Boss of Seplat wants to ‘demystify’ Nigeria for investors

Financial Times M&A

APRIL 5, 2025

Roger Brown says discount on major oil producers shares is unwarranted

Financial Times M&A

APRIL 5, 2025

Roger Brown says discount on major oil producers shares is unwarranted

The Motley Fool

APRIL 5, 2025

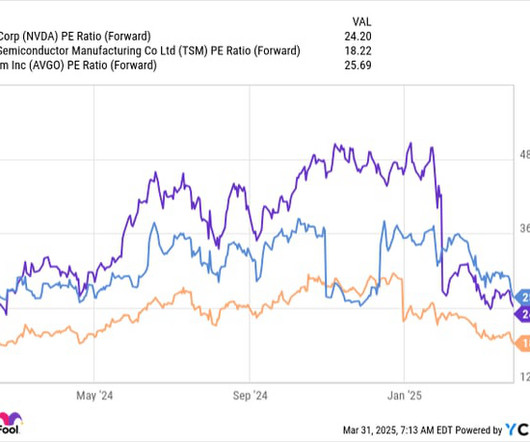

The recent market sell-off has created some nice opportunities in the market for long-term investors, particularly among artificial intelligence (AI) stocks. This includes several AI semiconductor stocks besides Nvidia , which has also seen its stock come under pressure. Let's look at two AI chip stocks that investors can look to buy ahead of the next AI stock bull run.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

APRIL 5, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat outside, and get ready for our longer-form weekend reads: How to Think About the Tariffs : This is bad policy, executed thoughtlessly. But it is worth thinking through exactly *why* it is bad. ( The Overshoot ) How Trump Could Make Larry Ellison the Next Media Mogul : The co-founder of Oracle and friend of President Trump, who was a flamboyant fixture in the 1990s, has returned to the

The Motley Fool

APRIL 5, 2025

With the stock market going through a downturn due to uncertainties about how tariffs will (or won't) affect the economy, it's opening up several investment opportunities in the artificial intelligence (AI) realm. AI has been the dominant trend in the market since 2023, so it should come as no surprise that these stocks are the first to sell off because investors are taking gains.

The Motley Fool

APRIL 5, 2025

The tech sell-off of 2025 has created several buying opportunities. Last year, the valuations for countless tech businesses went through the roof, making it difficult to bargain hunt. If you've been waiting for the right time to jump in or add to your positions, now could be that time. Two iconic businesses in particular have seen their share prices slump so far this year: Palo Alto Networks (NASDAQ: PANW) and Nvidia (NASDAQ: NVDA).

The Motley Fool

APRIL 5, 2025

In turbulent times like these, it's always interesting to see what some of today's top investors are doing with their portfolios. One of the best investors of the past 30 years has been David Tepper of Appaloosa Management. Between 1993 and 2013, Tepper averaged a whopping 40% annualized return, while more recent estimates put Appaloosa at a low- to mid-20% annualized return through today.

The Motley Fool

APRIL 5, 2025

The Nasdaq Composite (NASDAQINDEX: ^IXIC) recently entered a bear market , which means the technology-focused index has tumbled more than 20% from its record high. But most Wall Street analysts see the decline as an opportunity to buy shares of Arm Holdings (NASDAQ: ARM) and The Trade Desk (NASDAQ: TTD). Arm stock has fallen 53% from its high, partially because investors were disappointed with the guidance management provided in the latest quarter.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

The Motley Fool

APRIL 5, 2025

Out of the 11 stock market sectors, energy is the best-performing year to date -- up 7.9% at the time of this writing compared to a 5.1% decline in the S&P 500 (SNPINDEX: ^GSPC). The move may come as a surprise, given that the U.S. benchmark oil price, West Texas Intermediate, is $69.36 per barrel compared to an average of $76.63 in 2024. But leading oil and gas stocks offer investors a great deal of safety amid economic uncertainty and trade tensions.

The Motley Fool

APRIL 5, 2025

First things first: The stock market is not in a bear market -- at least not the entire stock market. To officially be in bear market territory, stocks would need to be at least 20% below their previous high. As of now, neither the S&P 500 (SNPINDEX: ^GSPC) nor the Dow Jones Industrial Average (DJINDICES: ^DJI) have fallen that much. Sooner or later, though, a bear market will arrive.

The Motley Fool

APRIL 5, 2025

Next month will mark the 10th anniversary of Shopify 's (NASDAQ: SHOP) initial public offering (IPO). During this time, the Ottawa-based company has become Canada's second-largest company by market capitalization , surpassing $126 billion. With those kinds of gains, investors who bought the stock 10 years ago have obviously benefited tremendously, but the size of those gains may come as a surprise.

The Motley Fool

APRIL 5, 2025

In the search for income, investors sometimes don't pay enough attention to risk. That is a problem with both stocks and bonds. The interesting thing is that risk can often be very rewarding on the equity side of the equation, but with bonds, the reward is often less material than you'd expect. Here's a look at a collection of Vanguard bond ETFs, from the Vanguard Short Term Treasury ETF (NASDAQ: VGSH) all the way to the Vanguard Extended Duration Treasury ETF (NYSEMKT: EDV).

