Experts say Musk faces uphill battle for victory in Twitter legal fight

Financial Times M&A

JULY 9, 2022

Social media platform seeks to force the Tesla boss to go through with his takeover

Financial Times M&A

JULY 9, 2022

Social media platform seeks to force the Tesla boss to go through with his takeover

A Wealth of Common Sense

JULY 15, 2022

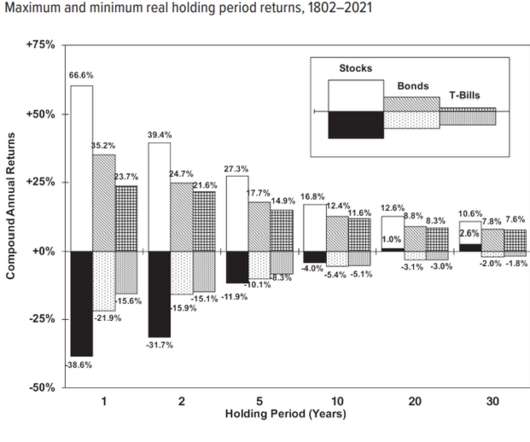

I don’t believe there is one singular way to invest your money. If there was everyone would invest that way. Every strategy and philosophy has its pros and cons. The good strategy you can stick with is far superior to the great strategy you can’t stick with so a lot of this comes down to who you are as an investor. There are a number of factors that determine the type of investor you are.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Reformed Broker

JULY 13, 2022

Put this phrase in your vocabulary for the second half of the year because you are going to be hearing it everywhere: “a mild recession.” This is where the puck is going. All of Wall Street’s chief strategists and chief economists are going to be pivoting to this case if they haven’t already. The “soft landing” idea is going to fade away.

Financial Times: Moral Money

JULY 15, 2022

Plus, what’s behind Bill Gates’ new $20bn pledge

Financial Times M&A

JULY 9, 2022

Who could have guessed that Elon wouldn’t follow through?

BlueMind

JULY 15, 2022

Category: Compliance. The Significance Of Financial Compliance Financial compliance requires all actions, procedures, guidelines, and business culture to abide by the rules and regulations set by the regulatory authorities of the financial market. For example, the Securities and Exchange Commission (SEC) in the United States or The Financial Consumer Agency of Canada (FCAC) in Canada.

Million Dollar Round Table (MDRT)

JULY 14, 2022

By Cynthia Nallely Rodriguez Barbosa For some of the people you’re calling, you’re creating a negative experience. It’s not personal. A telecommunications company surveyed thousands of young people and found that 81% of respondents feel anxious about making or receiving a phone call. Why? They consider it a waste of time. They do not like to do favors, and many times when someone calls, it’s to ask for something.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Financial Times M&A

JULY 15, 2022

Billionaire says he needs more time to prepare for courtroom showdown over his attempt to back out of $44bn deal

Investment Writing

JULY 12, 2022

Check out my top posts from the second quarter! They’re a mix of practical tips on grammar (#1 & #2), marketing (#3), investment commentary (#4), and blogging (#5). My posts that attracted the most views during 2022’s second quarter: My five favorite reference books for writers —These books would be great additions to your library. “In order to” versus “to” —The results of my research into whether it’s ever necessary to write “in order to” instead of “to” surprised me. 10-minute

Million Dollar Round Table (MDRT)

JULY 12, 2022

By Andreas T. Dailey Sr., CLTC In our industry, especially in MDRT, we participate in a lot of joint work with other financial advisors and specialists. This can be a winning situation for all involved. It allows us to: Help clients better in complex cases or areas that aren’t our strengths. Work on bigger cases. Expand our knowledge. If you’re not comfortable managing one area of financial planning for your client and you know someone who does well in that area, bring them in.

Financial Times: Moral Money

JULY 12, 2022

Amid the storm around ESG, impact investing offers a way forward

Financial Times M&A

JULY 15, 2022

Twitter has hired Wachtell’s Bill Savitt to try to save its $44bn deal with Tesla’s erratic founder

Covisum

JULY 12, 2022

Inflation is a top concern for consumers and advisors alike, and that’s why our team prioritized adding an inflation stress test to our product offering. Our advisor-led team understands the concerns of your retired clients and how the right financial planning software can make addressing them easier. Read on to see how we've updated our software to help you quickly and easily address client needs and demonstrate the value of your financial advice.

Million Dollar Round Table (MDRT)

JULY 10, 2022

By Mike Beirne, MDRT Round the Table editor Try these ideas from the 2022 MDRT Annual Meeting speakers about referrals, communications and marketing. 1) Give the referral process a push. One of the reasons good clients don’t give referrals is they don’t know what we’re looking for. If we don’t know, how can they know? I started networking myself by telling 10 to 20 of my best clients exactly what kind of prospect I was looking for from their personal networks.

Financial Times: Moral Money

JULY 10, 2022

Influential member of European Commission advisory board calls for action amid rising criticism of greenwashing

Financial Times M&A

JULY 15, 2022

Battle over Huntsman shows costs and gains of suing a suitor that walks away

A VC: Musings of a VC in NYC

JULY 10, 2022

I wrote the post at the bottom and linked here when Elon Musk announced his intention to buy Twitter in late April. I am relieved that Musk has decided he does not want to own Twitter. I never thought he would be a good shepherd of the Twitter network and maybe now we have the opportunity to find a better ownership/governance model for it. I understand why the Twitter Board and management team feel they must force Musk to perform on the agreed-upon deal.

