Find untapped deal flow in aged portfolio company holding periods

Private Equity Info

JANUARY 23, 2024

Access untapped M&A deal flow by searching for aged private equity-backed portfolio companies that may be seeking an exit.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Private Equity Info

JANUARY 23, 2024

Access untapped M&A deal flow by searching for aged private equity-backed portfolio companies that may be seeking an exit.

Private Equity Insights

JANUARY 23, 2025

SARA, a newly launched utility-scale renewable energy platform, aims to develop a 500 MW portfolio of greenfield renewable energy projects across Southeast Asia. Its portfolio includes projects in Vietnam, the Philippines, Thailand, and Cambodia.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Private Equity Insights

JANUARY 31, 2025

The potential transaction follows a wave of energy sector M&A activity, though analysts expect deal flow to slow in 2025 as consolidation among private oil and gas firms nears completion. As market conditions evolve, the sale of Camino could attract interest from major energy players looking to expand their natural gas portfolios.

Private Equity Wire

APRIL 26, 2024

In a statement, Daniel Roddick, Founder of Ely Place Partners, said: “Private debt secondary deals have been growing steadily in size and number over the past twelve months. The establishment of a dedicated buyer universe has given LPs confidence to bring large portfolios to market.

Private Equity Insights

FEBRUARY 14, 2025

Ron Kantowitz, managing director and head of direct lending, pointed to favourable market conditions, noting that record capital raised in the private equity sector is driving increased M&A activity and generating strong deal flow.

The Motley Fool

SEPTEMBER 21, 2023

But there's one important negative that has investors worried right now: Realty Income needs a lot of deal flow to grow. But there's another factor here, too: REITs tap the capital markets to raise capital so they can buy the properties that live in their portfolios. Management doesn't share that concern.

Private Equity Wire

JANUARY 23, 2025

After closing SAETF in 2023 at $120m, the fund was reopened in 2024 based on strong deal flow and demand from LPs. Through SARA, SUSI, in close partnership with co-investors BII and FMO, aims to build a 500 MW portfolio of greenfield renewable energy projects across selected Southeast Asian markets by the end of SAETFs fund life.

This is going to be BIG.

OCTOBER 7, 2015

Who is actually building a portfolio whose founders reflect the diversity of the greater population? I went back and calculated the number of companies in the first Brooklyn Bridge Ventures portfolio who have at least one founder who is female, from an underrepresented minority group, or LGBT.

The Motley Fool

SEPTEMBER 9, 2024

Many BDCs focus on specific sectors, making the risk profile of each portfolio vastly different. For this reason, it's very important to look at the overall performance of a BDC's operation in order to gauge the strength of its portfolio and get a sense of its credit controls. Image source: Getty Images.

The Motley Fool

AUGUST 20, 2023

The REIT has two big catalysts ahead that should increase its deal flow and ability to finance new investment opportunities. SK Capital helped finance that deal by selling a portfolio of four critical R&D and manufacturing campuses with 11 properties to W.P. That dividend growth should continue.

This is going to be BIG.

DECEMBER 3, 2020

Having a better overall portfolio of venture capital by adding funds into the mix. Are investors allowed to come into deals that the fund does side by side with the fund? This creates a source of deal flow for investors who aren’t out there full time creating opportunities. Access to the partner.

The Motley Fool

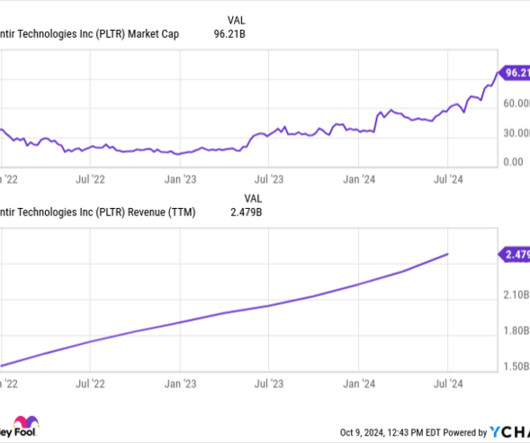

OCTOBER 13, 2024

I think the deals with Microsoft and Oracle bode well for Palantir's chances to continue partnering with the tech sector's largest businesses. Such relationships can help strengthen Palantir's deal flow pipeline and provide many cross-selling opportunities, ultimately serving as lucrative catalysts for the company and the stock.

The Motley Fool

JANUARY 28, 2024

For these reasons, many investors viewed the company as a government contractor and were skeptical of its prospects beyond lumpy public sector deal flow. Moreover, since it was founded nearly two decades ago, the company has fostered strong ties with the U.S. military and its Western allies.

