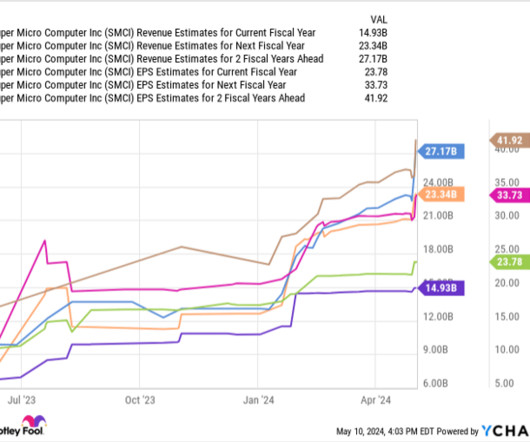

A Once-in-a-Generation Investment Opportunity: 3 Things Smart Investors Should Know About Super Micro Computer Stock

The Motley Fool

MAY 15, 2024

Considering the secular themes fueling AI and the chip market, in particular, Supermicro might look like one of the most compelling investment opportunities out there. Let's break down a few important items to explore when it comes to investing in Supermicro. Should you invest $1,000 in Super Micro Computer right now?

Let's personalize your content