‘Braintainment’ boom sees BC Partners aim to sell puzzle-setting big shot

Financial Times M&A

FEBRUARY 15, 2025

Dutch company Keesing is the market leader in print, online and app-based puzzles from sudoku to crosswords

Financial Times M&A

FEBRUARY 15, 2025

Dutch company Keesing is the market leader in print, online and app-based puzzles from sudoku to crosswords

SEI

FEBRUARY 15, 2025

Explore the role of digital innovation in alternative investments

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Motley Fool

FEBRUARY 15, 2025

United Parcel Service (NYSE: UPS) , usually just known by its ticker UPS, has been working through a turnaround. Wall Street hasn't been impressed with its efforts, but in the back half of 2024, the company's performance turned an important corner. Right at that moment, management announced a big change in its relationship with its largest customer, which upset investors anew.

The Big Picture

FEBRUARY 15, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: A Visit to Dog College : From disaster response to disease detection, these canines choose their own career paths. ( Popular Science ) 50 Surprising Facts About Saturday Night Live Saturday Night Live made its television debut on October 11, 1975.

The Motley Fool

FEBRUARY 15, 2025

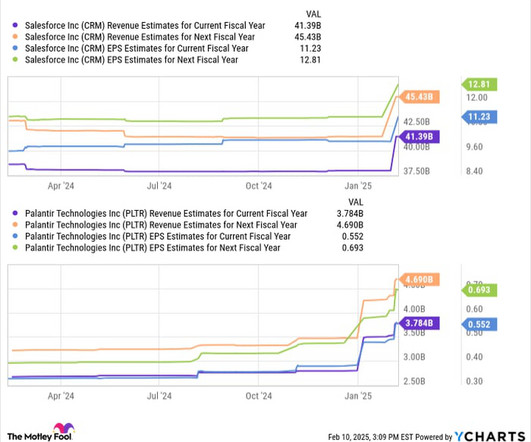

For the last two years, technology stocks have been rocking thanks to an overwhelmingly bullish narrative surrounding artificial intelligence (AI). Among AI's biggest winners have been software businesses, a theme that I don't see changing anytime soon. Below, I'm going to compare two of the biggest names in enterprise software benefiting from the AI revolution: Palantir Technologies (NASDAQ: PLTR) and Salesforce (NYSE: CRM).

The Motley Fool

FEBRUARY 15, 2025

Palantir Technologies (NASDAQ: PLTR) earlier this month reported fourth-quarter financial results that crushed Wall Street's expectations. The stock has rocketed higher on the news, such that its total return since January 2024 now stands at 585%. Palantir was the best-performing member of the S&P 500 (SNPINDEX: ^GSPC) during that period. In fact, it beat the next closest stock by 250 percentage points.

The Motley Fool

FEBRUARY 15, 2025

Wall Street recently discovered through Securities and Exchange Commission filings that artificial intelligence (AI) chipmaker Nvidia (NASDAQ: NVDA) reshuffled its tech portfolio, selling out of last-mile delivery pioneer Serve Robotics (NASDAQ: SERV) and AI voice leader SoundHound AI (NASDAQ: SOUN). As the preeminent force in AI hardware, Nvidia's investment moves often signal broader market trends.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

The Motley Fool

FEBRUARY 15, 2025

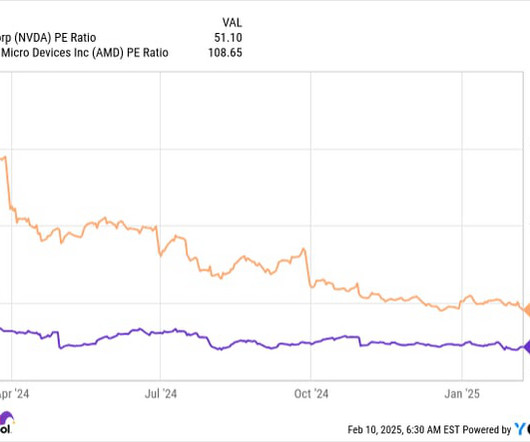

Nvidia (NASDAQ: NVDA) has essentially owned the data center computing market, which is a huge deal, considering the hundreds of billions of dollars being spent on artificial intelligence (AI) infrastructure. Nvidia is one of the primary benefactors of this investment, although some of its competitors, like AMD (NASDAQ: AMD) , are also benefiting. However, the lead that Nvidia has surmounted looks unassailable, but all it takes is one innovation, and AMD could be neck and neck with Nvidia.