Financial Symmetry

JULY 11, 2022

How do you deal with a major financial or life decision? When this happens there can be many choices that you need to make. Without the right decision-making framework, navigating these choices can lead to analysis paralysis. Allison Berger joins … Continued. The post How to Create a Framework for Navigating Major Financial Decisions, Ep #168 appeared first on Financial Symmetry, Inc.

Financial Times: Moral Money

JULY 11, 2022

Plus, the SEC offers whistleblowers a juicy reward

Financial Times M&A

JULY 14, 2022

US securities regulator asks why Tesla chief did not notify investors before saying deal ‘cannot move forward’ over bots

FMG

JULY 13, 2022

One of the top questions that we get is, “How can I promote myself as a financial advisor?” And we always tell them how important it is to share content and engage on social media. But with 3.96 billion people on social media , how can you stand out from the crowd? We’re sharing eight ways to stand out on social media and ultimately grow your business. 8 Ways to Stand Out on Social Media.

XY Planning Network

JULY 11, 2022

6 MIN READ. Investopedia.com defines direct indexing as “an approach to index investing that involves buying the individual stocks that make up the index, in the same weights as the index.” For example, rather than owning a mutual fund or ETF that tracks the S&P 500, investors can replicate the index, meaning they would own all of the individual 500 stocks that comprise the index.

ModernAdvisor

JULY 15, 2022

June was a difficult month for equity and fixed income investors alike. June 2022 Market Performance All index returns are total return (includes reinvestment of dividends) and are in Canadian Dollars unless noted. *Absolute change in yield, not the return from holding the security. June was a difficult month for equity and fixed income investors alike.

Financial Times M&A

JULY 14, 2022

All sorts of interesting questions now arise from failures of lenders

The Reformed Broker

JULY 15, 2022

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Alex Kantrowitz, and Downtown Josh Brown discuss earnings season, big tech, the outlook for crypto, Elon vs Twitter, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods! Listen here: Apple podcasts Spotify podcasts Google podcasts Everywhere else!

Conneqtor

JULY 14, 2022

Derek Notman awarded Rising Star Award and is Named a Finalist in the 2022 WealthManagement.com Industry Awards (Wealthies) for Innovator of the Year Thought Leader of the Year (July 14, 2022) — Derek Notman, CFP® was named one of this year’s Rising Stars in the 2022 WealthManagement.com Industry Awards program.

FMG

JULY 14, 2022

For today’s Advisor Website Showcase, we are joined by Letizia Carlisto of Navis Wealth Advisors. We asked Letizia handpicked questions about the firm, its strategies and it’s processes. It was great to talk with Letizia and hope you enjoy her answers as much as we did. Modernize Your Website. Making use of FMG’s website engine, Navis Wealth Advisor took aim at creating a website themed around its logo – the compass.

Financial Times M&A

JULY 13, 2022

New York-based firm says Tesla chief has ‘squandered much of his leverage’ in attempt to pull out of $44bn deal

Zajac Group

JULY 14, 2022

If there’s such a thing as a match made in philanthropic heaven, it may be the ability to donate a portion of your equity compensation shares to a Donor Advised Fund (DAF). DAFs are relatively easy to fund, easy to manage, and they ensure that you get a tax deduction for the full, appreciated value of your donated stock. A tax deduction that can be especially beneficial in a high-income tax year, as may be the case when you have significant equity compensation activity.

Financial Times: Moral Money

JULY 14, 2022

FT personal finance and investment journalists singled out at top industry event

The Reformed Broker

JULY 13, 2022

The stickiest thing is going to be fighting the wage-price spiral, says Ritholtz’s Josh Brown from CNBC. The post Clips From Today’s Closing Bell appeared first on The Reformed Broker.

Financial Times M&A

JULY 14, 2022

A timely global outage for the no-longer-$44bn valued blue bird

FMG

JULY 12, 2022

When stocks go down, communication from your financial advisor should go up. However, many financial advisors don’t know what to say to clients during times of extreme volatility. So, they either don’t say anything or they communicate but don’t want to keep reaching out, since they don’t know how much communication is too much.

Wealthfront

JULY 12, 2022

Individual retirement accounts (IRAs) are a popular way to save for retirement, and with good reason—they come with numerous benefits for investors building long-term wealth. They also come with a few drawbacks you should be aware of. In this post, we’ll break down what you need to know, focusing on two popular account types: traditional […]. The post What Are the Benefits and Drawbacks of IRAs?

The Reformed Broker

JULY 12, 2022

Final Trades: Occidental, Qualcomm, JPMorgan & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Financial Times M&A

JULY 13, 2022

Unity announce acquisition of ironSource for $4.

FMG

JULY 12, 2022

We hope everyone’s week is going well! This roundup is a good one, full of some great articles on niche marketing tips, social media content prompts, client communication tips and much more. 1. 5 Niche Marketing Tips For Financial Advisors (With Tyler Hackenberg) via The Podcast Factory. We often talk about the importance of choosing a niche to serve and really honing in on that.

Let's personalize your content