Investing in early childhood is a down payment on all our futures

Financial Times: Moral Money

MARCH 24, 2023

Businesses should play a central role in changing attitudes

Financial Times: Moral Money

MARCH 24, 2023

Businesses should play a central role in changing attitudes

A Wealth of Common Sense

MARCH 28, 2023

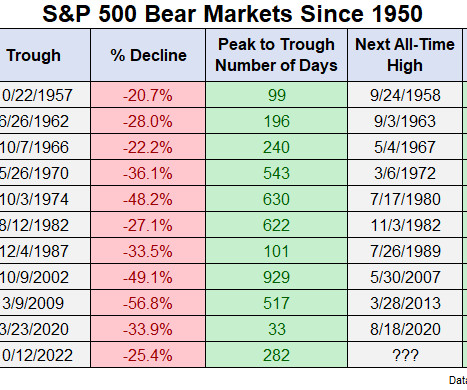

The last new all-time high for the S&P 500 was on January 3, 2022. That means it’s been almost 450 days since we’ve experienced new highs in the stock market. That feels like a long time. But based on the history of bear markets, it’s really not all that long. It might be a while until we hit new highs again if we use history as a guide.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

MARCH 17, 2023

Swiss authorities press for merger to stem crisis of confidence in country’s banking sector

The Reformed Broker

MARCH 12, 2023

I feel pretty confident in making this call, and I don’t make market calls very often: We have seen the top for 2-year Treasury yields. It’s not going any higher than it’s been because there’s no reason for it to. Financial conditions are now contracting hard due in part to the events of this week but also because monetary policy operates on a lag – and the first Fed Funds hike of the cycle.

The Big Picture

MARCH 8, 2023

I love the idea of convergence — those rare times when multiple stories about very different issues seem to all land on the same “Grand Truth,” albeit from very different perspectives. Yesterday brought just such a three-part convergence into focus. It’s about money and happiness, which is very much the intersection of where I spend much of my time: Capital Markets , and Behavioral Finance.

Private Equity Info

MARCH 21, 2023

Customer Satisfaction Survey 2023: Results Show We Exceed Client Expectations in Quality of Data, Customer Service, and Pricing In January and February of 2023, Private Equity Info surveyed clients to understand our customers' perceptions of how we are doing, relative to the type of company we aim to be. My goal, when I founded Private Equity Info in 2005, was to create the data and tools I wished I had while working as an investment banker - to easily identify highly targeted lists of the priva

Private Equity Insights

MARCH 17, 2023

Ares Management Corp. faces the sort of quandary that other financial firms might find enviable. It has vaulted to the top rungs of the alternative-asset management world by focusing on what it does best: private credit. Yet, like its peers, Ares feels compelled to diversify into other asset classes, such as real estate, infrastructure, and private equity.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Financial Times M&A

MARCH 10, 2023

Indian group has sought lenders’ approval for disposal as it tries to boost investor confidence after fraud claims

The Reformed Broker

MARCH 27, 2023

This is it. The only chart you need to concern yourself with now if you’re trying to figure out where the economy is heading. Construction and Industrial (C&I) loans are a $2.8 trillion business (approximately) for banks all over the country. If they roll over, we have a soft landing. If they roll over hard, we have a hard landing. It’s not complicated, the only thing that’s up in the air is the tim.

The Big Picture

MARCH 10, 2023

Armchair quarterbacking the decisions of the Federal Reserve long ago became a blood sport. With the benefit of hindsight, we all are genius central bankers. I particularly loathe managers who lay all the woes of the world at the feet of the Federal Reserve. For more than a century, America’s central bank has been a key part of the investing environment, and it’s your job as an active manager to incorporate their probable policy decisions into your strategy.

Steve Sanduski

MARCH 14, 2023

Guest: Gayle Colman , Certified Financial Planner®, Master Integral Coach®, and author of the new book The Body of Money. In a Nutshell: Financial decisions are often framed as a tug of war between the head and the heart. But by paying attention to how the whole body expresses feelings around money, advisors can guide clients past their fears and towards a fulfilling sense of sufficiency and inner knowing. – Gayle Colman and I discuss: Gayle’s early history with the life planning mov

Private Equity Insights

MARCH 17, 2023

I Squared Capital is considering selling a minority stake in Think Gas Distribution Pvt. that could value the Indian natural gas supplier at more than $1bn, according to people familiar with the matter. The private equity firm is working with an adviser to sell as much as a 30% stake in Think Gas, said the people, who asked not to be identified as the information is private.

