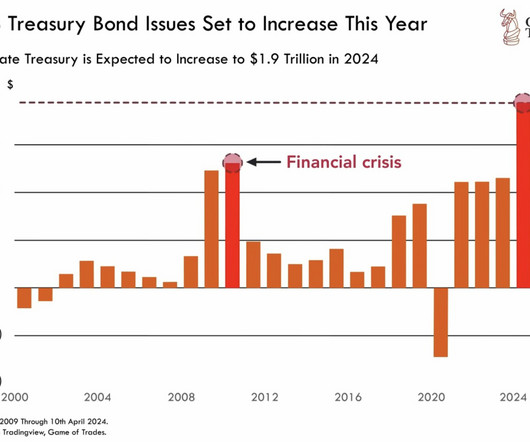

Catastrophizing Debt

The Big Picture

AUGUST 12, 2024

I’m deep in my book writing work discussing federal debt when I see a tweet that simply epitomizes the entire genre. Full disclosure: My priors on federal debt are that I don’t know where the line of too much should be drawn, but I do know that none of the terrible things we were warned about over the past 50 years due to excess debt have come to pass.

Let's personalize your content