Diageo sales hangover leaves investors with a headache

Financial Times M&A

FEBRUARY 1, 2025

FTSE 100 spirits giant faces a flagging share price and falling demand for alcohol

Financial Times M&A

FEBRUARY 1, 2025

FTSE 100 spirits giant faces a flagging share price and falling demand for alcohol

FinSMEs

FEBRUARY 1, 2025

Dubai, UAE, 1st February 2025, Chainwire The post MuskIt Team Announces Musk Tower: UAEs Upcoming Global Innovation and Crypto Hub appeared first on FinSMEs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

FEBRUARY 1, 2025

European buyout firm replaces longtime North America head and targets private credit deal

The Motley Fool

FEBRUARY 1, 2025

Americans are working longer these days, with the average retirement age rising from 57 in the early 1990s to 62 currently, according to the latest research from The Motley Fool. Some people need to work longer, of course, while others are choosing to extend their working years as some of the social and mental benefits of doing so come to light. No matter what age you're aiming to begin your retirement, planning your investment strategy years ahead of time is the key to achieving your goals.

Financial Times M&A

FEBRUARY 1, 2025

Head of Canadian Teck Resources on fending off a hostile takeover by Glencore and learning from the night shift

The Motley Fool

FEBRUARY 1, 2025

One of the most complex aspects of retirement planning is determining how much money you need to save. There are many variables involved. Some, like your life expectancy, are nearly impossible to predict with accuracy. A lot also depends on how you envision your retirement, including where you'll live and how you'll spend your time. There's no retirement savings target that works for everyone.

Indigo Marketing Agency

FEBRUARY 1, 2025

Ready for a Brand Refresh in 2025? Check Out This Advisors New Website! With a new year freshly underway, theres no better time for financial advisors to evaluate their online presence. Your website is often the first impression potential clients have of your firm, and it needs to reflect your professionalism, expertise, and ability to solve their unique financial challenges.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

A Wealth of Common Sense

FEBRUARY 1, 2025

Five years removed from the onset of the pandemic, it’s interesting to reflect on the stuff that’s changed and the stuff that hasn’t. Remember when people were predicting handshakes were going to become a thing of the past? Or how no one was going to attend college anymore? One of the quickest changes we all made was becoming comfortable with video calls to communicate.

The Motley Fool

FEBRUARY 1, 2025

Brookfield Infrastructure (NYSE: BIPC) (NYSE: BIP) recently closed the books on 2024 by reporting its fourth-quarter and full-year financial results. The leading global infrastructure operator posted strong results, which it expects will continue. That gave it the confidence to increase its high-yielding dividend (currently 4%) by another 6%, representing its 16th straight year of dividend growth.

The Big Picture

FEBRUARY 1, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: Legal Weed Didnt Deliver on Its Promises : Advocates touted a host of benefits and no real costs. Thats proved to be a fantasy. ( The Atlantic ) The real DeepSeek revelation: The market doesnt understand AI : The real DeepSeek revelation: The market doesnt understand AI ( Semafor ) see also They Invested Billions.

The Motley Fool

FEBRUARY 1, 2025

It's now been more than two months since Walt Disney (NYSE: DIS) shares have been trading consistently in the triple figures. Making sure it stays above $100 -- and building on its market-matching 24% gain in 2024 -- will depend on its ability to continue delivering across its media empire. February may be the shortest month of the year, but it doesn't mean that this will be 28 days that investors can spend tapping the snooze bar.

The Motley Fool

FEBRUARY 1, 2025

Social Security is an essential source of income for American seniors. About half of households with someone age 65 or older receive the majority of their income from the government program, according to multiple studies reviewed by the Social Security Administration. At the same time, many seniors feel the spending power of their Social Security checks is going down, despite the annual cost-of-living adjustments (COLAs) they receive.

The Motley Fool

FEBRUARY 1, 2025

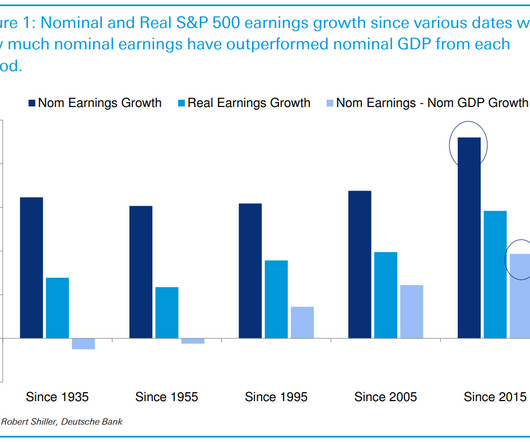

Goldman Sachs strategists set their 2025 target for the S&P 500 (SNPINDEX: ^GSPC) at 6,500. That implies about 6% upside in the remaining months of the year from its current level of 6,115, and 11% upside from where the index started in January. But their outlook is quite bleak beyond that point. Goldman Sachs recently updated its long-term forecast to account for the S&P 500's historically expensive valuation and nearly unprecedented concentration.

