Commerzbank explores thousands of job cuts in answer to Andrea Orcel

Financial Times M&A

JANUARY 18, 2025

German lender under pressure to cut costs and boost returns after approach from UniCredit

Financial Times M&A

JANUARY 18, 2025

German lender under pressure to cut costs and boost returns after approach from UniCredit

FinSMEs

JANUARY 18, 2025

Austin, United States / Texas, 18th January 2025, Chainwire The post GameGPT Launches The Revolutionary Genesis AI NFT Collection, Combining AI and Blockchain for the Future of Gaming appeared first on FinSMEs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

JANUARY 18, 2025

Labour may allow stakes of up to 10% to encourage passive investment from sovereign wealth and pension funds

The Motley Fool

JANUARY 18, 2025

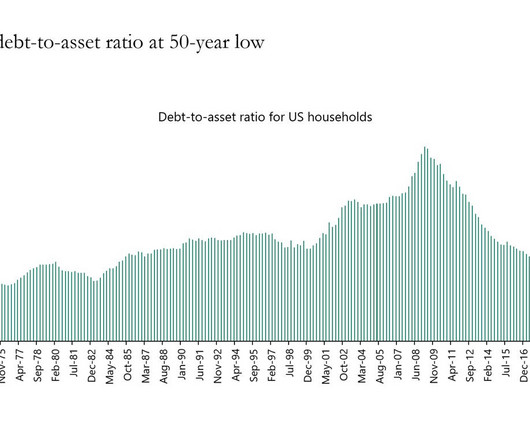

Millions of Americans rely on Social Security, but many are also concerned about its dependability going forward. 60% of current retirees say their benefits are a major source of income, according to a 2024 poll from Gallup. 43% of Americans worry "a great deal" about the future of Social Security, the poll found, and 47% of workers don't believe the program will be able to pay them a benefit once they retire.

The Big Picture

JANUARY 18, 2025

I wanted to share a quick update as to what’s been keeping me occupied during the run up to the release of the new book. The past few weeks have been pretty busy and full of surprises. We have been designing a dedicated website for the How Not to Invest book, and working with the team at Off Menu has been much more fun than I expected. But the biggest surprise has been the booksAudible version.

The Motley Fool

JANUARY 18, 2025

Nvidia stock has been one of the biggest winners of the artificial intelligence (AI) revolution in the past couple of years, clocking remarkable gains of nearly 800% over the past two years on account of the red-hot demand for its data center graphics cards, but the past three months have been difficult for the chipmaker. Shares of the semiconductor giant are down 1% over the past three months.

The Big Picture

JANUARY 18, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat outside, and get ready for our longer-form weekend reads: Is There a Problem with Passive Investing? Passive investing has absolutely revolutionized the investment landscape for individual investors. Not only has it dramatically lowered the costs of asset ownership, but it has done so while delivering strong returns.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

The Motley Fool

JANUARY 18, 2025

DigitalOcean (NYSE: DOCN) stock peaked more than three years ago. After the stock price made a sharp reversal beginning in late 2021, its potential for investor returns seemed to have vanished, as its stock lost more than 70% of its value. In addition to the bear market, slowing growth and the rise of artificial intelligence (AI) added to the uncertainty.

The Motley Fool

JANUARY 18, 2025

In some ways, 2024 was a great year for space investors. With 138 combined Falcon 9, Falcon Heavy, and Starship launches, SpaceX launched more rockets last year than all the rest of the world combined. That made 2024 a pretty terrific year for SpaceX. But for the rest of the space industry. not so much. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now.

The Motley Fool

JANUARY 18, 2025

My long-term financial goal is to eventually collect enough passive income each year to cover my basic living expenses. One aspect of my strategy is to invest in companies that pay an above-average dividend that steadily rises. That should enable me to achieve my passive income goal sooner. I'm always looking for new dividend stocks to help me reach my goal.

