Big investors look to sell out of private equity after market rout

Financial Times M&A

APRIL 6, 2025

Pensions and endowments seek exit from battered portfolios in blow to buyout industry

Financial Times M&A

APRIL 6, 2025

Pensions and endowments seek exit from battered portfolios in blow to buyout industry

Africa Capital Digest

APRIL 6, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post Janngo Capital Leads Investors Backing Fintech App Djamo first appeared on Africa Capital Digest.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

APRIL 6, 2025

Deal would be latest successful private equity exit as M&A is frozen over market turmoil

Africa Capital Digest

APRIL 6, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post DOB Equity Buys Stake in Kenyan Agribusiness first appeared on Africa Capital Digest.

Financial Times M&A

APRIL 6, 2025

Deal dispels fears Australian energy group would struggle to find partners for major US development

Africa Capital Digest

APRIL 6, 2025

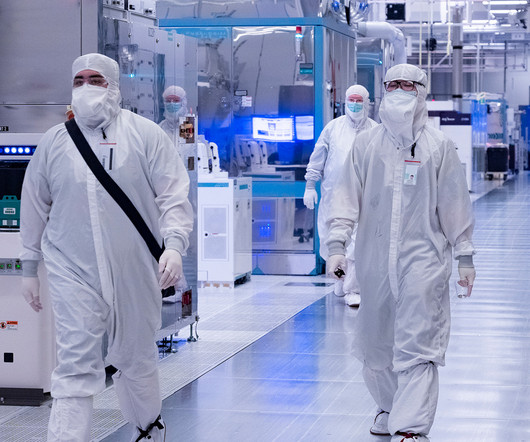

To read this article, you must be a paid subscription member. (Current members login here) [.] The post Egyptian semiconductor startup InfiniLink raises $10M Seed Round first appeared on Africa Capital Digest.

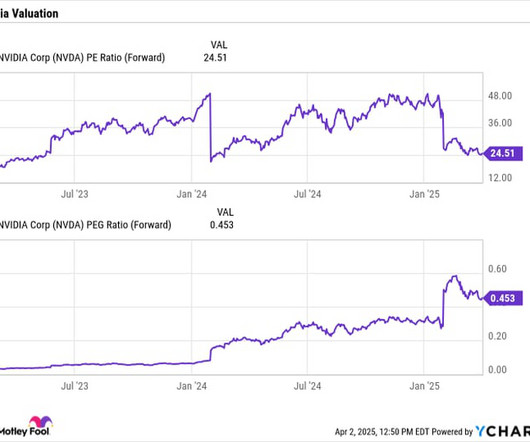

The Motley Fool

APRIL 6, 2025

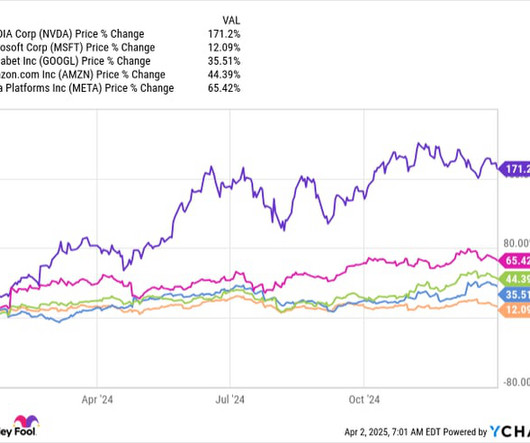

Some of the best companies in the world have gotten caught up in the recent market sell-off, including Nvidia (NASDAQ: NVDA). The stock is trading down more than 25% off its highs set earlier this year as of this writing. However, this weakness has created a nice buying opportunity in the stock. Let's look at three reasons why investors should buy the stock like there is no tomorrow.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

The Motley Fool

APRIL 6, 2025

The past year has been a difficult one for ASML Holding (NASDAQ: ASML) investors. Shares of the semiconductor equipment-making giant have lost more than 36% of their value during this period, but it won't be surprising to see the Dutch company's fortunes changing for the better when it releases its first-quarter 2025 results on April 16. ASML stock's struggle in the past year can be attributed to a combination of factors.

