Here's Why Experts Can't Agree on What's Happening With Home Prices

The Motley Fool

NOVEMBER 18, 2023

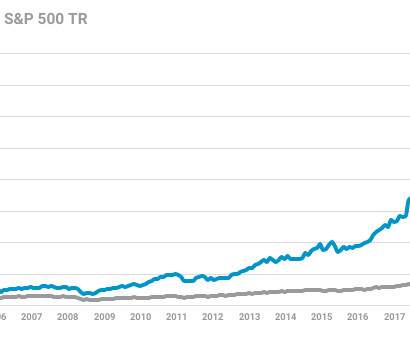

Image source: Getty Images If you've had your eye on buying a house lately, you've likely felt the sting of opening the Zillow app and finding suboptimal homes for sale at suborbital prices. You can thank both the pandemic-fueled home-buying frenzy and soaring mortgage interest rates for the sticker shock. The average selling price for a home has jumped 27.7% over the past three years.

Let's personalize your content