Private Equity Wire

MARCH 14, 2025

According to data from Pitchbook and Affinity’s annual predictions survey, more than a third of nearly 300 respondents identified due diligence criteria as a major factor impacting deal flow. With a 76% increase in the number of funds in operation from 2015 to 2023, the pressure to identify and close deals has never been higher.

Axial

APRIL 10, 2025

Lance shares how Serent approaches value creation, the importance of high gross retention, the role of pricing optimization, and how they are responding to AIs arrival as a threat and opportunity across their portfolio.

Private Equity Insights

FEBRUARY 2, 2024

Progressio SGR, the Italian private equity firm, is raising a new fund, Progressio Investimenti III, in response to LP demand and a doubling of proprietary deal flow over the past five years. As with previous funds, the money will predominantly be spent on proprietary deals and primary buyouts.

Private Equity Wire

JULY 10, 2024

As liquidity constraints put pressure on the private equity industry, the secondaries market is expected to grow substantially over the next twelve months, with fundraising and deal flow set to expand, according to Investec’s latest Secondaries Report, Charting a Course for Further Growth.

The Motley Fool

FEBRUARY 27, 2025

Overall, while navigating a challenging macro-environment, our portfolio continued to demonstrate resilience as we continued to grow our experiential portfolio in a disciplined manner. 100% of the spending was in our experiential portfolio. Overall portfolio coverage remains strong at two times, down slightly from last quarter.

Private Equity Insights

MAY 21, 2024

Discover the advantages of a relationship bank providing leverage on both fund and portfolio level, optimizing your investments for maximum returns. Synergy between Fund- and Portfolio Leverage Aligning fund and portfolio leverage under one bank offers streamlined processes and access to tailored financing solutions.

Private Equity Insights

NOVEMBER 28, 2023

This translates to a $2bn portfolio of investments, with over $1.2bn in dry powder still to be deployed into an attractive market environment. Pantheon’s deep expertise in private equity secondaries attracted investments from a wide range of new and existing clients.

Private Equity Insights

JANUARY 12, 2024

LCP X’s strategy is principally focused on the acquisition of private equity and alternative asset partnership portfolios from large-scale investors as they rebalance their allocations or seek liquidity, while also engaging in smaller opportunities leveraging Lexington’s deep industry relationships.

The Motley Fool

NOVEMBER 26, 2024

While any individual building is a high risk because there's only one tenant, across a large enough portfolio the risk is fairly low. Agree owns around 2,250 properties, which is a large portfolio -- just not quite as large as Realty Income's. Realty Income owns over 15,400 properties, so individual property risk is also fairly low.

The Motley Fool

SEPTEMBER 12, 2024

However, the deal flows and opportunities originating from the public sector tend to be much lumpier than those from the private sector. Relying too much on government business can make forecasting revenue and cash flow difficult. To be clear, being a government contractor is not a bad business, per se. Image source: Palantir.

Private Equity Wire

JANUARY 26, 2024

In a statement, Blair Faulstich, Head of US Private Debt at BSP, said: “The private credit asset class has been established as an integral part of the leveraged finance ecosystem and as an all-weather allocation for institutional investors’ portfolios.

Private Equity Wire

OCTOBER 25, 2024

IAIM leverages the origination and proprietary deal flow capabilities of Investec’s franchises to deliver private market investment solutions for investors. According to a press statement, the partnership will seek to accelerate Investec’s sustainability progress, with a particular focus on enhancing data capture and evaluation.

The Motley Fool

NOVEMBER 24, 2024

But acquisitions are lumpy: Subsequent to the end of the quarter, it added another $230 million worth of properties to the portfolio. But that probably won't last, as the REIT continues to build back its portfolio via new acquisitions. Through the first nine months of 2024, it bought roughly $740 million of new assets. Carey right now?

This is going to be BIG.

FEBRUARY 21, 2021

If I was to guess, the demographics of people pitching me are reflective of two things—what my own network looks like and what my portfolio looks like. Given that I have a more diverse portfolio than most I would say that on average my gender pitch split is perhaps about 50/50.

Pension Pulse

JULY 3, 2024

Sarah Rundell of Top1000funds reports AIMCo talks total portfolio approach, private credit, and risk: Alberta Investment Management Corporation, AIMCo, the $160 billion asset manager for pensions, endowments and insurance groups in Canada’s western province, is developing a total portfolio approach in private assets.