The Motley Fool

FEBRUARY 15, 2025

Growth stocks are a great tool to build lasting wealth in the stock market. Three Motley Fool contributors believe Celsius Holdings (NASDAQ: CELH) , Sweetgreen (NYSE: SG) , and Shopify (NYSE: SHOP) offer excellent return prospects over the long term, but Wall Street analysts also see the potential for upside in the near term. Analyst price targets on these stocks range from 44% to 72%.

The Motley Fool

FEBRUARY 15, 2025

After producing incredible returns for investors in 2023 and 2024, the stock market got off to a great start in 2025, as well. Since the start of the current bull market in October 2022, the S&P 500 index is up nearly 70%, as of this writing. Many growth stocks have seen their prices climb even faster. While many top growth stocks might look overvalued at this point, there are still plenty of great opportunities in the market.

The Motley Fool

FEBRUARY 15, 2025

Image source: Getty Images When planning for retirement, choosing the right account can make a huge difference in how much money you get to keep. While 401(k)s and traditional IRAs offer tax advantages, the Roth IRA stands out as one of the most powerful retirement tools available. Looking for a secure place to grow your savings? See our expert picks for the best FDIC-insured high-yield savings accounts available today - enjoy peace of mind with competitive rates.

The Motley Fool

FEBRUARY 15, 2025

Millions of older Americans today get a benefit each month from Social Security. And a 2020 report by the National Institute on Retirement Security found that 40% of Americans have only Social Security to rely on for retirement income. I have a very different plan for retirement, though. And it's one that has me using Social Security for one specific purpose.

The Motley Fool

FEBRUARY 15, 2025

Over the course of the past few years, growth stocks have led the charge for the stock market. However, every year presents different challenges, and I think a different set of stocks -- a few that have been left behind -- could provide some serious growth potential in 2025 and beyond. In today's video, I will cover six stocks with high growth potential.

The Motley Fool

FEBRUARY 15, 2025

More than two months ago, Intel (NASDAQ: INTC) made a surprising move. It pushed CEO Pat Gelsinger out the door. The board of directors did so without lining up a replacement and named two interim co-CEOs in his place, CFO David Zinsner and CEO of Intel Products Michelle Johnston (MJ) Holthaus. In some ways, the move made sense. The stock had floundered under Gelsinger as Intel struggled to overcome past missteps, gain ground in AI, and turn its foundry business profitable.

The Motley Fool

FEBRUARY 15, 2025

Investors should never ignore valuations when picking stocks. The price a stock trades at can drastically impact your overall returns. A metric such as the price-to-earnings (P/E) ratio can be helpful in enabling you to easily gauge how expensive or cheap a stock is. In some cases, however, it can make sense to buy a stock that's trading at a seemingly high P/E multiple simply because of its fantastic growth prospects.

The Motley Fool

FEBRUARY 15, 2025

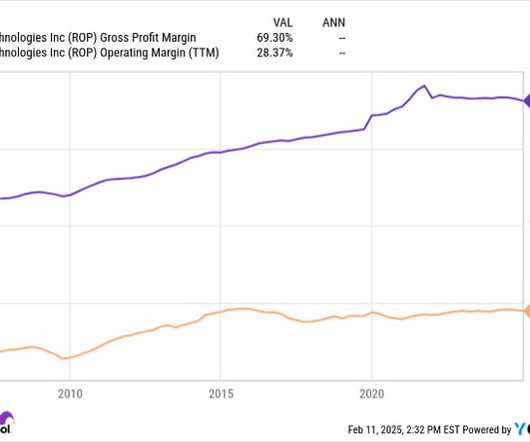

Roper Technologies (NASDAQ: ROP) is a diversified technology company that has delivered total returns of roughly 3,740% since 2000. These returns are six times larger than the S&P 500 's over the same time, making Roper one of the most successful stocks in the index. Despite this incredible run, the average person probably hasn't heard of Roper or its portfolio of roughly 28 independent businesses.