Africa Capital Digest

APRIL 6, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post The Rohatyn Group pares back stake in Optasia first appeared on Africa Capital Digest.

The Motley Fool

APRIL 6, 2025

When most investors think of artificial intelligence stocks, Nvidia is a top-of-mind name. And rightfully so. Its hardware is at the heart of most AI data centers. Or maybe it's Microsoft or Alphabet 's, both of which offer popular AI-powered virtual assistants free of charge. IBM (NYSE: IBM) , on the other hand, doesn't come up much during discussions of artificial intelligence's likely future.

Africa Capital Digest

APRIL 6, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post South African Pension Fund Takes $40M Stake in Africa50 first appeared on Africa Capital Digest.

The Motley Fool

APRIL 6, 2025

Over the course of the last few years, Warren Buffett has slowly amassed the largest reserve of cash and equivalents his Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) has ever had on its books. While the now-$334 billion he has sitting on the sidelines makes more sense in the face of an uncertain market, Buffett began growing the reserve in earnest when things looked a bit different from today.

Africa Capital Digest

APRIL 6, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post EIB taps Ducorroy to lead equity and fund investments first appeared on Africa Capital Digest.

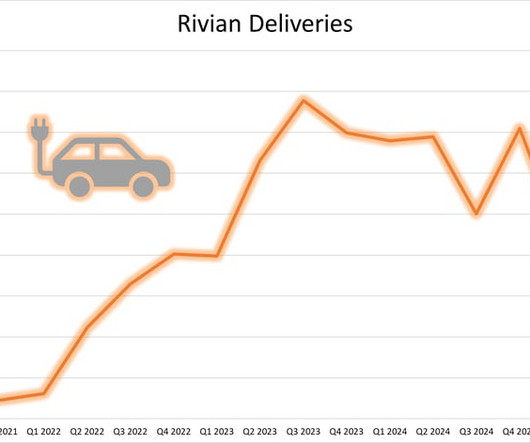

The Motley Fool

APRIL 6, 2025

Investors knew that 2025 might be a slow one for Rivian Automotive (NASDAQ: RIVN). The young electric vehicle (EV) maker doesn't have any obvious catalysts to boost demand or deliveries throughout the year, and its highly anticipated R2 model doesn't launch until 2026. But is the company's slow start a reason to raise a red flag, or is it just the beginning of a lackluster year most anticipated?

Africa Capital Digest

APRIL 6, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post Triple Jumps Emerging Markets Fund Nears Final Close Target first appeared on Africa Capital Digest.

The Motley Fool

APRIL 6, 2025

Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) is a difficult company to understand. There's nothing about the individual businesses within the conglomerate that's all that difficult to wrap one's head around. The problem is that there are so many different business lines under the Berkshire umbrella. That said, the company's most important business had a great year in 2024.

Africa Capital Digest

APRIL 6, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post IFC Weighs Commitment to TPG Rises Emerging Markets Climate Fund first appeared on Africa Capital Digest.

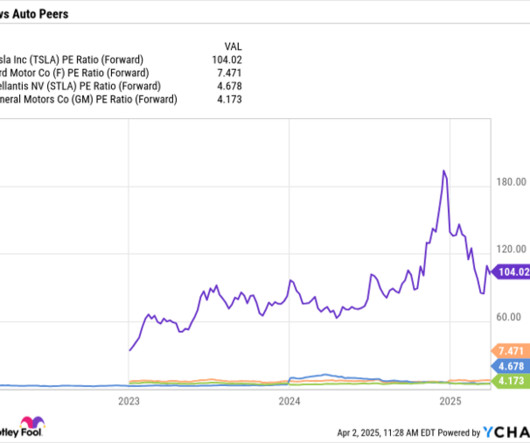

The Motley Fool

APRIL 6, 2025

Wall Street analysts are becoming increasingly bearish on Tesla (NASDAQ: TSLA). Following the car maker's first-quarter deliveries announcement, Wedbush analyst Daniel Ives called the report a "disaster" and said CEO Elon Musk needs to "get his act together." However, Ives still has an "outperform" rating and a $550 target on the stock. Wells Fargo analyst Colin Langan, meanwhile, has been far more critical of the stock, with an "underweight" rating and $130 price target on it.