The Motley Fool

JULY 27, 2024

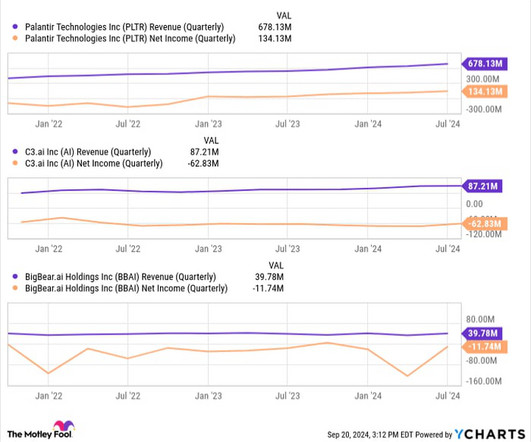

This partner network has proven to be a good source of lead generation , as evidenced by the company's rising deal flow. ai closed 115 deals through its partner ecosystem, an increase of 62% year over year. ai is best left out of your portfolio for now. One thing that I find particularly impressive about C3.ai

Private Equity Insights

JUNE 27, 2023

Teddy Kaplan, a New Mountain Managing Director and Head of New Mountain Net Lease commented, “We launched the net lease strategy at New Mountain in early 2016 seeking to utilize the firm’s analytical capabilities, industry experience, deal flow and relationships to build a differentiated net lease platform.

Private Equity Wire

JULY 17, 2024

Some 56 new issuers across a range of industries were added to PGI Private Capital’s portfolio, and 79 existing borrower companies returned for further funding. During H1 PGI Private Capital made $5.5bm of investment-grade investments, $1.7bn of below-investment-grade investments, over $230m of mezzanine and private equity investments.

Private Equity Wire

JANUARY 29, 2024

Venture capital and private equity firms meanwhile, will increasingly elect to move their portfolio companies to exits due to funding needs, pressure to return capital and improving business fundamentals.

Private Equity Wire

JANUARY 26, 2024

Disagreements over valuations have been a barrier for buyout firms attempting to exit their portfolio companies, according to a report by Bloomberg, which cites an Ares Management (Ares) executive speaking at this year’s IPEM in Cannes. Michael Elio, a Partner at StepStone Group who also spoke on the panel, noted a boom in continuation funds.

The Motley Fool

SEPTEMBER 24, 2024

Per the deal, Microsoft and Palantir will be integrating their respective AI and analytics capabilities throughout classified networks and national security protocols, namely with the Department of Defense (DoD). To me, Palantir is far more prolific than C3.ai ai and BigBear.ai. Consider when Nvidia made this list on April 15, 2005.

The Motley Fool

SEPTEMBER 17, 2024

I think Palantir will continue forging alliances with the tech world's biggest names, and I see these relationships as further sources of lead generation to bolster the company's deal flow. Can Palantir stock reach $50? I see several reasons why Palantir stock could soar even higher.

The Motley Fool

MAY 3, 2024

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Importantly and atypically, over half of our Q1 debt brokerage deal flow was on non-multifamily assets in retail, hospitality, industrial, and office.

The Motley Fool

JANUARY 30, 2024

Some short-sellers view Palantir as a glorified government contractor, given its heavy reliance on public sector deal flow. of its combined portfolio. This is far from the first time Palantir has been doubted by research analysts. Moreover, this latest downgrade from Jefferies wasn't the bank's first bearish call on Palantir.

Private Equity Insights

OCTOBER 23, 2023

The combination of BMO’s broad investment banking platform and OHA’s private credit expertise has delivered enhanced deal flow and financing flexibility while adding value for borrowers and private equity sponsors. Harrington will continue to operate as a standalone company and be led by its current management team.

This is going to be BIG.

SEPTEMBER 18, 2019

That believe has not only translated into the most diverse portfolio run by an investor who looks like me, with over 50% of the teams including diverse founders, but also into top quartile returns in our last fund. Venture is all about access—getting the best deals.

The Motley Fool

AUGUST 4, 2023

Please note that certain information discussed on this call, including information related to portfolio companies, was derived from third-party sources and has not been independently verified. Main Street defined ROE as the net increase in net assets resulting from operations divided by the average quarterly total net assets.

Private Equity Wire

FEBRUARY 26, 2024

According to a press statement, moving the strategy to the credit group is expected to enable greater collaboration across the Ares platform, enhancing benefits to Ares’s LPs, sponsor partners and portfolio companies.

The Motley Fool

SEPTEMBER 28, 2024

ai offers a portfolio of over 40 finished AI applications, which can be customized to suit almost any business in as little as three months from the date of the first meeting. ai's partner network accounted for 72% of its deal flow, making it a valuable sales channel. However, with C3.ai, The company generated a record $87.2

The Motley Fool

NOVEMBER 9, 2023

When I joined Walker in Dunlop in 2003, I looked at the consistent revenues generated by the company's $4 billion loan servicing portfolio and said to myself, "More of that." And that strategy has worked, resulting in negligible credit defaults, allowing us to fully benefit from our servicing and asset management cash flows.

Private Equity Wire

DECEMBER 28, 2023

Interest rates beginning to consistently move downwards will help to ease pressure on valuations, reduce the cost of leverage and start to unlock deal flow. There will be a point when asset values are perceived to have bottomed out – and there is then potential in the market for opportunities.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content