5 Affordable Luxury Finds You Can Buy at Costco

The Motley Fool

OCTOBER 28, 2023

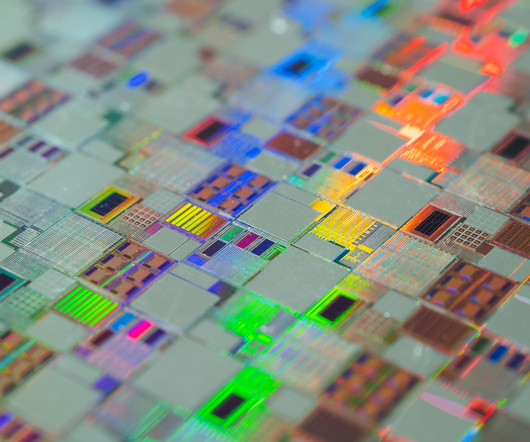

Image source: Getty Images Shopping at Costco is all about finding great deals, but that doesn't mean your purchases have to be low-quality or even cheap. We're getting closer to the Christmas shopping season every day, and if you're looking for some high-end gifts to give out without completely derailing your personal finances , you may want to consider some of these luxury items.

Let's personalize your content