The Motley Fool

FEBRUARY 1, 2025

Berkshire Hathaway (NYSE: BRK.B) (NYSE: BRK.A) enables people to invest with one of the greatest investors of all time, Warren Buffett. The conglomerate owns a set of businesses outright, and it has a large portfolio of publicly traded stocks. The core of Berkshire's empire is insurance companies, such as GEICO and General Re. Buffett likes the insurance industry, as it provides him with a lot of money to invest with through its float.

The Motley Fool

FEBRUARY 1, 2025

I'm loading my retirement account with dividend stocks. The thesis is simple: Dividend stocks have historically outperformed non-dividend payers by more than 2-to-1 over the past 50 years and have been much less volatile. The highest returns and lowest volatility have come from dividend growers. That's why I'm most focused on investing in companies with excellent records of increasing their dividends that should continue over the long term.

The Motley Fool

FEBRUARY 1, 2025

Billionaires haven't missed out on the artificial intelligence (AI) story. Managers of some of the world's biggest funds have piled into this popular growth area, investing in stocks that have fueled gains in all three major indexes. Last year, the S&P 500 and Nasdaq rose 23% and 28%, respectively, and the Dow Jones Industrial Average added 12% thanks to excitement about this technology.

The Motley Fool

FEBRUARY 1, 2025

No one thought the path to artificial general intelligence (AGI) would be smooth for investors, but the emergence of DeepSeek has clearly thrown a plot twist into the AI narrative. Nvidia (NASDAQ: NVDA) and other AI stocks plunged on Monday, Jan. 27, as investors responded to the threat from DeepSeek, the Chinese AI chatbot that rivals top models like ChatGPT for a fraction of the cost.

The Motley Fool

FEBRUARY 1, 2025

Broadcom (NASDAQ: AVGO) had an incredible 2024, with the stock more than doubling. After a run-up like that, many investors might wonder how much upside potential is left -- if any. Broadcom is in a great position in the artificial intelligence (AI) industry. It helps design custom AI accelerators, and also sells connectivity switches used in AI data centers.

The Motley Fool

FEBRUARY 1, 2025

2024 was a rough year for Dollar General (NYSE: DG). During a year when the S&P 500 jumped 23%, shares of the discount retailer fell 44%. Profits were down at Dollar General as it faced headwinds from weak consumer spending and inflation , competition from Walmart , and operational missteps. Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day.

The Motley Fool

FEBRUARY 1, 2025

Billionaire investors generally choose stocks of profitable companies that can safely preserve and grow their capital over the long term. This is naturally leading many top investors to invest in the " Magnificent Seven " -- a group of elite tech companies that have a history of market-beating returns and hold dominant competitive positions in their respective markets.

The Motley Fool

FEBRUARY 1, 2025

If you want stocks that you can buy and hold for not only years, but potentially the rest of your life, it's important to consider businesses that have massive growth opportunities. These are the types of companies that generate significant profits, are leaders within their respective industries, and are likely to remain dominant for years -- potentially decades.

The Motley Fool

FEBRUARY 1, 2025

Wall Street is off to a volatile start in 2025. The S&P 500 (SNPINDEX: ^GSPC) index has seen a total return of 3.2% year to date on Jan. 28, but the ride has not been smooth. Growth investors threw some more fuel on the unpredictable fires this week as the DeepSeek artificial intelligence (AI) tool cast dark shadows over the ongoing AI spree. And the Federal Reserve might slow down its interest rate cuts in 2025, which is more bad news for growth-oriented investors.

The Motley Fool

FEBRUARY 1, 2025

One of the easiest, most effective ways to invest in stocks is by using exchange-traded funds (ETFs) that give you a broad position in the entire market. Just holding on to these types of ETFs for the long haul can help you grow your portfolio in the years ahead. ETFs are popular because they can give you plenty of diversification and minimize your risk and exposure to any single stock.

The Motley Fool

FEBRUARY 1, 2025

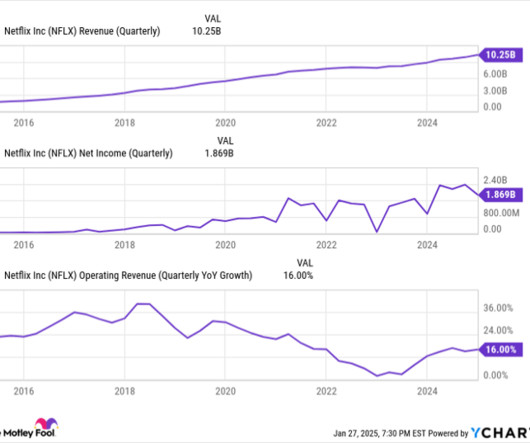

Some investors and analysts were writing Netflix 's (NASDAQ: NFLX) eulogy not too long ago. Though it delivered life-changing results from the early 2010s through the early pandemic years, the streaming specialist started encountering issues, including slow revenue and subscriber growth, and mounting competition. However, Netflix has successfully dealt with these challenges and has delivered excellent financial results in the past few years.

The Motley Fool

FEBRUARY 1, 2025

Intel (NASDAQ: INTC) made significant progress last year in its server central processing unit (CPU) business. The company has been losing market share to AMD for years, partly because it was stuck on its aging Intel 7 manufacturing process. Sapphire Rapids and Emerald Rapids , which both launched in 2023, struggled to keep up with AMD's server CPUs and featured maximum core counts well below the competition.

