Rome vs Milan: how Mediobanca turned prey for Monte dei Paschi

Financial Times M&A

JANUARY 25, 2025

Prestigious Milanese bank has become latest pawn in government consolidation efforts

Financial Times M&A

JANUARY 25, 2025

Prestigious Milanese bank has become latest pawn in government consolidation efforts

The Motley Fool

JANUARY 25, 2025

Some important Medicare updates took effect on Jan. 1. One of the biggest changes is a $2,000 cap on out-of-pocket prescription drug costs, which could save some households a lot of money in 2025. But not all the changes were positive. Medicare premiums for Parts A and B went up again. And one benefit that's been a lifesaver for seniors over the last few years has been quietly restricted.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

JANUARY 25, 2025

Political interference fuels uncertainty for businesses in need of a stable competition policy

The Motley Fool

JANUARY 25, 2025

Investors often turn to Warren Buffett-led Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) for insight on market gyrations and top stocks to buy now. And while Berkshire's portfolio has seen its fair share of changes over the years, one theme that has stayed constant is the emphasis on the financial sector through Berkshire's public equity portfolio and its insurance businesses.

FinSMEs

JANUARY 25, 2025

SignalPlus, a Singapore-based provider of software and infrastructure solutions forcryptoderivatives, raised US$11M in Series B funding. The round was led by AppWorks and OKX Ventures, with participation from Avenir Group and HashKey. The company intends to use the funds for: Led by CEO Chris Yu, SignalPlus is a technology company building trading software focusing on […] The post SignalPlus Closes US$11M Series B Funding appeared first on FinSMEs.

The Motley Fool

JANUARY 25, 2025

Netflix (NASDAQ: NFLX) dazzled investors with its Q4 2024 earnings report on Jan. 21. The streaming leader blew past expectations for subscriber growth, posting record additions of 18.9 million, well above the analyst consensus of 9.8 million. Subscriber growth was also broad-based with the company adding at least 4 million subscribers in all four of its regions, showing its popularity around the world.

The Big Picture

JANUARY 25, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: How Long Can Toyota Put Off Figuring Out EVs? The worlds No. 1 automaker has kept its focus on hybrids and gas-guzzlers, for better and worse. ( Businessweek ) The Spectacular Burnout of a Solar Panel Salesman : He thought hed make millions of dollars selling solar panels door-to-door.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Indigo Marketing Agency

JANUARY 25, 2025

The financial advisory world is evolving faster than ever. To thrive, advisors must learn from todays top influencersleaders who push boundaries, share insights, and spark innovation. Here are the 30 voices to follow in 2025, along with rising stars you shouldnt miss. 1. Michael Kitces Reason to Follow: Deep insights into financial planning and wealth management Michael Kitces continues to dominate as a thought leader in financial planning.

The Motley Fool

JANUARY 25, 2025

I initially bought Hershey (NYSE: HSY) in late 2023 and over roughly a year built it up to what I consider a full position. The story behind the stock hasn't changed at all since I bought it, and if I didn't already have a full position, it would still be on my top-buy list. Here's why I have such a taste for Hershey today. What does Hershey do? If you are going to buy and hold Hershey stock, you have to get on board with one important fact: The food company's main business is confections.

FinSMEs

JANUARY 25, 2025

Allara Health, a NYC-based virtual care platform bridging the care divide for women battling chronic hormonal conditions, raised$26m inSeries B funding. The round, which brought total funding to$38.5m, was led by Index Ventures (with partnerMartin Mignot joining Allara’s board), with participation from existing investor GV (Google Ventures). The company intends to use the funds to […] The post Allara Health Raises $26M in Series B Funding appeared first on FinSMEs.

