QHP Capital buys Applied StemCell

PE Hub

OCTOBER 10, 2023

Dr. Ruby Chen-Tsai serves as CEO of Applied StemCell. The post QHP Capital buys Applied StemCell appeared first on PE Hub.

PE Hub

OCTOBER 10, 2023

Dr. Ruby Chen-Tsai serves as CEO of Applied StemCell. The post QHP Capital buys Applied StemCell appeared first on PE Hub.

A Wealth of Common Sense

OCTOBER 10, 2023

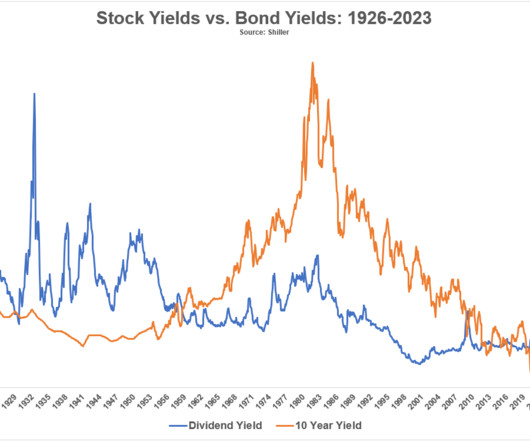

The 10 year Treasury yield recently hit 4.8%, its highest level since the summer of 2007. That’s higher than the dividend yield on all but 53 stocks in the S&P 500. Just four stocks out of 30 in the Dow Jones Industrial Average yield more than the benchmark U.S. government bond.1 The dividend yield on the S&P 500 has been falling for years from a combination of rising valuations and the increased usage of sh.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PE Hub

OCTOBER 10, 2023

Bonaccord is a subsidiary of P10, Inc. The post Bonaccord invests in healthcare PE firm Revelstoke appeared first on PE Hub.

Financial Times M&A

OCTOBER 10, 2023

Plus, Warburg Pincus sticks to its buyout roots and the UBS/Credit Suisse lawsuits pile up

PE Hub

OCTOBER 10, 2023

David H Coons Insurance Brokers is a family-owned insurance brokerage located in Burlington, Ontario. The post Westland Insurance snaps up David H Coons Insurance Brokers appeared first on PE Hub.

Private Equity Insights

OCTOBER 10, 2023

Warburg Pincus Global Growth 14 represents Warburg Pincus’ largest fundraise in its nearly 60-year history. Warburg Pincus, the oldest private equity firm and a leading global growth investor, today announced, together with any parallel funds, the successful close of its latest global flagship fund, Warburg Pincus Global Growth 14, L.P. (“WPGG 14”).

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Private Equity Professional

OCTOBER 10, 2023

Grove Mountain Partners has sold Central States Paving and Concrete to Pave America, a portfolio company of Shoreline Equity Partners and Trivest Partners. Grove Mountain will maintain an equity interest in the business in partnership with Shoreline and Trivest. Shoreline formed Pave America in June 2021 (then Pavement Partners) in partnership with Tom York, the… This content is for members only.

PE Hub

OCTOBER 10, 2023

In his new role, Forbis will support the firm’s efforts in identifying, sourcing, and growing investment opportunities across the bank technology sector. The post Forbis joins THL as exec partner appeared first on PE Hub.

Private Equity Professional

OCTOBER 10, 2023

Gemspring Capital Management has acquired ClearCompany, a provider of human capital management software, from Primus Capital which invested in the business in August 2018. Gemspring’s investment in ClearCompany was made through its $1.7 billion third fund which closed in January 2023. ClearCompany’s talent management software platform provides a suite of services used for recruiting, performance… This content is for members only.

PE Hub

OCTOBER 10, 2023

While PE deal value was down, the number of deals was up slightly, suggesting more activity focused on the lower mid-market, finds LSEG. The post Global private equity deal value fell 40% in first three quarters appeared first on PE Hub.