The Motley Fool

APRIL 5, 2025

When thinking about saving for retirement, you might assume that getting to $1 million is a solid goal to aim for. It's a nice round number, and it seems like a lot of money to have at your disposal. However, given the high rate of inflation in recent years, that may not be enough to ensure that you have a comfortable retirement. Below, I'll look at how much savings you might need to aim for in retirement and how to set up an investing plan to ensure that you can attain that goal.

The Motley Fool

APRIL 5, 2025

Palantir Technologies (NASDAQ: PLTR) was one of the hottest artificial intelligence (AI) stocks on the market in 2024. In fact, with shares soaring 340%, it was the top-performing member of the S&P 500 (SNPINDEX: ^GSPC) last year. The stock initially maintained its upward trajectory in 2025. It climbed another 65% to peak at $125 per share on Feb. 18.

The Motley Fool

APRIL 5, 2025

Warren Buffett has built a fortune for Berkshire Hathaway shareholders. Buffett's success at buying stocks of great businesses and holding them for the long term has inspired many investors to follow his style. Berkshire held a stock portfolio worth $271 billion at the end of 2024. Three Fool.com contributors combed through the holdings and selected one stock each that would be a great investment for the next 20 years.

The Motley Fool

APRIL 5, 2025

The U.S. equity market has been volatile over the past few weeks, with major indexes reflecting bearish market sentiment. Investors are concerned about the rising risk of stagflation (a combination of slower growth and higher prices), fueled mainly by increasing tariffs, rising costs, and policy uncertainties. Investing in such an uncertain environment may seem risky.

The Motley Fool

APRIL 5, 2025

There's never a bad time to buy a good stock. But there are certainly better times than others. Stepping into a new name after a pullback ultimately raises your potential gain. With that as the backdrop, risk-tolerant investors might want to wade into a new position in Celsius Holdings (NASDAQ: CELH) while shares are still down 64% from last March's peak.

The Motley Fool

APRIL 5, 2025

In this video, Motley Fool contributors Jason Hall and Tyler Crowe break down BYD 's (OTC: BYDD.F) latest battery tech, what it means for Tesla (NASDAQ: TSLA) , and why QuantumScape (NYSE: QS) might be a bigger winner than either. *Stock prices used were from the afternoon of March 27, 2025. The video was published on April 4, 2025. Where to invest $1,000 right now?

The Motley Fool

APRIL 5, 2025

Warren Buffett has been the CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) for decades. His track record in allocating capital for the company is astonishing, with a stellar compound annual growth rate of about 20%. In the past several years, though, one company, in particular, has produced a fantastic return that has lifted the Omaha conglomerate.

The Motley Fool

APRIL 5, 2025

Give Tory Bruno credit: He called it. Last year, the CEO of Boeing (NYSE: BA) and Lockheed Martin (NYSE: LMT) joint venture United Launch Alliance (ULA) seemed frustrated at the amount of time the U.S. Space Force was taking to decide whether to certify Vulcan Centaur, ULA's new space rocket, as being safe to launch national security cargoes. Nevertheless, after decades in the space business, and well familiar with how these things go, Bruno confidently predicted in December that Space Force wou

The Motley Fool

APRIL 5, 2025

Numerous secular trends have shaped the economy and influenced consumer behavior in the past decade. One area that continues to show promise is at the intersection of financial services and technology. An increasingly digital world will help propel this sector for years. Investors won't struggle to find fintech stocks to invest in. But there's one enterprise with a strong position among both merchants and consumers that deserves a closer look, especially since its shares are currently trading 79

The Motley Fool

APRIL 5, 2025

Bloom Energy (NYSE: BE) believes it is perfectly positioned to help power the development of artificial intelligence (AI). With a $2.5 billion backlog of fuel cells to deliver, the benefit is showing up right now. The company's recent deal with American Electric Power (NASDAQ: AEP) highlights the opportunity. Here's what you need to know. Where to invest $1,000 right now?

The Motley Fool

APRIL 5, 2025

Contract electronics manufacturer Jabil (NYSE: JBL) delivered healthy 27% stock price gains in the past nine months even after a sharp pullback in the company's shares in mid-February 2025. Even better, the stock's recent slide has made it an even more attractive investment option thanks to its improving growth prospects. Jabil provides design, production, and manufacturing services for verticals ranging from cloud and data centers to semiconductor capital equipment to networking and communicati

The Motley Fool

APRIL 5, 2025

Nvidia (NASDAQ: NVDA) stock hasn't been performing well so far in 2025 thanks largely to factors outside the company's control. That's too bad considering the graphics card design specialist has made so many investors significantly richer in the past decade. An investment of just $100 made in Nvidia shares 10 years ago is now worth $20,000. So, Nvidia has turned out to be a huge multibagger in the past decade.

The Motley Fool

APRIL 5, 2025

Investing is a slow grind that pays off massively over time but takes consistency and patience. Individual investors should always strive to put new funds to work, even if it's $100, $500, or $1,000 here and there. For me, and probably most individuals, a thousand bucks is a lot of money. When it comes time to invest that hard-earned cash, one must choose wisely.

