Tulipmania!

The Big Picture

FEBRUARY 6, 2025

Previously : 1 2 3 See also : Is This a Bubble? (Ben Carlson, January 31, 2025) Tulipomania! (The Paris Review, February 3, 2014) The post Tulipmania! appeared first on The Big Picture.

The Big Picture

FEBRUARY 6, 2025

Previously : 1 2 3 See also : Is This a Bubble? (Ben Carlson, January 31, 2025) Tulipomania! (The Paris Review, February 3, 2014) The post Tulipmania! appeared first on The Big Picture.

Financial Times M&A

FEBRUARY 6, 2025

Struggling Japanese carmaker is pursuing tech rather than automotive ally to revive its business

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times - Banking

FEBRUARY 6, 2025

There are a lot of ways to make money in investment banking, the mistake is to keep making U-turns

Financial Times M&A

FEBRUARY 6, 2025

The two billionaires lead talks over record deal to make Japanese investor biggest backer of ChatGPT-maker

Blackstone

FEBRUARY 6, 2025

Blackstone President Jon Gray is seeing signs of strength in the economy, which could mean good news for M&A activity this year.

Financial Times M&A

FEBRUARY 6, 2025

US industrial group is latest conglomerate to break up its business

Private Capital Investment in Latin America

FEBRUARY 6, 2025

The post Patria Investments and AXA IM and To Acquire Stake in Latour Capital; Riverwood Invests ~USD39.8m in Brazils Paytrack appeared first on LAVCA.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

SEI

FEBRUARY 6, 2025

Access to More Service Providers Helps Advisors Reduce Costs, Save Time, and Increase Efficiencies

Vistra

FEBRUARY 6, 2025

In the US, transfer agents have expanded their work from listed companies to investment funds and alternatives, including private equity and venture capital.

Financial Times M&A

FEBRUARY 6, 2025

Plus, an anaemic start to the year for dealmaking in the US and talks over a $58bn Japanese carmaker deal fall apart

Axial

FEBRUARY 6, 2025

Welcome to the January edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection of recently closed lower middle market deals that were brought to market via Axial. In each issue, we include the following information on each closed transaction: Deal Headline Close Date Region Industry Revenue EBITDA Buyer Matches In addition, each month, we select one closed deal to feature, sharing additional data and insights on the acquired business and tra

FinSMEs

FEBRUARY 6, 2025

Dubai, United Arab Emirates, 6th February 2025, Chainwire The post Dubai to Host Second Edition of Middle East Blockchain Awards as MENA Drives Global Crypto Growth appeared first on FinSMEs.

The Motley Fool

FEBRUARY 6, 2025

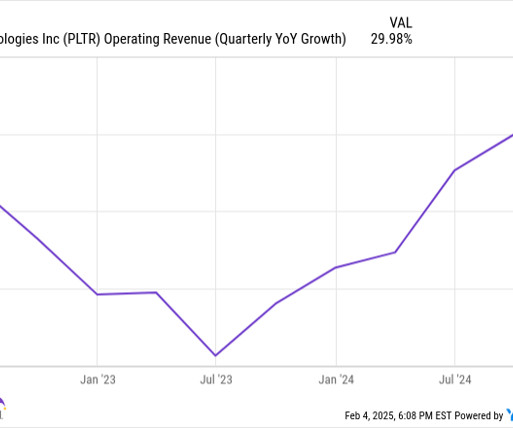

Shares of big data platform Palantir (NASDAQ: PLTR) stunned investors on Monday, blowing away analyst revenue and profit targets on its fourth-quarter earnings report. In response, Palantir's stock rallied another 24% on Tuesday, surpassing $100 per share and reaching a market cap around $236.5 billion. The stock is now up over 500% over the past year, cementing its standing as one of the biggest winners of the AI revolution.

Private Equity Insights

FEBRUARY 6, 2025

Bain Capital has acquired a 51% stake in Milacron, in a deal that values the company at more than $560m. Current owner Hillenbrand will retain a 49% stake, continuing its involvement in the companys future growth. Founded in 1968, Milacron supplies injection molding and extrusion equipment, along with aftermarket parts and services, to industries including construction, automotive, packaging, consumer goods, and medical.

The Motley Fool

FEBRUARY 6, 2025

Military shipbuilder Huntington Ingalls (NYSE: HII) missed quarterly expectations, and its issues are likely to continue into the new year. Shares of Huntington Ingalls traded down 17% as of 11:15 a.m. ET, as investors see little reason to get excited about the stock right now. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now.