A Wealth of Common Sense

MARCH 31, 2023

There are many different ways to succeed as an investor. If there were only one approach that worked, everyone would do that.1 I know plenty of investors with completely different styles that have found success in the markets over the years. But there are only a handful of ways investors fail in the markets: Allowing your emotions to get the best of you.

Financial Times M&A

MARCH 10, 2023

Tech-focused lender had faced deposit outflows and failed in eleventh-hour attempt to raise new capital

The Reformed Broker

MARCH 25, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

The Big Picture

MARCH 16, 2023

Depositors heaved a sigh of relief when news broke Sunday that the Federal Deposit Insurance Corporation was going to make whole all of the accounts held at Silicon Valley Bank. Having full access to bank accounts meant those tech start-ups that make up much of SVB’s depositors would be able to make their weekly payrolls. They were the lucky ones: SVB’s equity investors were wiped out and senior bank management was fired.

Investment Writing

MARCH 7, 2023

Commas drive me crazy. I’m often unsure about whether my clients’ long sentences need commas. A helpful rule is finally sinking into my head. I need to place a comma before an independent clause that follows a coordinating conjunction. What’s an independent clause? Here’s a nice, informative example from Actually, the Comma Goes Here by Lucy Cripps: Each independent clause makes sense on its own, but it links very closely in theme to the other independent clause.

Private Equity Insights

MARCH 16, 2023

Investcorp, an alternative asset manager that counts Mubadala Investment Company as its biggest shareholder, has distributed $1.2bn in total to its GCC-based investors over the past 12 months, driven by “several value realisation initiatives”. The investment realisations were across asset classes, including recent exits from its private equity platform in the US, the company said on Monday.

A Wealth of Common Sense

MARCH 3, 2023

The latest Case-Shiller national home price index data was released this week. Here’s where we stand in terms of the drawdown from peak prices: This is the third largest national home price drawdown since 1987 but I’m sure lots of people are surprised prices haven’t fallen more what with 7% mortgage rates and unsustainable price gains in recent years.

Financial Times M&A

MARCH 29, 2023

Shares in Atos plummet after plane maker bows to demand from hedge fund boss to end interest in Evidian

The Reformed Broker

MARCH 11, 2023

I want to start out this week with a big thank you to all our fans, friends, employees and clients who came out to see us in Chicago this week for what can only be described as a whirlwind of productivity and fun. The meetings were meaningful, the catch-ups were long overdue and the food was fantastic. We will be back! If you live in the Chicago area and could use a little help with your portfolio, tax advice or just want.

The Big Picture

MARCH 29, 2023

Normally, I am a fan of Steve Rattner’s work. The former Obama “Car Czar” makes great charts and seems to be a fairly level-headed asset manager. But in the great baseball game of punditry, we all occasionally we step up to the plate and whiff. Such a down on three swings was contained in his recent NYT Op-Ed, “ Is Working From Home Really Working?

XY Planning Network

MARCH 27, 2023

4 MIN READ Are you still hiring or already onboarding? And no, onboarding is not referring to boarding the plane to your next vacation adventure you certainly earned. The term onboarding refers to the full integration of a new employee into the workplace. Subsequently, the onboarding experience of a new hire should not be limited to completing the required documentation of an I-9, W-4, and benefits enrollment.

Million Dollar Round Table (MDRT)

MARCH 5, 2023

By Matt Pais, MDRT Content Specialist Whether you’re a new or a veteran advisor, you know that a thriving business relies on a combination of a lot of moving parts. In his 2014 Annual Meeting presentation “Essence of excellence,” John Spence, who at 26 oversaw projects in 20 countries as CEO of an international Rockefeller foundation, identified business achievement as the product of a formula: (T+C+ECF) X DE = success.

A Wealth of Common Sense

MARCH 5, 2023

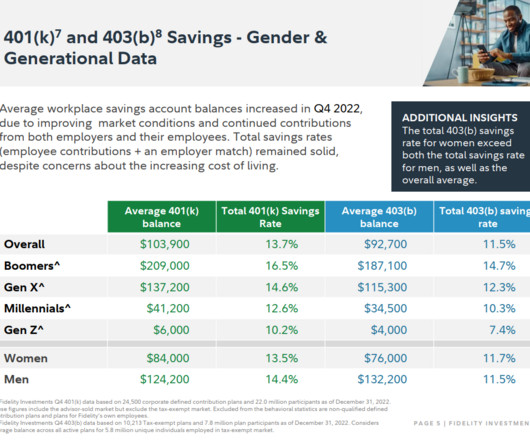

According to the Bureau of Labor Statistics, nearly 70% of private industry workers had access to a workplace retirement plan in 2021. Just 51% of them participated in those plans. It’s estimated more than 100 million Americans are covered by a defined contribution retirement plan. Those plans hold something like $11 trillion. That’s a lot of money but is it enough to retire comfortably?

