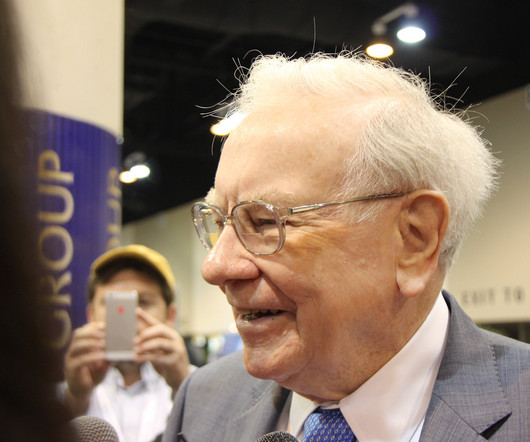

Warren Buffett's $277 Billion Warning That the Stock Market Could Be Headed for Trouble

The Motley Fool

OCTOBER 5, 2024

Warren Buffett has never claimed to be able to predict what the stock market would do over the near term. In a 2008 op-ed for The New York Times , he wrote, "I can't predict the short-term movements of the stock market. I haven't the faintest idea as to whether stocks will be higher or lower a month, or a year, from now."

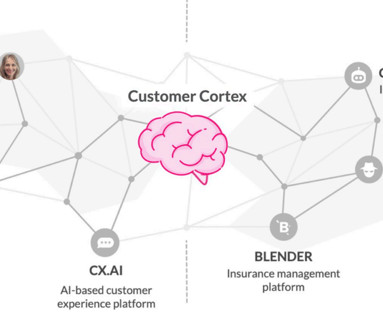

Let's personalize your content