Private Equity Insights

FEBRUARY 6, 2025

The Oregon Investment Council, which oversees the $100.1bn Oregon Public Employees Retirement Fund, committed $795m across multiple alternative investment funds, reinforcing its strategy of diversifying its portfolio. The latest commitments include $350m to KKR North America Fund XIV, a megacap buyout fund managed by KKR, and $165m to Sixth Street Specialty Lending Europe III, a direct lending fund operated by Sixth Street Partners.

The Motley Fool

FEBRUARY 6, 2025

With the decline in pensions and Social Security losing buying power , 401(k)s have become an increasingly important part of retirement planning. It's where many workers keep most of their savings, and it also gives them a chance to earn an employer match on those savings so they don't have to do it all alone. Yet, many people aren't able to save as much as they'd like to in their 401(k)s.

Private Equity Insights

FEBRUARY 6, 2025

Private equity assets hit an all-time high of $10.8tn at the end of 2024, reflecting an 11.6% increase from the previous year, according to Ocorians latest Global Asset Monitor. The analysis highlights private equitys long-term expansion, with market values surging 636% since 2009 and more than doubling since 2019. Private equity continued to show resilience after a brief dip in 2022, when rising interest rates led to a 1.9% decline in asset values to $9.08tn.

The Motley Fool

FEBRUARY 6, 2025

Image source: The Motley Fool. Amazon.com (NASDAQ: AMZN) Q4 2024 Earnings Call Feb 06, 2025 , 5:00 p.m. ET Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks: Operator Thank you for standing by. Good day, everyone, and welcome to the Amazon.com fourth quarter 2024 financial results teleconference. At this time, all participants are in a listen-only mode.

Private Equity Insights

FEBRUARY 6, 2025

Private equity investment in Scotland grew by 35.6% in 2024, reaching 9.4bn, according to KPMG UK’s latest report. The increase reflects improved economic stability, lower inflation, and a surge in deal activity ahead of expected tax changes. The number of private equity deals in Scotland also rose from 92 to 111, with Edinburgh and Glasgow securing high-value transactions.

The Motley Fool

FEBRUARY 6, 2025

A lot has changed over the past 20 years. In 2005, the iPhone didn't exist, YouTube was just starting, and people listened to music on CDs instead of an app on their smartphones. During that time, Social Security retirement benefits have also experienced a change. In 2005, the average monthly Social Security benefit was $1,002, or just over $12,000 annually.

Private Equity Insights

FEBRUARY 6, 2025

Avathon Capital acquired Yellow Brick Road Early Childhood Development Center, a network of early education centers. The deal marks Avathons third investment in early childhood education, reinforcing its strategy of supporting high-quality learning institutions. Founded in 2006 as a single center, Yellow Brick Road has since grown to 25 locations, serving thousands of families with education-based programs for infants through school-age children.

The Motley Fool

FEBRUARY 6, 2025

Buying shares of growing companies when they are offering solid value can help you build wealth over many years. If you have extra cash you don't need for paying bills or reducing debt, here are two stocks that can set up you up for outstanding returns in the coming years. 1. Roku Roku (NASDAQ: ROKU) is one of the leading brands in streaming, with more than 85 million households using its platform.

Private Equity Professional

FEBRUARY 6, 2025

Platte River Equity has acquired Building Controls & Solutions (BCS) from LKCM Headwater Investments. BCS is a value-added distributor of building automation products, including building controls, automation systems, gas detection equipment, and energy management equipment. The company’s customers operate in sectors such as education, government, data centers, healthcare, and other commercial industries.

The Motley Fool

FEBRUARY 6, 2025

Palantir Technologies recently reported stellar fourth-quarter financial results that propelled its market value to $230 billion. But some Wall Street analysts think Advanced Micro Devices (NASDAQ: AMD) and ServiceNow (NYSE: NOW) will surpass that figure in the next year, as detailed below: Hans Mosesmann at Rosenblatt Securities recently reiterated his AMD target price of $250 per share.

Private Equity Professional

FEBRUARY 6, 2025

The Stephens Group has acquired Astro Pak , a provider of cleaning services tailored to highly regulated industries. Astro Pak offers high-purity and precision cleaning services to companies in the pharmaceutical, biotechnology, food and beverage, semiconductor, aerospace, and defense sectors, meeting micron-level cleanliness and compliance standards.