Financial Times M&A

MARCH 8, 2023

Payments group made $17.

The Reformed Broker

MARCH 10, 2023

The spectacular blow-up currently taking place at SVB and its primary subsidiary, Silicon Valley Bank, is the biggest story in the markets this week. SVB is systemically important for the technology sector and its Northern California ecosystem. As Jim Cramer put it last night, the Federal Reserve has been firing a machine gun at the economy for the last 12 months but it hasn’t hit anything yet.

The Big Picture

MARCH 3, 2023

Have a look at the BAML chart above. 1 It is one of my favorites, but for reasons that might not be readily apparent at first glance. The chart shows the peak-to-trough declines of all the bear markets with the popular definition of a 20% decline, measured up until the start of the first 20% rally. 2 The current move from 2021 highs is shown in red.

Financial Times: Moral Money

MARCH 23, 2023

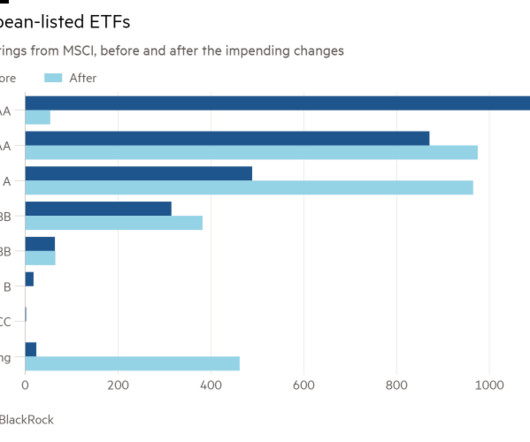

Unpublished BlackRock research also reveals thousands more will be downgraded in wide-ranging MSCI shake-up

Dear Mr. Market

MARCH 11, 2023

Dear Mr. Market: March Madness is back! And so are we… The world stopped pretty much everything at one point during the pandemic and sports were of course no exception. For true sports fans there was nothing more depressing than watching cornhole tournaments or empty arenas void of fans, sounds, and energy. Even if you don’t like or follow college basketball, we think you’ll enjoy what we pioneered and have put together.

A Wealth of Common Sense

MARCH 17, 2023

There were a lot of surprising details that came to light from the Silicon Valley Bank fiasco. It was surprising how quickly a bank run took hold for such a large institution. It was surprising how quickly the bank’s customers fled one of their most trusted partners. It was surprising how seemingly little oversight this now systemically important bank had.

Financial Times M&A

MARCH 28, 2023

Todd Snyder ran auctions of Silicon Valley and Signature after failures shook financial system

The Reformed Broker

MARCH 15, 2023

Apparently it’s news to the whole world this morning that Credit Suisse is some sort of undead Swiss zombie bank worth more dissected and sold off in chunks than alive. Who knew? Oh wait – everyone knew, for a long time now. Open secret. Single digit stock price. Come on. I meet financial advisors at industry events and cocktail parties – I wince when they say they work at Credit Suisse.

The Big Picture

MARCH 22, 2023

Bank failures since 2001, scaled by amount of assets in 2023 dollars. The graphic above, via Flowing Data , puts recent events into perspective: At $209 billion in assets, the Silicon Valley Bank failure since Washington Mutual crashed in 2008 (JPM Chase took them over from the FDIC). The post U.S. Bank Failures, 2001 – Present appeared first on The Big Picture.

Financial Times: Moral Money

MARCH 29, 2023

Also in today’s newsletter, first results are in for the ECB’s effort to green its bond holdings

Investment Writing

MARCH 27, 2023

Can you spot what’s wrong in the image below? Please post your answer as a comment. I think this one is pretty easy to spot. I post these challenges to raise awareness of the importance of proofreading. The post MISTAKE MONDAY for March 27: Can YOU spot what’s wrong? appeared first on Susan Weiner Investment Writing.

A Wealth of Common Sense

MARCH 30, 2023

A reader asks: Technology has made investing easier (indexing, direct indexing, robo advisors, etc.). With AI in vogue right now, what does the RIA space/ financial planning look like in another 20-30 years? Will there still be a human need to hold hands/talk you off a ledge, or will the only human interactions be those maintaining the tech behind the scenes?

Let's personalize your content