James Hardie to buy building products group Azek for nearly $9bn

Financial Times M&A

MARCH 23, 2025

Investors bet on spending power of US homeowners as mortgage rates fall

Financial Times M&A

MARCH 23, 2025

Investors bet on spending power of US homeowners as mortgage rates fall

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post European VC Leads Seed Round in Kenyan Logistics Startup first appeared on Africa Capital Digest.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

MARCH 23, 2025

Company faced Monday deadline to make firm offer for London-listed oil services and engineering business or walk away

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post CEI Africa Joins Crowdfunding Platforms to Back MPower first appeared on Africa Capital Digest.

The Motley Fool

MARCH 23, 2025

It may surprise some people that Amazon (NASDAQ: AMZN) retains high growth potential after years of high revenue increases. The company conducted its initial public offering in 1997 at a split-adjusted price of about 8 cents, it currently trades near $200, and it has a more than $2 trillion market cap. However, analyzing the company's various businesses shows that its growth rate could actually accelerate in the coming years.

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post Yango Launches Venture Fund Targeting Startups in Africa and Emerging Markets first appeared on Africa Capital Digest.

The Motley Fool

MARCH 23, 2025

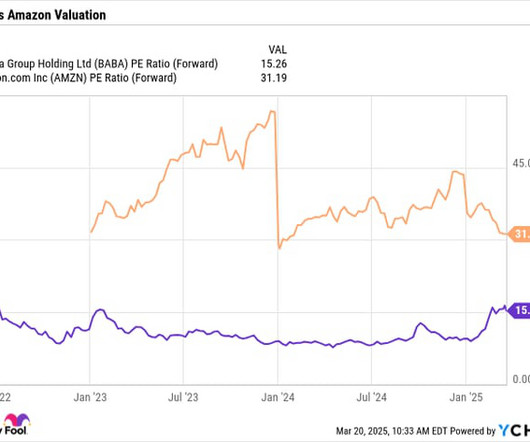

While the U.S. stock market has been under pressure, the ADRs (American depositary receipts) of Chinese stocks have suddenly become red hot. And there could be a lot more upside ahead. One of the most intriguing Chinese stocks right now is Alibaba (NYSE: BABA). Let's look at four reasons to buy the stock like there is no tomorrow. Where to invest $1,000 right now?

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

The Motley Fool

MARCH 23, 2025

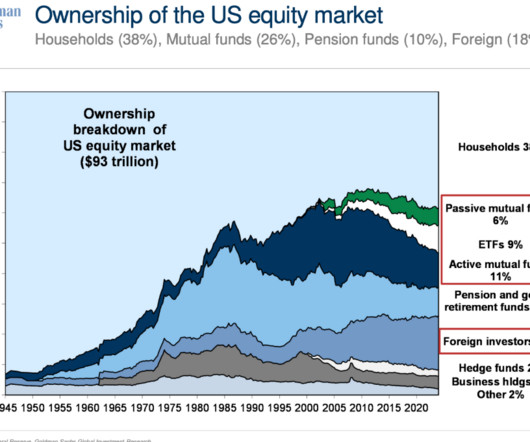

For many people, investing in the stock market is the most effective way to build wealth. Unless you're an accredited investor , accessing opportunities in private companies is rare. That said, every now and again, a private company becomes large enough that investors consider the potential of an initial public offering (IPO). Private companies that have eclipsed a valuation of $1 billion or more are often referred to as unicorns in the financial world.

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post South African Fund Acquires Stakes in Renewable Energy Assets first appeared on Africa Capital Digest.

The Motley Fool

MARCH 23, 2025

The burgeoning technology sector promises significant rewards for investors. The pandemic set off a wave of digitalization that resulted in a strong surge in demand for everything from cloud solutions to cybersecurity. These are the reasons why you should invest in solid growth stocks in the technology sector. Armed with sustainable catalysts, such businesses will naturally have a long growth runway coupled with a large total addressable market (TAM).

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post Alitheia and Goodwell Score Impressive Returns with Baobab Nigeria Exit first appeared on Africa Capital Digest.

The Motley Fool

MARCH 23, 2025

I come today bearing good news and bad news, and I'll give you the good news first: The S&P 500 (SNPINDEX: ^GSPC) is no longer in a "correction." Since closing at its highest ever level of 6,144 on Feb. 19, this index tracking the performance of America's 500 biggest companies tumbled quickly to close at 5,522 on March 13, 10.1% below its all-time high.