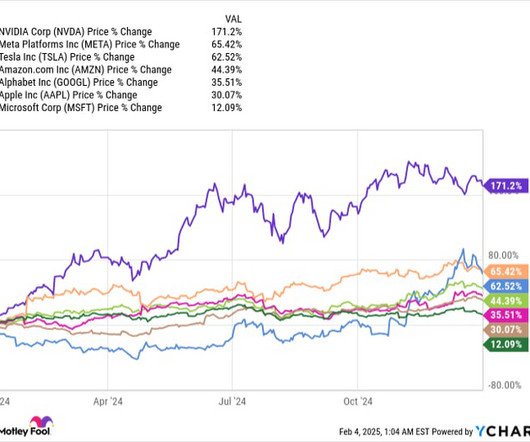

The Motley Fool

FEBRUARY 6, 2025

The S&P 500 (SNPINDEX: ^GSPC) is coming off a total return of 25% in 2024, which was more than double its average annual gain of 10.5% dating back to when it was established in 1957. The strong result was driven by a group of technology giants dubbed the Magnificent Seven, which earned the title for their incredible size and ability to consistently outperform the broader market.

Private Equity Insights

FEBRUARY 6, 2025

Warburg Pincus surpassed $1bn in capital deployment from its Capital Solutions Founders Fund, reinforcing its position as a key player in structured private equity investments. The fund closed in August 2024 with more than $4bn in commitmentsover double its initial target. It has been a major vehicle for strategic capital solutions in the private equity sector.

The Motley Fool

FEBRUARY 6, 2025

While the stock market is still surging right now, investor sentiment may be taking a turn. Around 34% of U.S. investors feel "bearish" about the next six months, according to a weekly survey from the American Association of Individual Investors released in late January. That's up from around 29% the week prior. While nobody can predict what the market will do, especially in the short term, some metrics suggest that a downturn could be on the horizon.

Private Equity Insights

FEBRUARY 6, 2025

UK-based private equity firm Montagu agreed to acquire fund accounting software provider Multifonds from Temenos for approximately $400m. The transaction is expected to close in Q2 2025. Montagu, which manages over 14bn in assets, plans to establish Multifonds as an independent company following the acquisition, retaining its existing management team.

The Motley Fool

FEBRUARY 6, 2025

There are several important things you should know about Social Security. For example, American workers should know that the Social Security Administration takes your 35 highest inflation-adjusted years of income into consideration, and married couples should definitely know how spousal benefits work. However, if there's one thing I'd encourage people to do before claiming Social Security benefits, it would be to read your latest Social Security statement.

Private Equity Professional

FEBRUARY 6, 2025

Legacy Bakehouse , a portfolio company of Benford Capital , has expanded with the acquisition of Mannon Specialty Foods (DBA Classic Cookie ). Benford Capital acquired Legacy Bakehouse in partnership with the companys president, Peter Sardina , in April 2023. Legacy Bakehouse is a developer and manufacturer of baked snack ingredients, including bagel chips, rye chips, pita chips, and other ingredients.

The Motley Fool

FEBRUARY 6, 2025

While many plan to remain in their homes throughout retirement, others seek a fresh start in a new state. A lot of factors can drive this decision, including cost of living, access to healthcare, and proximity to family and friends. Generally, when people think of retirement-friendly states, Florida tops the list -- for good reasons. But Florida's not the only state worth considering.

Private Equity Insights

FEBRUARY 6, 2025

Providence Equity Partners exited its stake in Tempo Music, selling its controlling interest to Warner Music Group in a deal valued at $450m. The transaction, which includes cash and the assumption of Tempos debt, marks Warners latest move to expand its catalog of music rights. Warner originally partnered with Providence in 2019 to launch Tempo as a vehicle for acquiring music rights.

The Motley Fool

FEBRUARY 6, 2025

Could investing in an airline stock set you up for life? It's an interesting question because, based on history, you'd have to be highly optimistic to even consider it. The airlines haven't traditionally generated a rate of return sufficient to cover the cost of their capital, and they've been subject to extraneous events -- such as terrorist attacks, wars, COVID-19, and even just good old-fashioned recessions -- that have challenged many airlines' ability to continue as a going concern.

Private Equity Insights

FEBRUARY 6, 2025

Mayfair Equity Partners announced the final close of Mayfair Fund III at 500m, bringing its total capital raised since inception to over 2bn. The fund secured backing from both existing and new institutional investors, with 60% of commitments coming from North America and the remainder from EMEA. This successful fundraising allows Mayfair to continue supporting innovative businesses and facilitating their international expansion.

The Motley Fool

FEBRUARY 6, 2025

UPS ' (NYSE: UPS) recent fourth-quarter earnings report was monumental. It wasn't so much the numbers from the final quarter of 2024 as it was management outlining the strategic changes it was making to its business. The market didn't like the update much, sending the stock sharply lower. At the time of writing, it's down 9.4% in 2025. Still, the changes align with management's philosophy, and there's a robust case for arguing that the stock is an excellent value right now.

Let's personalize your content