Why Home Depot Stock Slipped Today

The Motley Fool

APRIL 1, 2024

billion, including debt, and will pay for the deal with cash on hand in debt. Home Depot makes a big move Home Depot will acquire SRS Distribution for $18.25

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Motley Fool

APRIL 1, 2024

billion, including debt, and will pay for the deal with cash on hand in debt. Home Depot makes a big move Home Depot will acquire SRS Distribution for $18.25

The Motley Fool

SEPTEMBER 5, 2024

billion in consolidated debt and only $12.6 billion in earnings before interest, taxes, depreciation, and amortization ( EBITDA ), and $31.3 billion in net debt in 2026. The company ended the second quarter with $57.9 billion in cash and marketable securities. billion penciled in.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Motley Fool

AUGUST 8, 2024

After staring at the brink of bankruptcy, a debt restructuring deal rescued the stock. The company has now reported an earnings before interest, taxes, depreciation, and amortization ( EBITDA ) profit and positive net income for each of the first two quarters in 2024. It expects EBITDA of $1 billion to $1.2

The Motley Fool

OCTOBER 7, 2024

Despite another excellent earnings report, Carnival stock fell after the third-quarter report. Some of them have felt it more acutely than others, and while it hasn't stymied Carnival's performance, one way the company will feel lower interest rates is in its debt repayments. billion since the beginning of 2023.

The Motley Fool

FEBRUARY 13, 2024

However, due to the $6 billion in long-term debt it took on to fund that purchase, the market has taken a cautious view toward Nasdaq's stock, and it remains below its pre-acquisition announcement price. Armed with this growing FCF creation, management aims to lower Nasdaq's debt load from 4.3 With its $10.5 times within three years.

The Motley Fool

JULY 20, 2023

The most impressive number was $6,520 in gross profit per vehicle, which drove positive adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) during the quarter. But Carvana did report a net loss of $105 million for the quarter.

The Motley Fool

MARCH 20, 2024

It also cut the dividend enough to free up cash to help pay down debt. T Cash Dividend Payout Ratio data by YCharts Yep, that's discretionary cash profits that can go toward paying down debt (more on that in a minute) and eventually repurchasing shares to help drive earnings growth. However, things could finally be looking up.

The Motley Fool

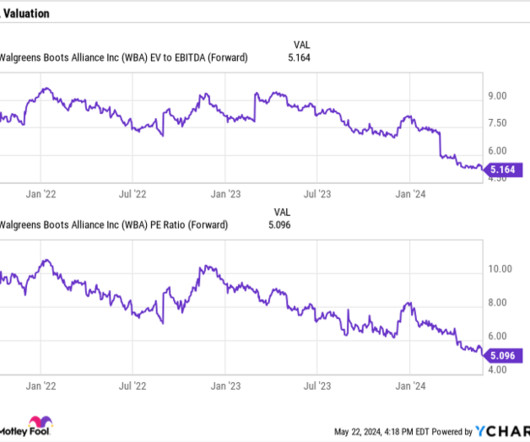

MAY 28, 2024

billion after-tax goodwill write-down of its VillageMD investment in an admission that it greatly overpaid for the business. billion in net debt, not including operating leases, an ill-advised investment was not a good use of cash. The latter metric takes into account its net debt and takes out non-cash items.

The Motley Fool

APRIL 22, 2024

billion in long-term debt, and another $1 billion in long-term lease obligations, this used car dealer's future looked grim. It's starting to look like Carvana (NYSE: CVNA) stock is going to survive its near-death experience. One year ago, Carvana wrapped up its worst year ever, losing $1.6 billion despite booking a record $13.6

The Motley Fool

JUNE 9, 2024

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) more than doubled from last year in the first quarter to $871 million, and Carnival reported its third consecutive quarter of positive operating income. The long-term opportunity Carnival was a market-beating stock before the pandemic.

The Motley Fool

AUGUST 24, 2023

Carvana risked bankruptcy because it operated at a loss, funded its business with low-interest debt that was no longer available, and stuffed its sales channels with used car inventory right as consumer demand slowed. Fortunately for shareholders, Carvana's management renegotiated some of its debt.

The Motley Fool

NOVEMBER 10, 2024

However, there's much less of a tax drag on the transaction. Share repurchases incur a 1% tax (paid by the business); qualified dividends are taxed at the long-term capital gains tax rate (paid by the shareholder). They're still working to pay down debt, which eats up a lot of cash flow.

The Motley Fool

NOVEMBER 3, 2024

That momentum continued in 2022, but the pressure of renovating and reselling those homes boosted its operating expenses, squeezed its adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) margins, and caused its net losses to widen. It had a high debt-to-equity ratio of 3.0.

The Motley Fool

NOVEMBER 16, 2024

If a company can't make money on what it sells, before paying for operating costs, the business isn't sustainable. Plug Power has been promising it's close to adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) break-even for over a decade, which I highlighted as far back as 2017 !

