Billionaire Warren Buffett Recently Cut This Stock From Berkshire Hathaway's Portfolio. It Just Dropped 53% In 1 Day. Here's What Investors Need to Know.

The Motley Fool

APRIL 17, 2024

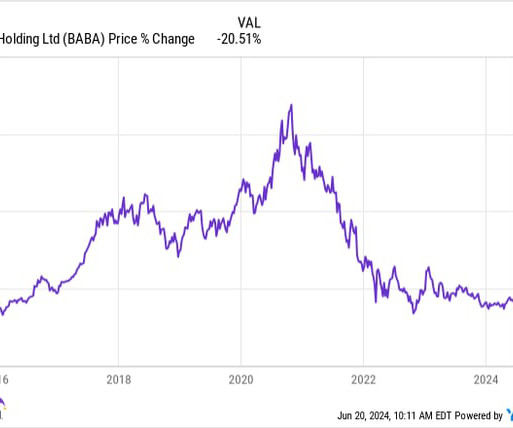

The claims piled onto the already struggling stock, which had previously been a longtime holding of Warren Buffett's conglomerate, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B). Buffett and his team have an excellent track record of evaluating management, which is a big reason for the conglomerate's long-term success.

Let's personalize your content