2 Growth Stocks to Buy and Hold Forever

The Motley Fool

NOVEMBER 21, 2024

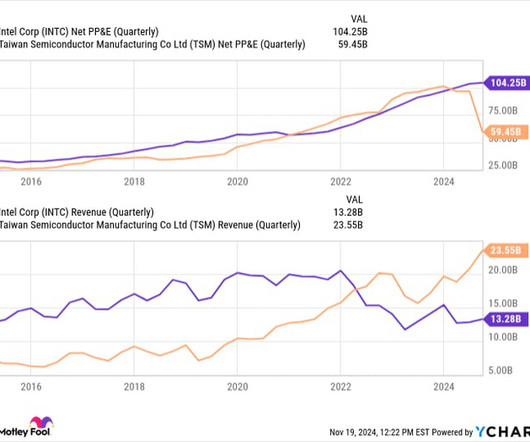

The S&P 500 started this year off on the right foot -- confirming the presence of a bull market -- and the good times have continued to roll from there for all three major benchmarks. The S&P 500, the Nasdaq, and the Dow Jones Industrial Average each have climbed 24%, 26%, and 14%, respectively, since the start of the year. And the companies leading the gains have been growth stocks, players that traditionally excel in bull environments.

Let's personalize your content