story is all the capital investment that will be needed to develop the Delta spacecraft. Virgin Galactic has a long way to go Here's the problem: Virgin Galactic doesn't expect its second-gen spacecraft to take paying passengers into space until early 2026. That's roughly two years from now.

The Motley Fool

OCTOBER 24, 2024

The Japanese auto giant will own over 20% of Joby once the second part of this investment tranche is funded in 2025. Best of all, this landmark partnership extends far beyond capital investment. Image source: Joby Aviation.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content