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post Swedfund Backs AfricInvests Latest SME-Focused Private Equity Fund first appeared on Africa Capital Digest.

The Motley Fool

MARCH 23, 2025

Quantum computing could make it easier to process massive amounts of information in the near future. Unlike traditional computers, which still store data in binary bits of zeros and ones, quantum computers can store them simultaneously in qubits. That approach enables quantum computers to process data much faster than binary computers, but the ones in operation now are also larger, more expensive, and consume more power while making more mistakes than binary computers.

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post BII Commits $20M to Alterras Africa Acclerator Fund first appeared on Africa Capital Digest.

The Motley Fool

MARCH 23, 2025

Buoyed by the post-election stock market rally, Plug Power (NASDAQ: PLUG) stock ran up to a recent high of $3.15 on Jan. 6. On that day, Plug stock closed at a price not seen since the previous summer. But it's been all downhill from there. From Jan. 6 through Plug's earnings day on March 3, shares of the hydrogen fuel producer and hydrogen fuel cell manufacturer lost more than half their value, plunging all the way to $1.50 per share.

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post Mirovas Gigaton Fund Backs KOKOs Clean Cooking Expansion Plans first appeared on Africa Capital Digest.

The Motley Fool

MARCH 23, 2025

Shares of Dutch Bros (NYSE: BROS) have fallen 25% or so from their February 2025 highs. That's a swift drawdown, but given that the restaurant chain is still fairly small and in its growth phase, seeing that kind of volatility isn't shocking. And it has to be juxtaposed against the price advance of more than 80% over the past six months, which is inclusive of the big drop.

Africa Capital Digest

MARCH 23, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post DEG Doubles Down on Mediterranias Latest Fund with Additional Investment first appeared on Africa Capital Digest.

The Motley Fool

MARCH 23, 2025

The Nasdaq Composite index is made up of almost every stock listed on the Nasdaq exchange. It soared by 28% during 2024 thanks to massive gains in artificial intelligence (AI) stocks, but it's currently down 12% from its December record high, placing it in correction territory. History suggests that corrections are an ideal time to buy stocks, because U.S. markets have always climbed to new highs over the long term.

A Wealth of Common Sense

MARCH 23, 2025

I like Jesse Livermore quotes because they’re often multi-faceted. This is one of my favorites: Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again. I agree with this sentiment.

The Motley Fool

MARCH 23, 2025

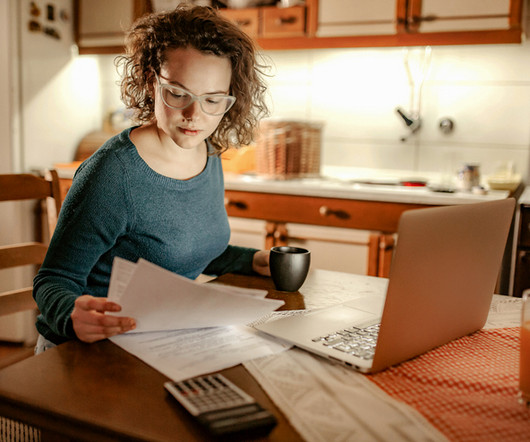

There's a reason retirees tend to claim Social Security at age 62 rather than wait. That's the earliest age to receive benefits, and many people want their money as soon as they can get it. But data shows that choosing the wrong Social Security filing age can result in a $110,000 loss of income. And perhaps the easiest way to get more Social Security is to file for benefits after reaching full retirement age (which is 67 for anyone born in 1960 or later).

Million Dollar Round Table (MDRT)

MARCH 23, 2025

By Antoinette Tuscano, MDRT senior content specialist Significant life experiences such as the death of a loved one, marriage, divorce and the birth of a child impact your clients lives and finances. Financial advisors often have a front-row seat to many of these seasons in their clients lives. While cards and flowers are kind and thoughtful gestures for these life changes, some advisors go the extra mile and offer referrals and connections to additional services as a next level of client serv

The Motley Fool

MARCH 23, 2025

If you're receiving (or soon will receive) Social Security benefits, you may be aware that the Social Security Administration increases benefits most years to offset the impact of inflation. Do these annual increases actually achieve their goal, though? It depends on who you ask. Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now.

Financial Times M&A

MARCH 23, 2025

Stock market falls and policy uncertainty from presidents administration have held back longed-for revival

The Motley Fool

MARCH 23, 2025

Opinions will always differ, but our current economic environment seems rather uncertain to me, with tariffs, tariff wars, the threat of inflation, and a lot of investors with stock market jitters. So if you're looking to invest in stocks, I suggest taking a close look at dividend payers. Why dividend-paying stocks ? Well, because to some degree, they've been prequalified.

