Is Amazon Web Services (AWS) a Liability for Amazon?

The Motley Fool

FEBRUARY 9, 2024

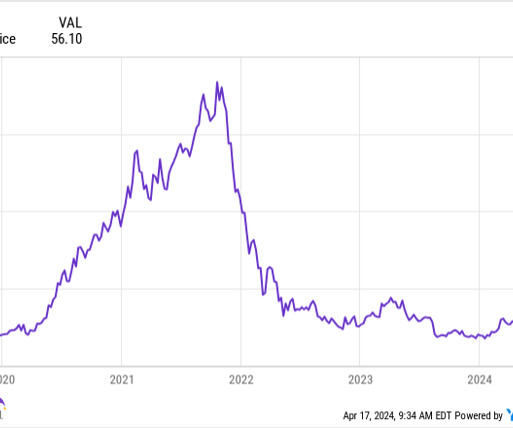

Amazon (NASDAQ: AMZN) is known for e-commerce, but the company has a lot more going for it than that. So, is AWS starting to become a liability for its parent? This allows companies to stay nimble and scale up or down when necessary. Should you invest $1,000 in Amazon right now? AMZN gross profit margin, data by YCharts.

Let's personalize your content