The Motley Fool

APRIL 5, 2025

It wasn't that long ago that Nio (NYSE: NIO) seemed poised to post a breakout fourth quarter. The Chinese electric vehicle (EV) maker had delivery momentum driven by a new brand, Onvo, which began boosting deliveries at the end of 2024. It had a good third quarter when it improved vehicle margins amid a challenging environment, and it had launched yet another brand, Firefly, that was positioned to drive the top line even higher throughout 2025.

The Motley Fool

APRIL 5, 2025

Do you experience FOMO, or the fear of missing out? I do, and I'm betting you do, too. It's a risky motivator that can have you doing things you wouldn't normally consider doing, and Wall Street is a treacherous place when it comes to FOMO. One of the big investing trends today is cryptocurrency, which is why I've had my eye on the iShares Bitcoin Trust (NASDAQ: IBIT).

The Motley Fool

APRIL 5, 2025

The recent market sell-off has opened the door for some good buying opportunities in growth stocks. Let's look at four that investors can buy for the long term. Amazon Down just over 20% from its highs, Amazon (NASDAQ: AMZN) is trading at one of its lowest valuations in its history with a trailing price-to-earnings ratio (P/E) of around 34. That's despite the strong growth the company has shown, with revenue increasing by 10% last year while its adjusted earnings per share (EPS) soared 91%.

The Motley Fool

APRIL 5, 2025

Investors willing to look around can still find potential opportunities. Even the share prices of generally high-quality businesses can take a hit due to a variety of factors. It's worth understanding whether or not they are deserving of your capital. There's one notable growth stock trading 45% below its record (as of March 31), which was established in December 2023.

The Motley Fool

APRIL 5, 2025

When investors think about the retail coffee industry, I'm sure Starbucks immediately comes to mind. Its $38 billion in annualized revenue and more than 40,000 locations across the globe make it a leader in the market. But Dutch Bros (NYSE: BROS) isn't fazed. The Oregon-based coffeehouse chain is winning over investors. Shares are up 84% in the past five months (as of April 1).

The Motley Fool

APRIL 5, 2025

Rigetti Computing (NASDAQ: RGTI) has been a tough stock to hold over the past three years. The quantum computing company, which went public by merging with a special purpose acquisition company (SPAC) on March 2, 2022, started trading at $9.75, but eventually closed at a record low of $0.38 per share on May 3, 2023. But on April 2, 2025, Rigetti's stock trades at about $8.50 a share.

The Motley Fool

APRIL 5, 2025

It's important to save for retirement, because if you don't, you might end up having to live a pretty bare-boned lifestyle. And after years of hard work, you deserve better. But you have options when it comes to choosing a retirement account. Many savers like the idea of putting money into a traditional IRA for the up-front tax break on contributions.

The Motley Fool

APRIL 5, 2025

With artificial intelligence (AI) increasing demand for electricity, nuclear energy is becoming a more viable option. In fact, all three big cloud computing companies have announced major investments in nuclear power. Microsoft started the ball rolling when last fall it signed a 20-year power purchase agreement with Constellation Energy in which the power company would restart its Three Mile Island nuclear facility to power Microsoft's data centers.

The Motley Fool

APRIL 5, 2025

It's always good to receive dividend payments, and it's particularly nice when markets are volatile, like they are now. United Parcel Service (NYSE: UPS) has paid a dividend for more than a quarter of a century. How many shares would you have to own to receive $1,000 in yearly payments? Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now.

The Motley Fool

APRIL 5, 2025

There's no denying it: Amazon (NASDAQ: AMZN) has not only been one of this century's most rewarding stock picks, but also one of the market's biggest-ever winners. Shares are up by more than 250,000% since their 1997 public offering, and that's counting the sizable pullback from January's peak. There's also no denying, however, that Amazon's highest growth days are in the rearview mirror if only because comparisons to its past are now such a high bar.

The Motley Fool

APRIL 5, 2025

Investing in the best growth stocks in the world can be a great way to build up your wealth over the years. One top index that contains many fast-growing businesses is the Nasdaq-100 , which contains the 100 largest nonfinancial stocks on the Nasdaq stock exchange. This includes big names such as Nvidia , Microsoft , Meta Platforms , and many other well-known tech stocks.

The Motley Fool

APRIL 5, 2025

A 401(k) is the most popular retirement account and one of the best tools for saving for retirement. It's hands-off and offers a great tax break -- a win-win. Because 401(k)s play a major role in many people's retirement finances, it makes sense that people would aim to max out these accounts. However, despite how great a 401(k) can be and how important saving for retirement is, I believe aiming to max out your 401(k) is an overrated goal and not the best move for most people.

The Motley Fool

APRIL 5, 2025

People are increasingly treating their pets like family members, and Chewy (NYSE: CHWY) has taken advantage of this trend to become the leading seller of pet food and accessories. The company has more than doubled its revenue in the past five years to reach $11.9 billion of sales in its latest fiscal year. Serving the needs of pet owners is a huge business, and one of the most important things behind Chewy's success is the recurring revenue and customer loyalty it has built up thanks to its Auto

Let's personalize your content