If You'd Invested $1,000 in Amazon Stock 27 Years Ago, Here's How Much You'd Have Today

The Motley Fool

OCTOBER 3, 2024

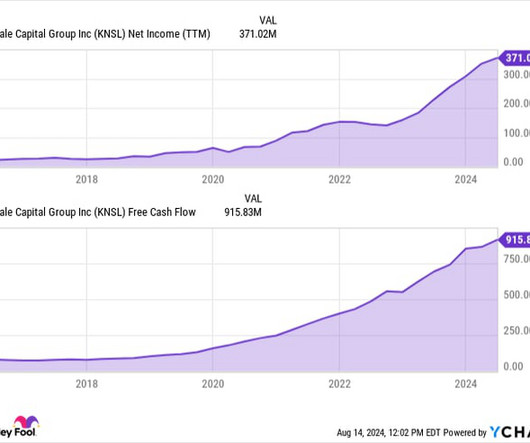

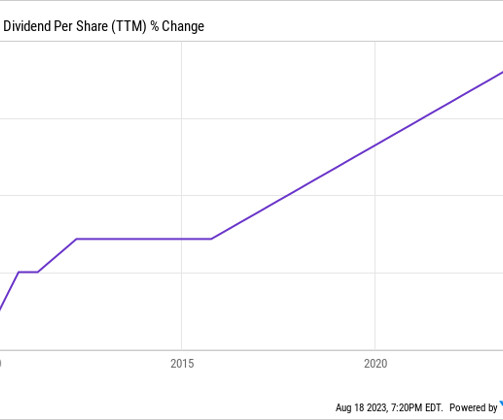

The e-commerce pioneer has evolved from an online bookseller to a conglomerate that leads the way in several niches of retail and technology. Amazon's growth A $1,000 investment at the closing price on the day of the IPO and not sold would be worth roughly $1.87 million today.

Let's personalize your content