Private Equity Professional

OCTOBER 10, 2023

Kelso & Company has formed Armada Materials in partnership with industry veteran Rob Duke and other industry executives. In tandem with the formation of Tampa, Florida-based Armada, the company has acquired Lewisburg, Tennessee-headquartered Volunteer Materials and its sister companies Volunteer Paving, Volunteer Sand and Gravel, Volunteer Concrete, Action Enterprise Company, and TMC Construction Services.

PE Hub

OCTOBER 10, 2023

A data deep dive with LSEG’s Matt Toole about the dealmaking numbers for the first three quarters; a portfolio company of Parabellum Investments acquiring a digital banking software business; BharCap Partners buys a company in the insurance sector; and Bonaccord Capital making a minority investment in a healthcare-focused private equity firm. The post US private equity M&A value drops 35%, finds LSEG; Parabellum, BharCap and Bonaccord sign deals appeared first on PE Hub.

Private Equity Professional

OCTOBER 10, 2023

Pritzker Private Capital has acquired privately held Sugar Foods Corporation in partnership with members of the Sugar Foods management team. Sugar Foods is a producer and distributor of branded, private label and licensed products such as crunchy toppings, croutons, ready-to-use pizza toppings and beverage ingredients. Company owned brands include Fresh Gourmet, Mrs.

PE Hub

OCTOBER 10, 2023

In this role, McClure will be responsible for providing guidance and support on financial-related portfolio company initiatives. The post One Rock appoints McClure as operating partner appeared first on PE Hub.

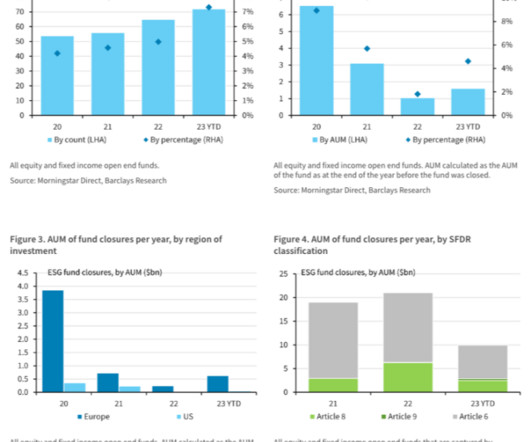

Financial Times: Moral Money

OCTOBER 10, 2023

Whatever you think of the sector, it doesn’t seem to be in major trouble

PE Hub

OCTOBER 10, 2023

Her position will begin October 31, 2023. The post Carrick Capital appoints Passalacqua as managing director and CFO appeared first on PE Hub.

Financial Times M&A

OCTOBER 10, 2023

Jozef Síkela accuses billionaire of using his media assets to criticise government’s acquisition of gas pipeline operator

PE Hub

OCTOBER 10, 2023

Agilia Solutions is a digital solutions development consulting business based in Montreal. The post Novacap-backed Cofomo closes acquisition of Agilia Solutions appeared first on PE Hub.

Financial Times M&A

OCTOBER 10, 2023

Gina Rinehart’s Hancock Prospecting is muscling in on Albemarle’s mine proposal

PE Hub

OCTOBER 10, 2023

Windsor Private Capital will own all of Bruce Telecom’s shares post the closing of the deal. The post Windsor Private Capital to buy Bruce Telecom from municipality appeared first on PE Hub.

Steve Sanduski

OCTOBER 10, 2023

Guest: Saundra Davis, the Founder and Executive Director of Sage Financial Solutions , an organization that develops comprehensive financial capability programs for low- and moderate-income communities throughout the United States. Saundra is a U.S. Navy veteran, financial coach, educator, and consultant who is nationally recognized as an expert in the financial coaching field and for her work with community-based organizations that focus on asset-building for the working poor.

PE Hub

OCTOBER 10, 2023

Lincoln International and William Blair served as financial advisors to ARMStrong and selling shareholders. The post BharCap acquires insurance and commercial B2B receivable firm ARMStrong appeared first on PE Hub.