The Motley Fool

JANUARY 25, 2025

Charging out of the gate, Plug Power (NASDAQ: PLUG) stock has soared nearly 15% to start 2025. It's undeniably a welcome sight, considering the S&P 500 (SNPINDEX: ^GSPC) has inched 2% higher during the same time, and the stock's performance was far less encouraging in 2024. While the hydrogen and fuel cell stock has rocketed higher over the past few weeks, investors who have maintained positions in Plug Power over the past three years are still waiting for the stock to recover from what has

The Motley Fool

JANUARY 25, 2025

It's a matchup between two innovative and high-growth financial technology (fintech) giants. In one corner, SoFi Technologies (NASDAQ: SOFI) has emerged as a prominent U.S. financial services player enjoying strong demand for its online-based suite of solutions. On the other side, Nu Holdings (NYSE: NU) shares similarities through its digital-native platform, but with a strategic focus on Latin America.

The Motley Fool

JANUARY 25, 2025

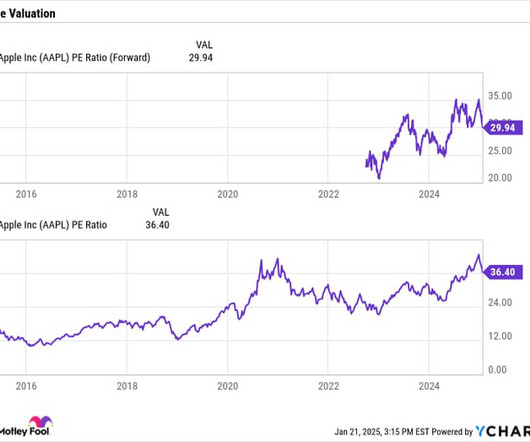

In a rare move, analysts at Jefferies downgraded one of the largest companies in the world, Apple (NASDAQ: AAPL) , to underperform. Wall Street analysts are known for being bullish, so underperform and sell ratings tend to make up only a small percentage of overall analyst ratings. For its part, Jefferies sees weak iPhone shipments in the fourth quarter, with Apple's artificial intelligence (AI) features not resonating with consumers.

The Motley Fool

JANUARY 25, 2025

While technology stocks get a lot of attention from the media, there are a lot of attractive options in the consumer goods space as well. Here are four stocks in that sector that I'd buy without any hesitation. Amazon While often classified as a consumer goods stock, Amazon (NASDAQ: AMZN) is really a combination of a consumer goods company and a technology company.

The Motley Fool

JANUARY 25, 2025

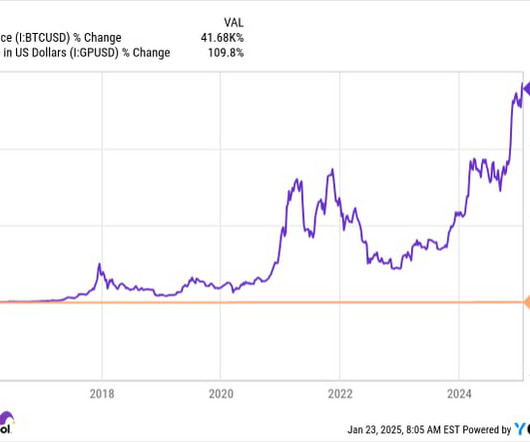

Are you willing to accept above-average risk for a shot at an above-average reward? Maybe you're even hoping to turn a modest amount of money into a seven-figure stash in a relatively short period of time. Well, these kinds of trades are out there. Many of them don't pan out as hoped, to be sure. Every now and then, though, one of them ends up defying the odds.

The Motley Fool

JANUARY 25, 2025

You might know Bank of America (NYSE: BAC) as one of the world's largest financial institutions. It is a well-known consumer-facing bank with over $3.2 trillion in assets today. You might also know it for the controversial bailout money it and its peers received following the financial crisis of 2007-2008. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now.

The Motley Fool

JANUARY 25, 2025

Heading into 2025, the biggest question for Nvidia (NASDAQ: NVDA) is whether the artificial intelligence (AI) chip superstar can continue to grow at a breakneck pace. Some investors have argued that an AI bubble is forming, and there is evidence that the new technology is following in the footsteps of earlier bubbles due in part to the dramatic growth in some AI stocks.

The Motley Fool

JANUARY 25, 2025

Would it surprise you to hear that 60% of Amazon 's (NASDAQ: AMZN) total operating income came from Amazon Web Services (AWS) alone over the past 12 months? It's true! While some still consider Amazon an online retailer, AWS is the company's best moneymaker. This is even more important given the rise of artificial intelligence (AI). Rather than use thousands of words, below are three charts that show why Amazon is one of the best AI stocks to own today.

