30% Up Years in the Stock Market

A Wealth of Common Sense

NOVEMBER 12, 2024

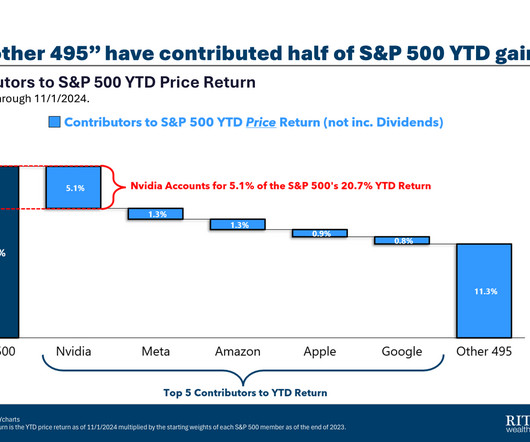

The S&P 500 is up 27% in 2024. We’re quickly closing in on a 30% gain for the calendar year. How rare is that feat? It happens more often than you would think. Here’s a look at every calendar year return on the S&P 500 going back to 1928: The 30% gains are highlighted. By my count, there were 18 years in which the stock market finished with a gain of 30% or more.

Let's personalize your content