The Motley Fool

APRIL 20, 2024

billion of net debt on AT&T's balance sheet at the end of 2023 is concerning, but the company's efforts to reduce it have been encouraging. Net debt fell to 2.97 times adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) last year, from 3.19 times adjusted EBITDA in 2022.

The Motley Fool

AUGUST 2, 2023

billion of debt principal. Management expects to continue deleveraging its balance sheet in the back half of the year and for the company to comfortably pay off the debt for the foreseeable future. Moreover, investors are still concerned about Carnival's need to pay down its enormous debt.

The Motley Fool

DECEMBER 4, 2023

AT&T finished September with $129 billion in net debt. 30 and it's using these profits to reduce debt. The company is on pace to achieve a net debt-to-adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) ratio in the 2.5 AT&T generated $19.8

The Motley Fool

FEBRUARY 14, 2024

In Verizon's case, the market is worried about a debt load that rose to $150.7 Verizon's debt load works out to about 2.6 times adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ). billion at the end of 2023.

The Motley Fool

OCTOBER 10, 2024

federal legalization, burdensome tax regimes, and competition from the black market. More notably, Green Thumb achieved a GAAP net income of $21 million and adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) of $94 million. million in outstanding debt. laws are reformed.

The Motley Fool

JUNE 30, 2024

billion, with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $23 million, an improvement from negative $113 million a year ago. billion in debt and $703 million in cash. Adjusted operating income slid 15.8% year over year to $175 million. Revenue from its U.S.

The Motley Fool

FEBRUARY 12, 2024

The company now holds a significant amount of debt. Management plans to divest non-core assets to accelerate the paydown of that debt. Shares currently trade for an enterprise value/earnings before interest, taxes, depreciation, and amortization (EV/ EBITDA ) multiple of just 5x.

The Motley Fool

JUNE 11, 2024

Strong cash flows have management thinking it can reduce its debt load from 2.9 times adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) at the moment to 2.5 times adjusted EBITDA in the first half of 2025.

The Motley Fool

JANUARY 10, 2024

in net debt to earnings before interest, taxes, depreciation, and amortization ( EBITDA ). Further evidence of Franco-Nevada's appeal for conservative investors comes from the stock's rock-solid balance sheet that features zero debt and $1.3 The stock sells for about 11.2 billion in cash.

The Motley Fool

NOVEMBER 27, 2023

I've seen numerous companies harm shareholders with massive debt-fueled acquisitions that put the balance sheet in peril. While Illinois Tool Works leans on debt, it doesn't do so too heavily. Today, the company has a reasonable debt-to- EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio of 1.8.

The Motley Fool

SEPTEMBER 29, 2024

Before the deal Enbridge generated 57% of earnings before interest, taxes, depreciation, and amortization (EBITDA) from oil. per-share hit in 2023 because of the impact of higher interest rates. With interest rates falling, they'll shift from a headwind to a tailwind for Kinder Morgan.

The Motley Fool

JUNE 20, 2023

The company has borrowed money in the form of both debt and equity to keep going, and it's now saddled with $34 billion in long-term debt and heavily diluted shares. It gained prominence as a meme stock when retail investors began to have outsize influence and it became unclear whether Carnival could stick it out.

The Motley Fool

OCTOBER 28, 2023

However, an analysis of the financial profile suggests that the company is doing a respectable job generating free cash flow and reducing its net debt. Cash flow is king A similar theme among telecommunications businesses is the heavy debt loads carried on their balance sheets. Source: Company investor presentation.

The Motley Fool

SEPTEMBER 7, 2023

Shares of the phone and internet service provider have fallen about 23% in 2023 as investors worry about a high debt load and potential litigation regarding lead-lined cables. Selling off its media assets helped reduce AT&T's debt load, but the company was still sitting on $132 billion in net debt at the end of June.

The Motley Fool

SEPTEMBER 3, 2024

Lumen is a debt-riddled company whose stock became distressed earlier this year. However, an early-year deal to extend its debt maturities, combined with long-term deals for AI (artificial intelligence) networking, caused the stock to skyrocket in early August. billion in debt and pension liabilities. as of 2:23 p.m.

The Motley Fool

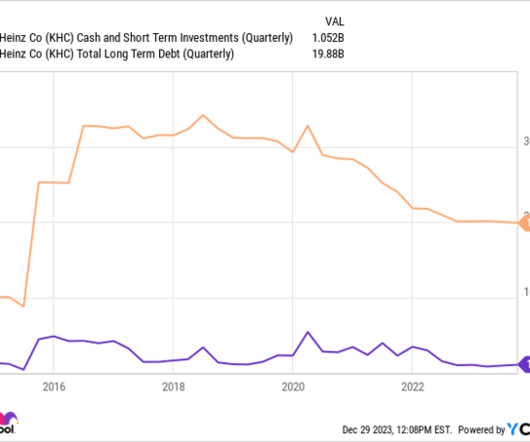

JANUARY 1, 2024

However, the merger also loaded up the new entity with debt. Below, the merger more than tripled the company's debt to over $30 billion. KHC Cash and Short-Term Investments (Quarterly) data by YCharts But through cost-cutting and divesting non-strategic brands, Kraft Heinz has slowly gotten its debt back under control.