The Motley Fool

JANUARY 25, 2025

Based on its share price, down 75% in the last three years, it's easy to write off Moderna (NASDAQ: MRNA) as a biotech that'll never recover its former glory -- which it built on the success of its coronavirus vaccine program. But where there are widespread bearish sentiments about a stock, there's also often an opportunity for investors who are willing to focus on the long term and appreciate that things won't always be like they are now.

The Motley Fool

JANUARY 25, 2025

The stock market is very highly valued to start 2025, and investors need to pick their buys wisely. In this video, Travis Hoium discusses five stocks, each with a combination of growth and value, for long-term investors to buy today. *Stock prices used were end-of-day prices of Jan. 22, 2025. The video was published on Jan. 24, 2025. Where to invest $1,000 right now?

The Motley Fool

JANUARY 25, 2025

It's been a bumpy ride for many electric vehicle (EV) stocks over the past few years, and both Rivian Automotive (NASDAQ: RIVN) and Lucid Group (NASDAQ: LCID) have felt each jarring pothole. Rivian's shares have tumbled 79% and Lucid's have fallen 92% over the past three years. If those declines haven't scared you off, then you might, like me, have a long-term optimistic view of the EV market.

The Motley Fool

JANUARY 25, 2025

Shares of Celsius Holdings (NASDAQ: CELH) are currently trading 73% off their all-time high. Lower sales are to blame as its largest distributor made inventory adjustments that weighed on Celsius' financial results last year. In the wake of new sales and market share data, Morgan Stanley is maintaining its equal weight (hold) rating on the shares and also keeping its price target at $42, which implies upside of 66% from where the stock trades as of this writing.

The Motley Fool

JANUARY 25, 2025

Some people make it a New Year's resolution to improve their finances by investing in stocks. It's a laudable goal, and to get started, it's crucial to pick stocks that have the tools to perform well for decades to come. Corporations that fit this criteria are a rare breed, but they do exist. Below, I'll look at two companies in the healthcare sector: Eli Lilly (NYSE: LLY) and Vertex Pharmaceuticals (NASDAQ: VRTX).

The Motley Fool

JANUARY 25, 2025

Recent developments in quantum computing have investors excited about Rigetti (NASDAQ: RGTI) stock. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks *Stock prices used were the afternoon prices of Jan. 22, 2025. The video was published on Jan. 24, 2025. Should you invest $1,000 in Rigetti Computing right now?

The Motley Fool

JANUARY 25, 2025

Plug Power (NASDAQ: PLUG) stock has cratered since hitting its pandemic highs, but is this a time to buy the dip or abandon the stock? Travis Hoium explains why Plug Power stock may be in an even worse position in one year than it's in today. *Stock prices used were end-of-day prices of Jan. 24, 2025. The video was published on Jan. 24, 2025. Where to invest $1,000 right now?

The Motley Fool

JANUARY 25, 2025

As shown by the ongoing rise of a galaxy of different cryptocurrencies that coexist alongside fiat-based currencies distributed by governments, money isn't what it used to be. Of course, when it comes to buying goods and services in the real world, there's still no substitute for cold hard cash, so your main medium of value exchange isn't going away.

The Motley Fool

JANUARY 25, 2025

Quantum computing has been an up-and-down investment theme over the past few months. The rage kicked off when Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) announced a breakthrough with its Willow quantum computing chip, and any stock associated with quantum computing rose on the news of the announcement. Then, Nvidia CEO Jensen Huang halted the momentum with his statement that "useful quantum computing" is likely 15 years away.

The Motley Fool

JANUARY 25, 2025

When you're buying income stocks, a company's underlying business is arguably still the most crucial factor to consider, even more than the dividend yield. Corporations with high yields may look attractive, but sometimes these are unsustainable. So it might be best to opt for stocks with lower yields but more robust operations. Which dividend-paying companies should investors put their money in this year, and which ones should they avoid?