The Big Picture

MARCH 23, 2025

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: ‘Shameful’: AARP’s partnership with healthcare giant faces backlash amid recent controversies : AARP has no fiduciary duty to seniors or retirees. They are up for sale to the highest bidder. Numerous transactions with various corporate entities confirms this.( Fox Business ) Its a Heist: Real Federal Auditors Are Horrified by DOGE : WIRED talked to actual federal auditors about how govern

The Motley Fool

MARCH 23, 2025

World-famous investor Warren Buffett is a unique personality. The chairman and CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) is probably as close to a celebrity as you'll find on Wall Street. Despite the 94-year-old's net worth exceeding $150 billion, his lifelong investing career and skill at distilling wisdom into common-sense jargon have produced a list of timeless quotes.

The Big Picture

MARCH 23, 2025

You’ve got to be willing to question the system. That was what Napster was about. That powered all the change at the turn of the century until a little over a decade ago when the tech companies solidified their power. This is why Trump won and is winning. He questioned orthodoxy. Meanwhile, the Democrats have put their faith in the system to save them, I wouldn’t be so sure.

The Motley Fool

MARCH 23, 2025

Many investors frantically read the news last week: The S&P 500 officially entered correction territory, which is a drop of at least 10%. As of this writing, however, the correction is proving to be short-lived. The S&P 500 appears to be bouncing back and at this writing is only down less than 8% from its previous all-time high. The market correction may be short-lived, but it turns out that there are plenty of high-quality S&P 500 stocks that are down 20% or more.

The Motley Fool

MARCH 23, 2025

In January, nearly 52 million retired-worker beneficiaries collected an average Social Security check totaling $1,978.77. While this is a relatively modest monthly payout, Social Security income has historically laid a financial foundation for most retirees. Based on an analysis from the Center on Budget and Policy Priorities, no social program lifts more people above the federal poverty line than Social Security.

The Motley Fool

MARCH 23, 2025

Enbridge 's (NYSE: ENB) big draw as an investment is its highly reliable dividend, which it has increased annually (in Canadian dollars) for three decades. There's just one problem for investors: The dividend growth rate for this Calgary-based pipeline operator has stalled over the last couple of years. However, there's a light at the end of the tunnel, and that suggests that now could be a decent time to buy Enbridge.

The Motley Fool

MARCH 23, 2025

Image source: Getty Images Warren Buffett, CEO of Berkshire Hathaway, is an investing legend. He's been one of the richest people in the world for decades, and billionaires and ordinary people alike follow his advice. Looking for a secure place to grow your savings? See our expert picks for the best FDIC-insured high-yield savings accounts available today - enjoy peace of mind with competitive rates.

The Motley Fool

MARCH 23, 2025

When it comes to looking for millionaire-making tech stocks, your best bet is to try to find small to mid-sized growth companies that have big potential. After all, a stock would need to go up 100x to turn a $10,000 investment into a $1 million. While these type of investment gains do occur, they are very rare. However, many of the largest companies in the world today have seen these types of gains over time, including the likes of Apple , Nvidia , Microsoft , Alphabet , and Amazon.

The Motley Fool

MARCH 23, 2025

The S&P 500 is down over 4% from the start of the year. While investors began the year with optimism, trade wars and tariffs have weighed on the outlook for the markets, for 2025 and beyond. It may seem like a bad time to invest right now. However, investing when valuations have dropped can position you for better returns, particularly in the long run.

The Motley Fool

MARCH 23, 2025

After a couple of years of making headlines in the stock market, artificial intelligence (AI) is starting to creep further into real-world applications. AI tools include large language models, virtual agents, robot workers, self-driving vehicles, and more. In research on AI adoption from February , The Motley Fool found that the national usage rate for AI in the United States is about 6.8% and is expected to rise to 9.3% over the next six months.

The Motley Fool

MARCH 23, 2025

Things are going from bad to worse for Sarepta Therapeutics (NASDAQ: SRPT) , a biotech focusing on gene therapies. The company's performance over the past six months had already been unimpressive. But on March 18, its shares fell by 20% in one day, following an update regarding its most important commercialized product. If this sell-off is overblown, now might be an excellent time to initiate positions in Sarepta Therapeutics.

Let's personalize your content