1 Warren Buffett Stock Down 62% to Buy in 2024 and Hold

The Motley Fool

JANUARY 1, 2024

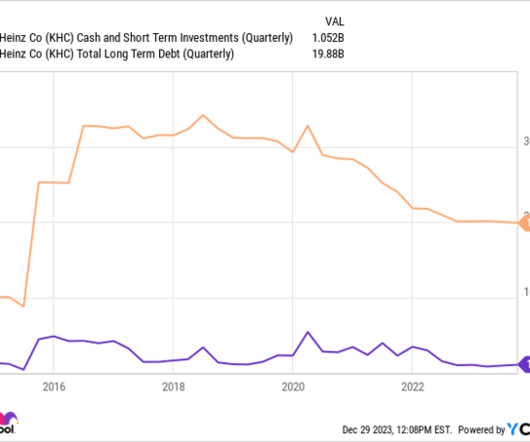

After all, he's owned it since he helped arrange a merger to create the entity in 2015. The merger was worth roughly $45 billion, creating a food giant that owns such famous brands as Kraft, Heinz, Oscar Meyer, Kool-Aid, Jell-O, Capri-Sun, and more. However, the merger also loaded up the new entity with debt.

Let's personalize your content