The Motley Fool

FEBRUARY 1, 2025

Dividend stocks can provide you with a lot of recurring income over the long term. But they can also prove to be risky investments to hold on their own because if a company's financials deteriorate, it may need to cut or stop its dividend. And if that happens, the stock could come crashing down, resulting in investors getting hit on multiple fronts: losing dividend income and seeing the value of their investment plummet as well.

The Motley Fool

FEBRUARY 1, 2025

Johnson & Johnson (NYSE: JNJ) didn't have an exceptional 2024; in fact, it was one of the worst-performing stocks on the vaunted, 30-company Dow Jones Industrial Average that year. Yet, if the company's inaugural earnings release in 2025 is any indication, this year might prove to be different. It posted encouraging growth on the top line and notched a double beat on analyst estimates.

The Motley Fool

FEBRUARY 1, 2025

Like bargains? Most people do. After all, why pay more when you can pay less? The idea even applies to investing -- the cheaper the stock is when you buy it, the bigger your potential returns. With that backdrop, investors shopping for a new growth stock to add to their portfolio may want to consider stepping into Domino's Pizza (NASDAQ: DPZ) while shares are down 20% from last June's peak.

The Motley Fool

FEBRUARY 1, 2025

Big tech companies are spending heavily to stay at the forefront of artificial intelligence. Budgets for building AI data centers filled with GPUs and network switches jumped higher in 2024. And a recent update from Meta Platforms (NASDAQ: META) CEO Mark Zuckerberg says 2025 could see an even bigger jump in spending. Zuckerberg said in a Facebook post that Meta will spend between $60 billion and $65 billion in capital expenditures in 2025.

The Motley Fool

FEBRUARY 1, 2025

The cybersecurity sector is a compelling industry to invest in. Customer demand remains strong, and cyberattacks show no signs of slowing down. The intense cyberattack on Chinese artificial intelligence start-up DeepSeek in January and the hack of the U.S. Treasury Department in December are just two recent examples. Two prominent cybersecurity providers that investors should consider adding to their portfolios are Palo Alto Networks (NASDAQ: PANW) and SentinelOne (NYSE: S).

The Motley Fool

FEBRUARY 1, 2025

It's hard to predict the future -- especially in the roller coaster ride of cryptocurrency investing. But with prices up by a jaw-dropping 473% over the last 12 months, many investors might wonder if the Ripple network's native token XRP (CRYPTO: XRP) can continue its run to $5 in 2025. With a current price of $3.07, an additional gain of 63% looks very doable for an asset with so many near-term tailwinds.

The Motley Fool

FEBRUARY 1, 2025

If you're looking for market insight and investment ideas, Warren-Buffett-led Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) is a good place to start. Berkshire's long-term track record is impeccable -- a 19.8% compound annual gain from 1965 to 2023, compared to 10.2% for the S&P 500 (SNPINDEX: ^GSPC) -- including dividends. Where to invest $1,000 right now?

The Motley Fool

FEBRUARY 1, 2025

I won't keep you in suspense: The average person in the 55-to-64 age group, which I'd call "pre-retirees," has $244,750 in their 401(k), according to the latest How America Saves report by Vanguard. However, there's more to it than this overall average indicates. For one thing, the median 401(k) balance in this age group is $87,571, a much lower amount.

The Motley Fool

FEBRUARY 1, 2025

DeepSeek, a Chinese artificial intelligence (AI) start-up, is sending shock waves through the U.S. tech sector by demonstrating its latest AI assistant, which achieves performance comparable to or even surpassing some of the world's best chatbots. The kicker here is that DeepSeek reportedly accomplished this using significantly less computational power, relying on fewer and less advanced AI chips -- particularly Nvidia 's (NASDAQ: NVDA) cutting-edge GPUs, which are typically considered essential

The Motley Fool

FEBRUARY 1, 2025

Big-box retailer Target (NYSE: TGT) is struggling. Sales growth has stalled out in the last two years, and trailing free cash flow (FCF) is down 13% over the same period. That wouldn't be so bad if Target faced these soft figures in a vacuum, but that's not the case. Walmart and Amazon have seen double-digit sales growth and generous cash flows while Target slumped.

The Motley Fool

FEBRUARY 1, 2025

Chip stocks got hit hard on Monday in response to the launch of the Chinese artificial intelligence (AI) chatbot DeepSeek. Several major AI stocks saw double-digit, one-day losses. Investors were shaken as the creators of DeepSeek were able to build a model as capable as OpenAI's ChatGPT and other industry-leading chatbots with less powerful chips and at a significantly lower cost.

The Motley Fool

FEBRUARY 1, 2025

Are you looking for a new stock pick with relatively low risk, even if that means muted gains? Take a look at Walmart (NYSE: WMT) , even at its recently reached record high. You know the company. Walmart is of course the world's biggest brick-and-mortar retailer, operating more than 10,000 stores collectively generating on the order $670 billion worth of annual sales.

Let's personalize your content