A Few Thoughts On Diversification Strategies

Fortune Financial

OCTOBER 14, 2024

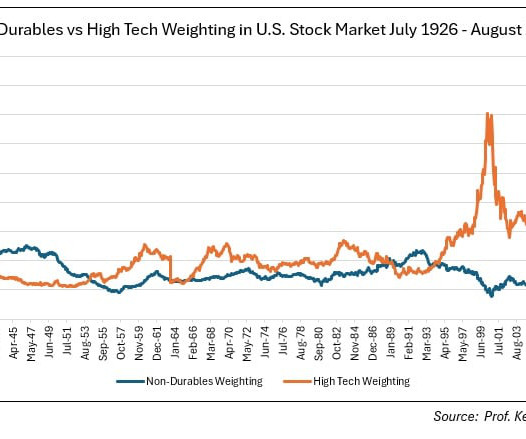

It has been my experience when reviewing portfolios that diversification is typically expressed simply as a number of various stocks owned, or owning a handful of asset classes, usually stocks of various sizes and geographies, and bonds of varying maturities. While such a simple asset allocation may work for many investors, it is my view that too little thought is given to other diversification tools that may enhance a portfolio by addressing some vulnerabilities that can result when a portfoli

Let's personalize your content