Africa Capital Digest

APRIL 6, 2025

To read this article, you must be a paid subscription member. (Current members login here) [.] The post Eargo and hearX Merge, Win Patient Square Capital Backing first appeared on Africa Capital Digest.

The Motley Fool

APRIL 6, 2025

Warren Buffett is, perhaps, one of the most famous investors of all time. Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) , his investment vehicle, has trounced the S&P 500 over the long term. Yet, Buffett has said he has no special talent. It's a good thing for all of us that he also said that you don't need special talent to be a successful investor.

A Wealth of Common Sense

APRIL 6, 2025

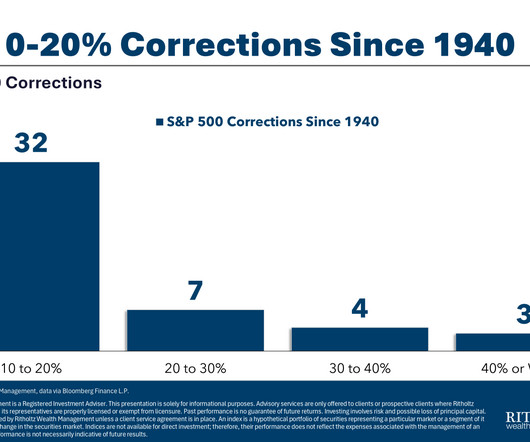

The S&P 500 is approaching bear market territory and it happened in a hurry: This drawdown profile doesn’t even look real. It looks like an intern fat-fingered the wrong number on the spreadsheet. The speed and ferocity of this downturn is a good reminder that risk can happen fast. The stock market lost nearly 11% in just two days. Woosh…gone.

The Motley Fool

APRIL 6, 2025

Looking at what successful hedge fund managers buy and hold is a great way for investors to drum up ideas about which stocks to pick. Fortunately, anyone with over $100 million in holdings must disclose what they own to the SEC, then they make that information public knowledge 45 days after the quarter ends. While this isn't necessarily a real-time view into what these hedge fund managers are doing, if you consider how long they've held the stocks, it could provide some valuable insights.

Million Dollar Round Table (MDRT)

APRIL 6, 2025

By Ellis N. Liddell, BS As we all do, your clients experience the joys and challenges of lifes many different stages. This may include buying homes, having children, getting married, expanding their business and retiring. Because I practice holistic financial planning, I help clients navigate through all of this. Creating wisdom teams To fully serve my clients in this capacity, I encourage my clients to have a wisdom team.

The Motley Fool

APRIL 6, 2025

If you're looking for an investor to emulate, you could do a lot worse than Warren Buffett. The Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) CEO has produced incredible returns for anyone who's stuck by his side throughout his career. He produced eye-popping 23.8% compound annual returns for investors in Buffett Partnership Ltd between 1957 and 1969, but that wasn't some one-off fluke.

FinSMEs

APRIL 6, 2025

Ethic, a NYC-based sustainable, tech-enabled asset manager, raised $64m in Series D funding. The round was led by State Street Global Advisors (SSGA), the asset management arm of State Street Corporation (NYSE: STT), who joined a group of existing backers from prior funding rounds including Oak HC/FT, Nyca Partners, UBS, Jordan Park, and Fidelity. The […] The post Ethic Raises $64M in Series D Funding appeared first on FinSMEs.

The Motley Fool

APRIL 6, 2025

When it comes to investing, putting all your money into one stock is risky, as it exposes your entire portfolio to the performance of a single company. To reduce the impact of volatility, having a well-diversified portfolio is recommended, with The Motley Fool suggesting at least 25 stocks. With that said, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) , a $1.1 trillion holding company, could be considered the exception to the rule due to its mixture of wholly owned companies, stocks, and a $334

The Big Picture

APRIL 6, 2025

Fun conversation with a few of the fun folk over at IEX. If you recognize that name, its because their founder, Brad Katsuyama was the focus of Michael Lewis’ “ Flash Boys.” Brad was also a guest on MiB. Here is the pod description: Rather than presenting a traditional how-to manual, the book emphasizes what investors should not do, covering bad ideas, bad numbers, and bad behaviors.

