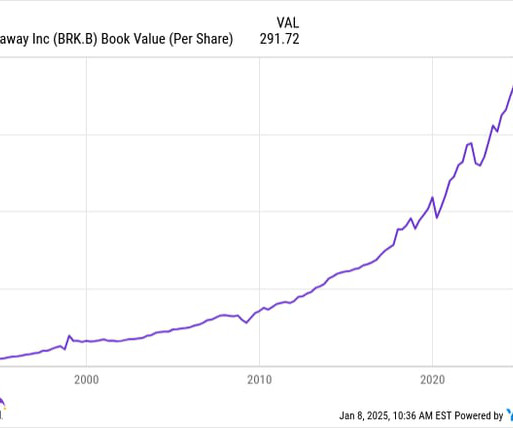

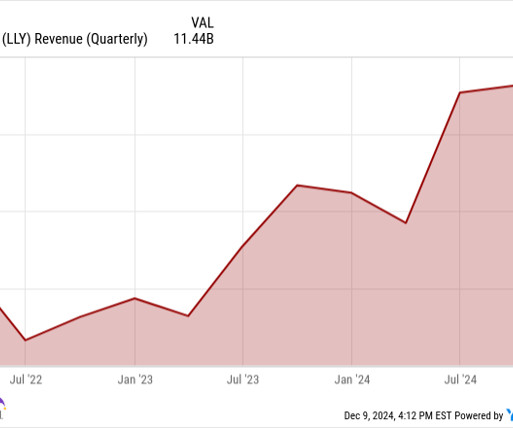

Investing $10,000 in These 3 Growth Stocks 10 Years Ago Would Have Created a Portfolio Worth $3.4 Million Today

The Motley Fool

JANUARY 16, 2025

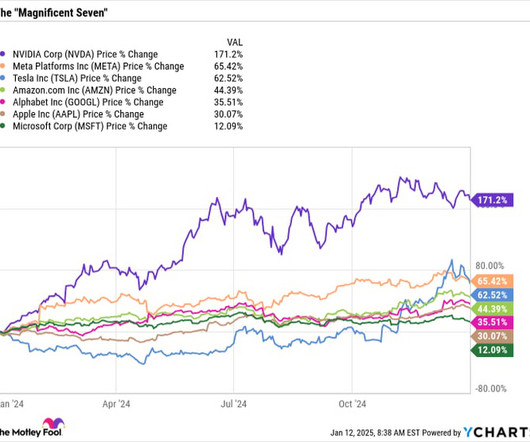

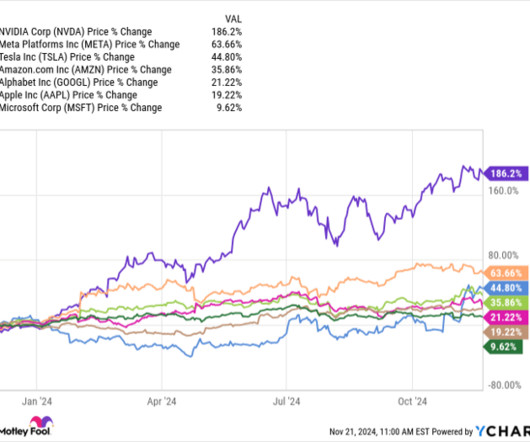

That's why investing in multiple stocks can be an effective strategy because it's almost impossible to predict where a business might end up in the long run. If you hit it big with a few stocks, that can more than make up for underwhelming performances in other areas of your portfolio. million today. million now.

Let's personalize your content