The Motley Fool

JANUARY 18, 2025

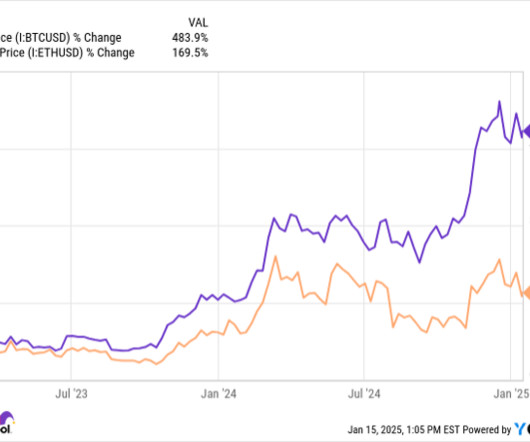

One of the key reasons that Bitcoin (CRYPTO: BTC) has performed so well, topping $108,000 at one point last year, and been more resilient than the rest of the crypto sector is because investors view the token as a potential inflation hedge. Only 21 million Bitcoin tokens can ever be mined and there are already 19.8 million in circulation, making the world's largest cryptocurrency a finite asset with similar dynamics to gold.

The Motley Fool

JANUARY 18, 2025

Returning 25% in 2024, the S&P 500 delivered a record-breaking year for stock market investors. A resilient global economy coupled with interest rate cuts by the Federal Reserve continues to fuel optimism toward a strong outlook. Investors have also cheered results from the technology sector, where developments in artificial intelligence (AI) are already proving transformative for various industries.

The Motley Fool

JANUARY 18, 2025

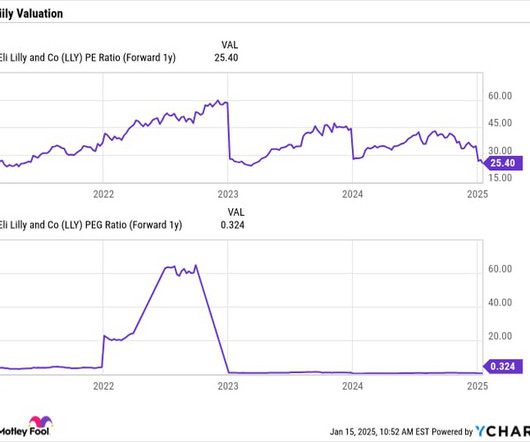

GLP-1 drugs have become all the rage for weight loss, with sales for drugs like Novo Nordisk 's Ozempic and Eli Lilly 's (NYSE: LLY) Mounjaro skyrocketing over the past year. However, Eli Lilly recently surprised investors when it cut its full-year revenue guidance ahead of an investor conference after sales of its GLP-1 drugs fell short of expectations.

The Motley Fool

JANUARY 18, 2025

Social Security is one of the foundations of most Americans' retirement planning. In an annual poll from Gallup, 60% of retirees said Social Security is a major source of income, and another 28% said it played a minor role in their budget. Keeping as much of your Social Security benefits as you can is essential for many households. That means keeping taxes on your Social Security income low.

The Motley Fool

JANUARY 18, 2025

Any stock associated with artificial intelligence (AI) has had quite a run in the last few years. Take Nvidia (NASDAQ: NVDA) , which is up more than 1,000% and now sports one of the largest market caps in the world. Frankly, almost every big tech stock is benefiting from the AI boom, leading to monster returns in 2024. The big question is, though, will this party continue in 2025?

The Motley Fool

JANUARY 18, 2025

"When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever." -- Warren Buffett, Berkshire Hathaway 's 1998 Letter to Shareholders Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks Warren Buffett has created incredible wealth for shareholders of Berkshire Hathaway.

The Motley Fool

JANUARY 18, 2025

Enterprise artificial intelligence (AI) software provider C3.ai (NYSE: AI) is off to a shaky start in 2025. Shares of the company have fallen 10% this year, though there has been no company-specific news of note that could have triggered this pullback. However, this seems like an opportunity for investors to add a promising AI stock to their portfolios.

The Motley Fool

JANUARY 18, 2025

Growth stocks have been helping propel the stock market higher for the past decade. Although the market has been off to a choppy start in 2025, there is good reason to believe that growth stocks can continue to lead it higher in the years ahead. Let's look at four companies with breakout revenue growth that investors can consider buying and holding for the next decade.

