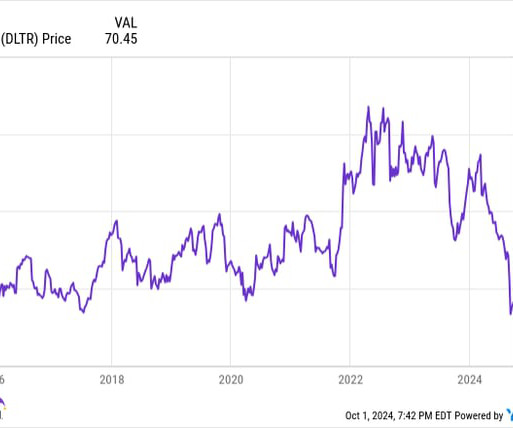

Should Investors Pull Dollar Tree Stock Out of the Bargain Bin?

The Motley Fool

OCTOBER 6, 2024

The question for investors is whether the retail stock has fallen so much that it is now a buy. The company blamed rising depreciation expenses, "unfavorable" news on liability claims, the cost of rolling out its new pricing plan, and other factors. Let's take a closer look. states and five Canadian provinces.

Let's personalize your content