This Institutional Investor Just Increased Its Stake in Norwegian Cruise Lines by Nearly 10%. Should You Do the Same?

The Motley Fool

JULY 21, 2024

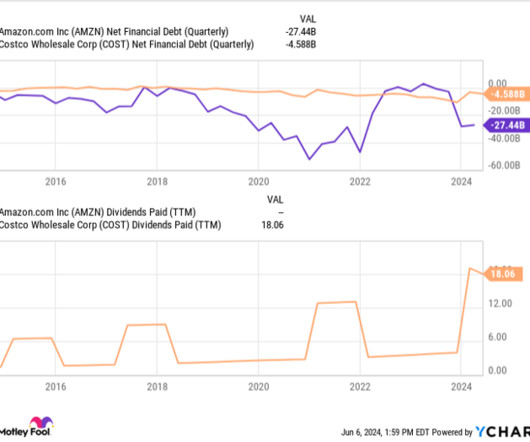

Also, interest will continue to be an ongoing problem due to Norwegian's $14 billion in total debt. Most of that debt came from its prolonged shutdown during the pandemic and remains a tremendous burden given its $362 million in shareholders' equity. In comparison, Carnival's shareholders' equity is $6.8

Let's personalize your content