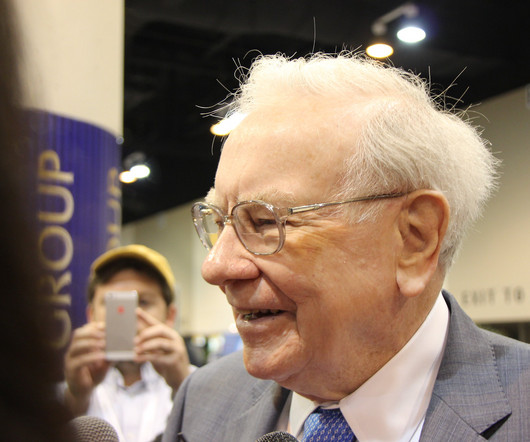

Warren Buffett Just Shunned His Favorite Stock for the First Time Since 2018, and It Could Spell Trouble for the S&P 500

The Motley Fool

NOVEMBER 22, 2024

Warren Buffett is the CEO of the conglomerate Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B). According to Berkshire's 13-F filing for the third quarter of 2024, the conglomerate continued to dump a substantial amount of stock. Finally, the conglomerate sold 25% of what was left during the third quarter. stock market indexes.

Let's personalize your content