AltAssets

OCTOBER 10, 2023

Rubicon Founders, the healthcare-focused investor launched by Landmark Health creator Adam Boehler, has pulled in more than $680m towards its sophomore fundraise. The post Ex-Landmark Health CEO passes $680m for latest Rubicon Founders healthcare fundraise first appeared on AltAssets Private Equity News.

PE Hub

OCTOBER 10, 2023

In this role, Van Dyke will play a key role in further building out Advent’s fintech franchise. The post Advent International taps Van Dyke as operating partner appeared first on PE Hub.

American Investment Council

OCTOBER 10, 2023

Private credit provides over $500 billion in capital to more than 3,600 businesses across America, supporting an estimated 1.6 million jobs, $137 billion in wages and benefits, and contributing $224 billion to the GDP Washington, D.C. – The American Investment Council (AIC) released a report today, prepared by EY , on the significant impact of private credit on the U.S. economy.

PE Hub

OCTOBER 10, 2023

The acquisition coincides with Huron Capital launching its facility services ExecFactor platform focused on the electrical services space. The post Huron Capital buys electrical contractor RK Electric appeared first on PE Hub.

Million Dollar Round Table (MDRT)

OCTOBER 10, 2023

By D. Kyle Atkins, CLU, CFP What we found from experience, having done one acquisition and working on two others now, is to make sure we’re clear as to what the current owners are trying to achieve. The guys and the gals who are out there just for the largest amount of money, we may not be a great fit. Nevertheless, if our cultures work together, if they’re looking to sell off gradually into the sunset, well, that’s marvelous.

AltAssets

OCTOBER 10, 2023

Grand Ventures, a VC firm focused on startups outside the traditional US hubs, has raised $50m to close its sophomore fund targeting fintech, supply chain and devops startups. The post Does the future of US venture capital lie within these cities? Grand Ventures thinks so – and has a new fund to prove it first appeared on AltAssets Private Equity News.

Private Equity Wire

OCTOBER 10, 2023

BharCap Partners (BharCap), a private investment firm focused on the financial services sector, has acquired ARMStrong Receivable Management (ARMStrong), one of the largest insurance and commercial B2B receivable management firms in North America. ARMStrong specialises in receivable management solutions for insurance companies, including insurance premium audit and recovery, subrogation solutions, and third-party deductible identification and recovery.

AltAssets

OCTOBER 10, 2023

Private markets investment major Pantheon has filed to register an evergreen private credit fund anchored in private credit secondaries. The post Pantheon says its new private credit secondaries fund is the ‘first of its type’ first appeared on AltAssets Private Equity News.

Private Equity Wire

OCTOBER 10, 2023

One Rock Capital Partners (One Rock), a value-oriented, operationally focused private equity firm, has added to its team Operating Partners with the appointment of Christine McClure, who will support value creation on key financial-related portfolio company initiatives. McClure joins One Rock with almost 30 years of experience working in financial leadership and change management.

AltAssets

OCTOBER 10, 2023

TPG's latest Asian private equity fundraise has picked up new capital from the Texas Teacher Retirement System, amid more than $700m of reported new commitements from the LP. The post TPG’s Asia fund, new Energy Capital flasghip vehicle among latest Texas Teachers pension commitments first appeared on AltAssets Private Equity News.

The Reformed Broker

OCTOBER 10, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Have Treasury Bonds Bottomed? – The crash in long-dated Treasurys since the pandemic now ranks as one of the most destructive financial crashes ever.

AltAssets

OCTOBER 10, 2023

Bonaccord Capital Partners has picked up a minority stake in healthcare-focused private equity house Revelstoke Capital Partners. P10 Inc subsidiary Bonnacord is a PE platform dedicated to acquiring non-control equity interests in private markets investment firms. Revelstoke, which was founded in 2013, has about $5.6bn of assets under management. Columna Capital has bought into fruit […] The post AltAssets private equity deal roundup – October 10, 2023 first appeared on AltAssets Private E

Let's personalize your content