The Motley Fool

FEBRUARY 15, 2025

Teladoc Health (NYSE: TDOC) , the famed telemedicine specialist that rose to prominence in the early pandemic years, is not performing nearly as well as it once did. Over the past three years, the company's financial results have been disappointing -- at best -- and its stock price has plummeted. Is the market too pessimistic about the telehealth company's prospects?

The Motley Fool

FEBRUARY 15, 2025

Quantum computing investing is incredibly hot right now, as this exciting technology is starting to have some significant breakthroughs. Additionally, artificial intelligence (AI) remains a huge theme in the market, as the buildout of this life-altering technology is just getting underway. Many investors want to take advantage of both trends, but there are only a few ways to do it.

The Motley Fool

FEBRUARY 15, 2025

Shares of Shopify (NYSE: SHOP) rose following the company's fourth-quarter results as it produced strong revenue growth. The stock of the e-commerce software platform is now up nearly 40% over the past year, as of this writing. However, the company could feel some pressure from potential tariffs. Let's examine the company's most recent results and guidance to see if now is a good time to buy the stock.

The Motley Fool

FEBRUARY 15, 2025

The energy sector can be a great source of durable passive income if you know where to look. While commodity price volatility can affect the cash flows of many energy companies, others have business models designed to mute the impact of that volatility on their earnings, so they can generate steadier cash flow to help support their growing dividends.

The Motley Fool

FEBRUARY 15, 2025

Honeywell International (NASDAQ: HON) is finally breaking up. The rationale for the breakup makes perfect sense, and it could release a lot of value for investors. Still, does that make the stock a buy right now? Here's what you need to know before deciding on the stock. Honeywell's breakup plans Having previously announced the spinoff of its advanced materials business (due in late 2025 or early 2026), Honeywell's management decided to take the next step and separate its automation and aerospac

The Motley Fool

FEBRUARY 15, 2025

Nvidia (NASDAQ: NVDA) has been a clear winner of the artificial intelligence (AI) revolution so far. The company has become the leading AI chip designer, holding about 80% of the market. Nvidia makes the world's most powerful graphics processing units (GPUs) -- these are the chips crucial for major AI tasks like the training and inferencing of models.

The Motley Fool

FEBRUARY 15, 2025

According to the latest estimates, the U.S. population is about 340 million. As of the end of 2024, more than 51.7 million Americans received Social Security retirement benefits, representing over 15% of the population. So, needless to say, Social Security plays a pivotal role in the U.S. retirement system and economy. And given its importance in many people's retirement finances , it's helpful to get a sense of how much you could be receiving.

The Motley Fool

FEBRUARY 15, 2025

Microsoft (NASDAQ: MSFT) has quickly emerged as a leading player in the generative AI race through internal investments in its products and services and billions of dollars in investments in ChatGPT creator OpenAI. Some recent research from The Motley Fool analyzed Microsoft's earnings call to find some of the ways the company mentions how it will benefit from generative AI and what steps it's taking now to expand its artificial intelligence footprint.

The Motley Fool

FEBRUARY 15, 2025

The S&P 500 (SNPINDEX: ^GSPC) has advanced 21% in the last year, and many stocks now trade at expensive valuations. However, most Wall Street analysts still see buying opportunities in Datadog (NASDAQ: DDOG) and The Trade Desk (NASDAQ: TTD) : Among the 47 analysts who follow Datadog, the median target price is $160 per share. That implies 21% upside from its current share price of $132.

The Motley Fool

FEBRUARY 15, 2025

Buying solid companies at attractive valuations and holding them for a long time is a tried and tested way of making money in the stock market. The strategy allows investors to benefit from secular growth trends and also take advantage of the power of compounding. Artificial intelligence (AI) has been one of the hottest trends that investors have hopped on in the past two years.

The Motley Fool

FEBRUARY 15, 2025

Might the Oracle of Omaha, Warren Buffett, ever get on board with investing in an asset like Bitcoin , (CRYPTO: BTC) which -- on the surface -- breaks all of his traditional rules for investing? It's more reasonable than it sounds. Here's why. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now.

The Motley Fool

FEBRUARY 15, 2025

The S&P 500 is in the midst of a market rally that has persisted for more than two years and continues to defy detractors. A solid economic outlook, growing corporate profits, and the vast potential of artificial intelligence (AI) have all helped fuel the market's advances. After gaining 24% in 2023, the benchmark index tacked on gains of 23% in 2024.