The Motley Fool

JANUARY 25, 2025

Snap (NYSE: SNAP) stock investors will be looking for the company to report better growth in North America. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks *Stock prices used were the afternoon prices of Jan. 21, 2025. The video was published on Jan. 23, 2025.

The Motley Fool

JANUARY 25, 2025

Uber (NYSE: UBER) stock is selling at a discounted price because of fears that driverless car technology will hurt its business. Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free *Stock prices used were the afternoon prices of Jan. 21, 2025. The video was published on Jan. 23, 2025. Should you invest $1,000 in Uber Technologies right now?

The Motley Fool

JANUARY 25, 2025

For the past few months, quantum computing stocks such as IonQ , Rigetti Computing , and D-Wave Quantum have garnered a lot of attention and witnessed pronounced run-ups in their share prices. The momentum each of these stocks is experiencing certainly makes the idea of quantum computing a tempting investment opportunity. But as I've expressed previously, I'd caution from following the crowd when it comes to mainstream quantum computing stocks.

The Motley Fool

JANUARY 25, 2025

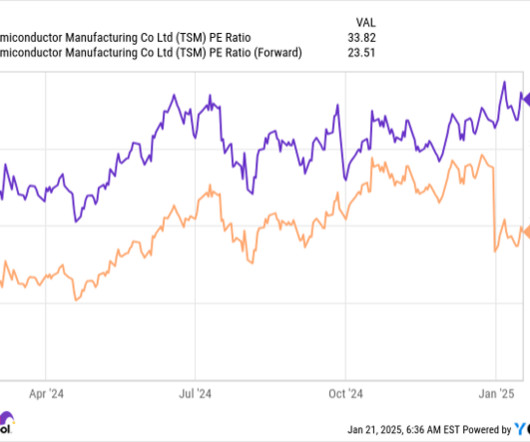

Making smart investments often requires you to not follow the crowd. In the semiconductor industry, you can't follow the crowd any less than buying Intel (NASDAQ: INTC) stock. While Intel is struggling right now, the company's manufacturing investments still hold a lot of potential and could be the key to the company's turnaround. Another neglected semiconductor stock is Qualcomm (NASDAQ: QCOM) , which trades at an uninspiring valuation.

The Motley Fool

JANUARY 25, 2025

Looking into companies that have recently split their stock is a fairly smart investing strategy. It's not that stock splits in and of themselves are special. It's that companies usually split their stock for one reason: The stock price has risen a lot. While some may see that as a red flag, that's a poor way of looking at it. Stock prices rise over the long term when the company is doing well, and finding companies that are doing well is a key part of investing.

The Motley Fool

JANUARY 25, 2025

PayPal 's (NASDAQ: PYPL) new CEO is doing an excellent job of responsibly growing the business. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks *Stock prices used were the afternoon prices of Jan. 22, 2025. The video was published on Jan. 24, 2025. Dont miss this second chance at a potentially lucrative opportunity Ever feel like you missed the boat in buying the most successful stocks?

The Motley Fool

JANUARY 25, 2025

Finding stocks that are among the top investments of the decade isn't easy. Many trends can rise and fall, causing some stocks to falter after a few years. However, one industry with obvious staying power that will benefit no matter how big other trends get is chip companies. While I believe artificial intelligence (AI) will become a huge factor, it's hard to identify which company will be the biggest winner a decade from now.

The Motley Fool

JANUARY 25, 2025

For the last couple of years, the pharmaceutical sector has become infatuated with glucagon-like peptide 1 (GLP-1) agonists used to treat diabetes and help with chronic weight management. While Novo Nordisk 's Ozempic is the most mainstream GLP-1 medication, Eli Lilly (NYSE: LLY) has two blockbuster weight loss drugs of its own: Mounjaro and Zepbound.

The Motley Fool

JANUARY 25, 2025

Nvidia (NASDAQ: NVDA) should get a boost from the announced $500 billion investment in building artificial intelligence capabilities in the United States. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks *Stock prices used were the afternoon prices of Jan. 21, 2025.

Let's personalize your content