What's Going On With Alibaba Cloud?

The Motley Fool

NOVEMBER 24, 2023

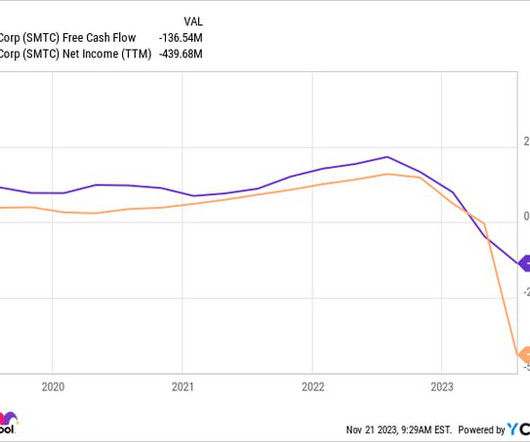

Once a rising star among Alibaba's (NYSE: BABA) diversified businesses, Alibaba Cloud has fallen from grace lately, with revenue growth coming to a halt. And just when investors hoped that a complete spin-off of Alibaba Cloud from the group would rekindle growth and unlock shareholder value, the parent company's recent decision to cancel the spin-off further confused investors.

Let's personalize your content