The Motley Fool

FEBRUARY 15, 2025

Investors have had something to smile about over the past couple of years. The S&P 500 (SNPINDEX: ^GSPC) has climbed in the double digits in each of the past two years, and last year confirmed the positive trend as it sailed into bull market territory. Investors piled into technology stocks as they bet on companies making progress in cutting-edge areas like artificial intelligence and quantum computing.

The Motley Fool

FEBRUARY 15, 2025

Are you on the hunt for a few good growth stocks? Here's a little secret: The longer you can hold them, the more likely you are to reap their full reward. Or, as the brilliant Benjamin Graham once explained it, "In the short run, the market is a voting machine, but in the long run it is a weighing machine." It just means that while a company's true value eventually shines through, a stock's price can be unpredictably erratic in the near term.

The Motley Fool

FEBRUARY 15, 2025

This February, Solana (CRYPTO: SOL) is continuing to one-up Ethereum (CRYPTO: ETH) , the second-largest cryptocurrency by market cap and its biggest rival. And, given Ethereum's ongoing leadership shake-up, there's a good chance that the hits will just keep coming. Here's what's happening and how it affects your choices about where to park your money.

The Motley Fool

FEBRUARY 15, 2025

Chinese artificial intelligence (AI) company DeepSeek rocked the tech world last month when it said that its AI model was on par with top North American models despite costing a fraction of the price. It raised questions about whether spending on AI has become excessive, as many tech companies plan to spend tens of billions of dollars on building out their AI capabilities.

The Motley Fool

FEBRUARY 15, 2025

It's very possible for cryptocurrencies to spend a bit too much time in the spotlight, leaving latecomers to crypto investing to take heavy losses, when having a bit of foresight would have spared them a lot of pain. In that vein, XRP (CRYPTO: XRP) is currently priced around $2.50 (as of Feb. 13), but is it still worth an investment if its price surges higher than $3 this year?

The Motley Fool

FEBRUARY 15, 2025

Tariffs and their impact on financial markets are the talk of the town right now, and it's no surprise why, given the new administration's intense interest in using tariffs as a tool of trade policy. Trade affects nearly every element of the economy, and it even has the potential to impact the cryptocurrency sector, including leading coins like XRP (CRYPTO: XRP).

The Motley Fool

FEBRUARY 15, 2025

If you're investing in the stock market, putting aside a regular amount each month can be a great way to build up your balance over time. It would be ideal to have a large lump sum to start with, but you can always add to your position. And the process can be as simple as putting money into the same exchange-traded fund (ETF) each month, which can make it a fairly straightforward habit to continue on an ongoing basis.

The Motley Fool

FEBRUARY 15, 2025

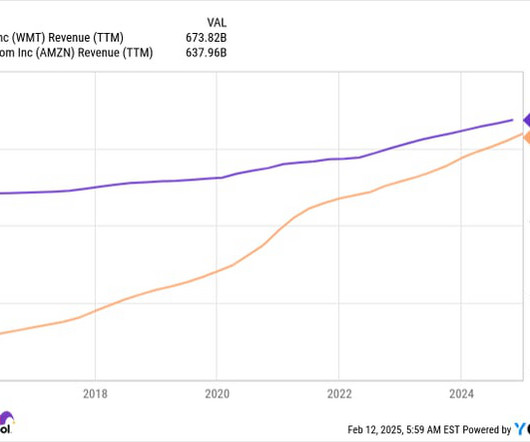

Is it official? Amazon (NASDAQ: AMZN) has been chasing Walmart (NYSE: WMT) as the largest company in the world by sales for years. Amazon's sales typically grow at a faster rate than Walmart's, but although the gap has been closing for a while, Walmart has been growing fast enough to maintain its lead. However, that might be about to change. After Amazon's smashing fourth quarter, it might be pulling ahead in the race.

The Motley Fool

FEBRUARY 15, 2025

Despite some recent headwinds, there are still plenty of reasons to be optimistic about electric vehicle stocks. For one, sales of EVs are making gains. Last year, a record 1.3 million EVs were sold in the U.S., up 7% from the previous year. Not everyone will want to buy one, of course. But when you're shopping for a new vehicle, the more options, the better, and EVs give consumers a unique option that many have never tried before.

Let's personalize your content