Want an Average of $100 Per Month in Super Safe Dividend Income? Invest $13,800 Into the Following 3 Ultra-High-Yield Stocks.

The Motley Fool

NOVEMBER 23, 2023

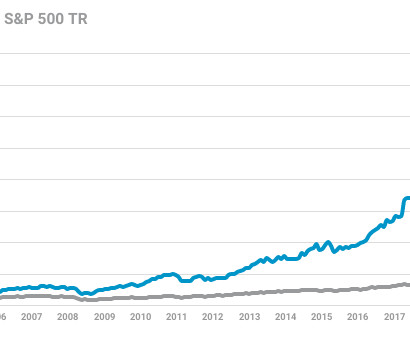

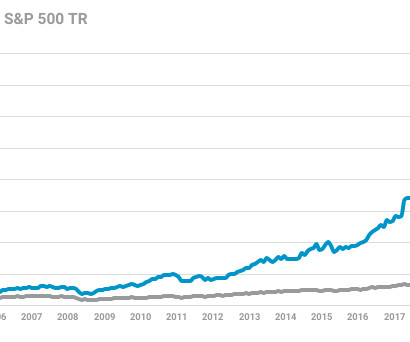

annualized return between 1972 and 2012, according to a 2013 report from the wealth management division of JPMorgan Chase , public companies that initiated and grew their payouts produced an annualized return of 9.5% A BDC is a company that invests in the equity (common and preferred stock) and/or debt of middle-market businesses.

Let's personalize your content