The Motley Fool

APRIL 6, 2025

Turbulence has returned to the stock market this year. Concerns about how much tariffs will impact the global economy have caused wild gyrations in the stock market. If they cause a global recession, stocks could fall further. While a recession would have a major impact on many companies, some produce much more durable income, putting them in a better position to weather economic storms.

The Big Picture

APRIL 6, 2025

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: Traders Fear Global FX Market May Be Less Liquid Than It Appears : Currency heavyweights warn the fragmented, tech-driven modern market could be storing up trouble.( Bloomberg ) The Confessions of Insurance Executives : Champagne for record profits. Being ordered to execute some hostages.

The Motley Fool

APRIL 6, 2025

One of the keys to successful investing is holding shares of companies that can perform well over long periods. However, few companies can thrive for that long while delivering excellent returns to investors. Those that do tend to have some key attributes, including a strong moat and attractive growth opportunities. Looking for stocks that fit this description?

The Motley Fool

APRIL 6, 2025

The market is suddenly on shaky ground. But sometimes, the mind lets recent events outshine the big picture. Take Palantir Technologies (NASDAQ: PLTR) , for example. The powerhouse artificial intelligence (AI) stock has quickly plunged over 30% from its high. Yet, the stock is still up a remarkable 274% over the past year! In other words, things aren't as painful as they might feel.

The Motley Fool

APRIL 6, 2025

What should investors do when stocks are tanking over the short term? Probably the best answer is to think long term. Three Motley Fool contributors think they've found great dividend stocks to own for the long term that pay you to wait for better days. Here's why they picked AbbVie (NYSE: ABBV) , Amgen (NASDAQ: AMGN) , and Eli Lilly (NYSE: LLY). Where to invest $1,000 right now?

The Motley Fool

APRIL 6, 2025

Investors are taking a new look at Intel 's (NASDAQ: INTC) stock after the appointment of Lip-Bu Tan as its new CEO. He takes over as Intel struggles to catch up to competitors and develop a foundry business that can compete with Taiwan Semiconductor Manufacturing and Samsung. Due to Intel stock's decline and the company's failed attempts to catch up under previous management teams, its stock trades at levels it first reached in 1997.

The Motley Fool

APRIL 6, 2025

Given the stock's poor performance since its pandemic-prompted peak in late 2020, it would have been easy to give up on China's e-commerce giant Alibaba Group (NYSE: BABA). And plenty of investors did. Yet in outright defiance of the Nasdaq Composite 's (NASDAQINDEX: ^IXIC) 10% tumble during the first quarter -- its worst quarter since the bear market of early 2022 -- Alibaba shares rallied to the tune of 56% during Q1 this year.

The Motley Fool

APRIL 6, 2025

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free Technology has become the single most important sector in the U.S. stock market. It contains the three most valuable companies in the world -- Microsoft (NASDAQ: MSFT) , Apple , and Nvidia. It has crushed the S&P 500 over the long term, gaining 342% over the last decade compared to 145% for the index.

The Motley Fool

APRIL 6, 2025

If you're feeling nervous about the future of the stock market, you're far from alone. Around 62% of U.S. investors are pessimistic about the next six months, according to an April 2025 survey from the American Association of Individual Investors -- the highest figure since March 2009. Recessions risks are also increasing, with J.P. Morgan estimating a 60% probability of a recession by the end of the year -- up from analysts' previous estimate of 40% before the president's latest tariff announce

The Motley Fool

APRIL 6, 2025

Intuitive Surgical (NASDAQ: ISRG) was a pioneer in minimally invasive robotic-assisted surgery technology, and its leadership in the field has long been a key edge for the company. Thanks to strong sales growth and climbing profitability over the past two decades, it has rewarded long-term shareholders handsomely: The stock has returned a staggering 24,632% since its 2003 initial public offering.

Let's personalize your content