The Motley Fool

JANUARY 18, 2025

Since ChatGPT was released on Nov. 30, 2022, the S&P 500 (SNPINDEX: ^GSPC) and Nasdaq Composite (NASDAQINDEX: ^IXIC) have boasted total returns of 48% and 69%, respectively. Euphoria around the prospects of artificial intelligence (AI) helped snap the capital markets out of a wicked funk that took place during much of 2022. And while some investors may be wary of just how long the bull market will last, history suggests 2025 should be another terrific year for technology stocks in particular

The Motley Fool

JANUARY 18, 2025

Many fintech stocks soared in 2020 and 2021 as pandemic-driven digital transactions, stimulus checks, and low interest rates generated strong tailwinds for the sector. But in 2022 and 2023, a lot of those stocks tumbled as inflation, rising rates, and other macroeconomic headwinds curbed consumer spending and crushed higher-growth stocks. Some of those stocks bounced back in 2024 as interest rates declined, but many of them are still trading well below their all-time highs.

The Motley Fool

JANUARY 18, 2025

International Business Machines ' (NYSE: IBM) strategy centers around hybrid cloud computing and artificial intelligence (AI). In the cloud computing market, IBM's acquisition of Red Hat forms the foundation of its hybrid cloud platform. For large companies and organizations looking to modernize their infrastructures and applications, aiming to save money, remove the burden of legacy tech, or deploy new technologies like AI, IBM's hybrid cloud platform offers a path forward.

The Motley Fool

JANUARY 18, 2025

It can pay to listen to Warren Buffett. The legendary investor has navigated multiple market cycles while generating market-beating returns for his investors for close to 75 years. What is Buffett saying right now? Well, the investor has been quite reclusive as of late (I don't blame him; he is 94 years old). The next time we will likely hear from Buffett is in his annual letter to shareholders and the annual meeting for Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) investors this spring.

The Motley Fool

JANUARY 18, 2025

There's a reason so many people rush to file for Social Security at 62. That's the earliest age you're allowed to sign up for benefits. And it's easy to see why many folks would rather get their money sooner rather than later. Of course, claiming Social Security at 62 means settling for a reduced benefit. You're not entitled to your entire monthly benefit based on your personal wage history until full retirement age arrives.

The Motley Fool

JANUARY 18, 2025

Let's face it. Whether you're working or retired, paying income taxes can be a drag. Although we each have a civic duty to help fund the government we benefit from, most consumers would typically like to minimize the amount. Well, there's good news for current and future retirees: A handful of states don't tax any retirement income at all. Now, you shouldn't simply move to one of these states as means of lowering your tax bill.

The Motley Fool

JANUARY 18, 2025

Welcome to Lake Wobegon, where all the women are strong, all the men are good-looking, and all the children are above average. -- Garrison Keillor We'd all like to be above average when it comes to financial things, so it's natural to wonder how other folks are doing. Here's a look at average 401(k) balances for people in different age groups: Start Your Mornings Smarter!

The Motley Fool

JANUARY 18, 2025

As of Jan. 16, the Ethereum (CRYPTO: ETH) cryptocurrency had gained 37% in a year. It was a wild ride along the way, however, with coin prices ranging from $2,220 to $4,070. All told, the second-largest name in crypto barely managed to outperform a stellar showing by the S&P 500 stock market index over the same period. Ethereum is worth about $3,333 per coin this morning.

The Motley Fool

JANUARY 18, 2025

Companies will commonly split their stock after a strong run-up in price. While it doesn't change any of the underlying fundamentals of the company, it's a strong signal from management that it believes the stock will continue moving higher. As a result, many investors buy shares immediately following a stock-split announcement and continue to buy well after the split executes.

The Motley Fool

JANUARY 18, 2025

Nvidia (NASDAQ: NVDA) , the producer of the world's most powerful artificial intelligence (AI) chips, has been at the forefront of the AI revolution. Customers have piled into these top graphics processing units (GPUs) for the crucial AI tasks of training and inferencing of models. So Nvidia plays a key role in helping customers at the earliest stages of their AI journey.

The Motley Fool

JANUARY 18, 2025

Investors often turn to Warren Buffett for advice for one good reason: He's proven his ability to navigate any investing waters -- from moments of euphoria to the doldrums -- and win over time. Buffett doesn't rush to buy the hottest stocks as markets soar and doesn't panic-sell during difficult periods. Instead, he invests in quality companies when the price is right and holds on for the long term.

