Social Security Just Released the 2025 COLA. Here's What It Means for Those Receiving Spousal Benefits.

The Motley Fool

OCTOBER 20, 2024

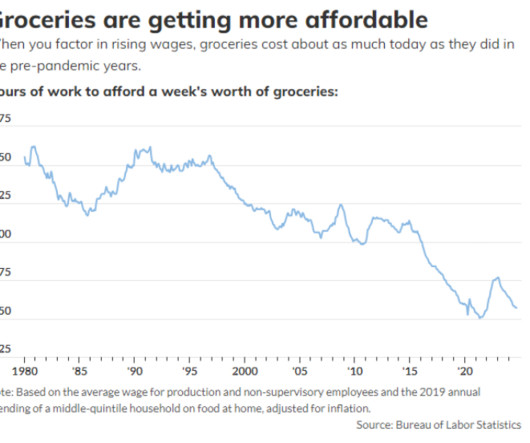

One of the more anticipated events when it comes to Social Security is the announcement of next year's cost-of-living adjustment (COLA). People are feeling the effects of inflation everywhere, from their groceries to household items, housing, cars, medical care, and more. That's why retirees pay extra attention to the Social Security cost-of-living adjustment (COLA).

Let's personalize your content