The Motley Fool

DECEMBER 1, 2023

The cruise line operator's revenue plunged in 2020 and 2021 as global travel ground to a halt during the pandemic, and it was forced to take on a lot more debt to stay solvent. On an adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) basis, it generated a profit of $3.3 NYSE: CCL).

The Motley Fool

OCTOBER 6, 2024

Over the past two years, its adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) margins shrank and it racked up steep losses. billion in long-term debt and a staggering debt-to-equity ratio of 70. billion (which includes all of its long-term debt), it trades at just 1.8

The Motley Fool

OCTOBER 8, 2024

It repaid debt, which steadily drove down its leverage ratio. Roughly 90% of its adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) come from stable, fee-based sources. However, Energy Transfer used the additional cash it retained to shore up its financial foundation.

The Motley Fool

APRIL 11, 2024

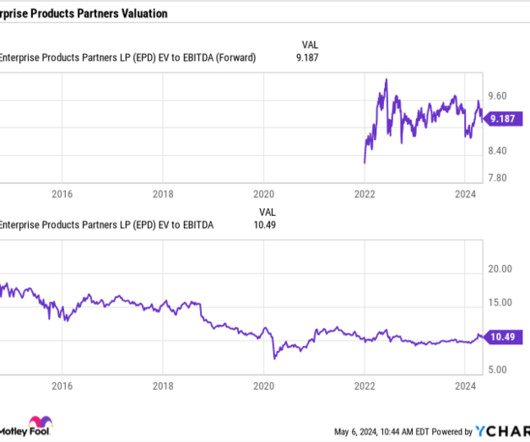

Not only does the MLP earn an investment-grade rating, but its ratio of debt to earnings before interest, taxes, depreciation, and amortization ( EBITDA ) of 3.1 EPD financial debt to EBITDA (TTM); data by YCharts; TTM = trailing 12 months. times is also lower than any of its closest peers.

The Motley Fool

AUGUST 18, 2023

Its debt load will continue to come down A big reason investors aren't overly thrilled with Viatris is that the business has a lot of debt on its books; that's not a good look as interest rates are rising. As of June 30, the company's long-term debt was over $17.2 The company is targeting a gross leverage ratio of 3.0.

The Motley Fool

JULY 25, 2024

billion, while its adjusted earnings per share (EPS) fell from $1.21 Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) edged up 2.5% Mixed Q2 quarterly results For the second quarter, Verizon saw its revenue rise 0.6% a year ago to $1.15. billion consensus.

The Motley Fool

SEPTEMBER 15, 2024

That will further reduce its total assets, and reduce its financial flexibility to borrow money at an attractive interest rate, as it will have less collateral. billion in debt, it may well have to further liquidate assets and dramatically curb its expenses by even more than it has planned to do so far. And, with $33.6 billion more.

The Motley Fool

JANUARY 6, 2024

There was $129 billion in net debt on AT&T's balance sheet at the end of September, which isn't as frightening as it might seem. The company expects to achieve a manageable net debt-to-adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA) ratio of 2.5 yield at recent prices.

The Motley Fool

JULY 12, 2023

Higher interest rates are a headwind both for Carvana directly and for its customers. The company has nearly $7 billion in debt, which is hampering its recovery and its ability to turn a profit, and higher rates also make it more expensive for customers to finance cars.

The Motley Fool

FEBRUARY 1, 2024

Discovery , AT&T earned more than $40 billion in concessions -- most of which involved the new media entity taking on select debt lots previously held by AT&T. Since March 31, 2022, AT&T's net debt has declined from $169 billion to $128.9 million in net debt, its net-leverage ratio is a modest 0.31.

The Motley Fool

AUGUST 9, 2023

However, Rivian is still inking fairly sizable losses on its bottom line, and the stock had already risen some 50% this year prior to last night's earnings. debt last week and investors perhaps nervous about tomorrow's inflation report, the stock nevertheless sold off. billion in debt, it also burned through more than $1.6

The Motley Fool

JULY 28, 2023

Why the stock scares off some investors The debt-to-equity (D/E) ratio of DigitalOcean is a negative 675% due to total debt of $1.47 You can calculate it by dividing the company's total debt by shareholder equity. On the one hand, the company has high debt. billion and negative shareholder equity of $217.7

The Motley Fool

MAY 12, 2024

A strong start to 2024 Enbridge generated $5 billion in adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) during the first quarter and $3.4 That massive deal has been a near-term growth headwind because Enbridge pre-funded most of the purchase price by issuing stock and taking on debt.

The Motley Fool

MAY 11, 2024

Its adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ), meanwhile, rose 6% to nearly $2.5 It defines leverage as net debt adjusted for equity credit in junior subordinated notes (hybrids) divided by adjusted EBITDA. It generated distributable cash flow of $1.9

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content