The Motley Fool

JANUARY 18, 2025

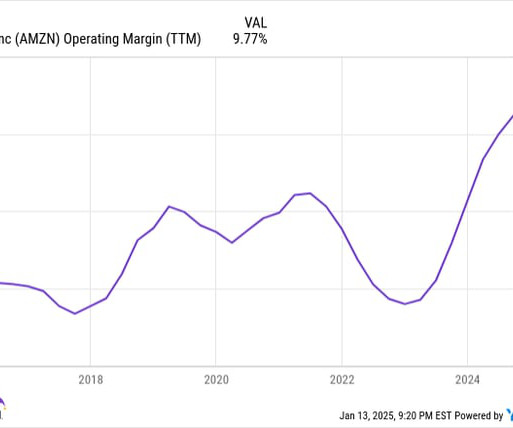

There are 10 companies in the world that currently have a market cap of more than $1 trillion. It would be reasonable to assume that none of these businesses have bargain stocks. These companies are very well known, and their valuations prove that huge swaths of the market already believe in their prospects. But there's one company on the list of the largest publicly traded stocks that is arguably a screaming deal.

The Motley Fool

JANUARY 18, 2025

In this video, Motley Fool contributors Jason Hall and Tyler Crowe explain why Brookfield Corporation (NYSE: BN) subsidiary Brookfield Asset Management (NYSE: BAM) and Curtiss-Wright (NYSE: CW) are likely to emerge as winners from the second nuclear era. *Stock prices used were from the afternoon of Jan. 15, 2025. The video was published on Jan. 18, 2025.

The Motley Fool

JANUARY 18, 2025

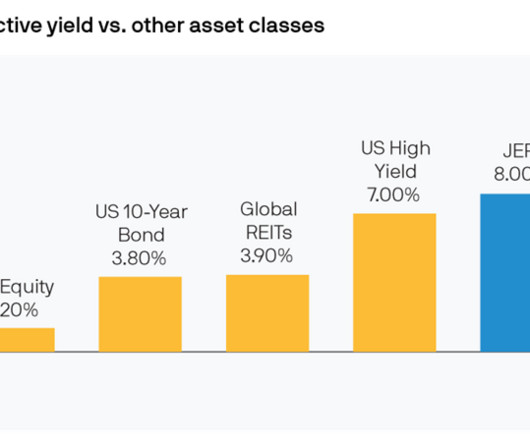

Exchange-traded funds (ETFs) are great options for those seeking to generate passive income. Many of these funds hold a portfolio of income-generating investments. Because of that, you don't have to actively manage your portfolio. You can just sit back and watch the income flow into your brokerage account. The Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) , JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI) , and Vanguard Real Estate ETF (NYSEMKT: VNQ) are three great ETFs for generating passi

The Motley Fool

JANUARY 18, 2025

The past couple of years have been great for the overall stock market, but there is a downside. When stock prices go up, dividend yields decline. Now, income-seeking investors need to look extra hard for reliable stocks that offer satisfying yields. The search for reliable high-yield dividend stocks is harder than it was a couple of years ago, but it's not impossible.

The Motley Fool

JANUARY 18, 2025

It seems clear that 2024 was the year of artificial intelligence (AI) -- or was it? Although some of the market's biggest winners were AI stocks, they weren't uniformly top performers. If you had invested in an AI-based exchange-traded fund (ETF) at the beginning of last year, the chance that you would have beaten the market wasn't great, and if you did, it may have been a slim win.

The Motley Fool

JANUARY 18, 2025

Social Security was never intended to provide the entirety of anyone's retirement income. The fact is, however, that many of the program's beneficiaries are doing reasonably well with it. Indeed, some are doing great. How well? That's largely a factor of age. Just for the record though, current 72-year-olds are among those collecting the biggest monthly Social Security payments.

The Motley Fool

JANUARY 18, 2025

It hasn't been a great period for investors in Novo Nordisk (NYSE: NVO) despite its ongoing status as one of the pharmaceutical industry's apex competitors in the field of cardiometabolic drugs. Its shares are down by more than 20% in the last 12 months, and, given a few new competitive developments, the next 12 months might not see much in the way of relief for shareholders unless there's an upset of some kind.

The Motley Fool

JANUARY 18, 2025

I own a lot of dividend stocks. They're a big part of my investment strategy. I'm working toward eventually generating enough passive income to cover my basic living expenses. Last year, five stocks supplied me with more than $500 of dividend income apiece. Here's a look at these leaders, which I expect will provide me with even more passive income in 2025.

Let's personalize your content