UBS in talks to acquire Credit Suisse

Financial Times M&A

MARCH 17, 2023

Swiss authorities press for merger to stem crisis of confidence in country’s banking sector

Financial Times M&A

MARCH 17, 2023

Swiss authorities press for merger to stem crisis of confidence in country’s banking sector

The Reformed Broker

MARCH 12, 2023

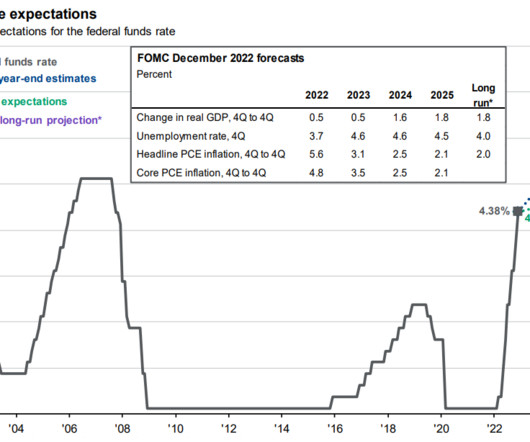

I feel pretty confident in making this call, and I don’t make market calls very often: We have seen the top for 2-year Treasury yields. It’s not going any higher than it’s been because there’s no reason for it to. Financial conditions are now contracting hard due in part to the events of this week but also because monetary policy operates on a lag – and the first Fed Funds hike of the cycle.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A Wealth of Common Sense

MARCH 17, 2023

There were a lot of surprising details that came to light from the Silicon Valley Bank fiasco. It was surprising how quickly a bank run took hold for such a large institution. It was surprising how quickly the bank’s customers fled one of their most trusted partners. It was surprising how seemingly little oversight this now systemically important bank had.

The Big Picture

MARCH 16, 2023

Depositors heaved a sigh of relief when news broke Sunday that the Federal Deposit Insurance Corporation was going to make whole all of the accounts held at Silicon Valley Bank. Having full access to bank accounts meant those tech start-ups that make up much of SVB’s depositors would be able to make their weekly payrolls. They were the lucky ones: SVB’s equity investors were wiped out and senior bank management was fired.

Private Equity Insights

MARCH 17, 2023

Ares Management Corp. faces the sort of quandary that other financial firms might find enviable. It has vaulted to the top rungs of the alternative-asset management world by focusing on what it does best: private credit. Yet, like its peers, Ares feels compelled to diversify into other asset classes, such as real estate, infrastructure, and private equity.

Steve Sanduski

MARCH 14, 2023

Guest: Gayle Colman , Certified Financial Planner®, Master Integral Coach®, and author of the new book The Body of Money. In a Nutshell: Financial decisions are often framed as a tug of war between the head and the heart. But by paying attention to how the whole body expresses feelings around money, advisors can guide clients past their fears and towards a fulfilling sense of sufficiency and inner knowing. – Gayle Colman and I discuss: Gayle’s early history with the life planning mov

A Wealth of Common Sense

MARCH 12, 2023

Silicon Valley Bank, the 16th biggest bank in the country, was closed on Friday. It was the second-biggest bank failure in U.S. history. As recently as November 2021, the market cap of the company was more than $44 billion. That equity is now essentially worthless. There is a lot to this story but it really boils down to an old-fashioned bank run. A flood of withdrawals from depositors destroyed the bank.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Private Equity Insights

MARCH 17, 2023

I Squared Capital is considering selling a minority stake in Think Gas Distribution Pvt. that could value the Indian natural gas supplier at more than $1bn, according to people familiar with the matter. The private equity firm is working with an adviser to sell as much as a 30% stake in Think Gas, said the people, who asked not to be identified as the information is private.

The Reformed Broker

MARCH 11, 2023

I want to start out this week with a big thank you to all our fans, friends, employees and clients who came out to see us in Chicago this week for what can only be described as a whirlwind of productivity and fun. The meetings were meaningful, the catch-ups were long overdue and the food was fantastic. We will be back! If you live in the Chicago area and could use a little help with your portfolio, tax advice or just want.

A Wealth of Common Sense

MARCH 14, 2023

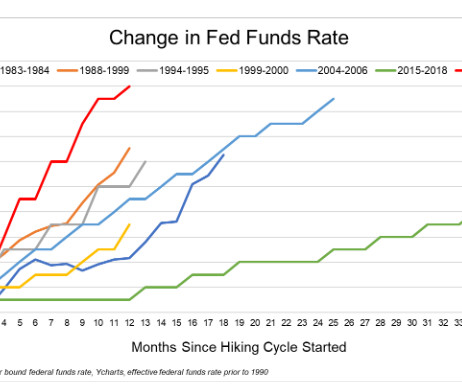

On last week’s Animal Spirits we asked why the Fed’s aggressive rate cuts had yet to break anything in the economy: Sure, the housing market is basically broken, but everything else has held up relatively well…until last week that is. We recorded our show on Tuesday. By the weekend we would see the 2nd and 3rd largest bank failures in U.S. history, including the biggest bank run we’ve ever seen.

The Big Picture

MARCH 14, 2023

My Two-for-Tuesday morning train reads: • Bank Runs, Now & Then : The Panic of 1907 would probably be more famous if it wasn’t overshadowed by the Great Depression just a couple of decades later. It lasted 15 months and saw GDP decline an estimated 30% (even more than the Great Depression). Commodity prices crashed. Bankruptcies exploded. The stock market fell 50%.

Private Equity Insights

MARCH 16, 2023

Investcorp, an alternative asset manager that counts Mubadala Investment Company as its biggest shareholder, has distributed $1.2bn in total to its GCC-based investors over the past 12 months, driven by “several value realisation initiatives”. The investment realisations were across asset classes, including recent exits from its private equity platform in the US, the company said on Monday.

The Reformed Broker

MARCH 15, 2023

Apparently it’s news to the whole world this morning that Credit Suisse is some sort of undead Swiss zombie bank worth more dissected and sold off in chunks than alive. Who knew? Oh wait – everyone knew, for a long time now. Open secret. Single digit stock price. Come on. I meet financial advisors at industry events and cocktail parties – I wince when they say they work at Credit Suisse.

A Wealth of Common Sense

MARCH 16, 2023

A reader asks: If a brokerage fails, what happens to a customer’s holdings there? Another reader asks: My wife and I have the bulk of our investments (401k & trading) in basically 2 accounts. Is this a dumb practice? Should we be more ‘diversified’ with our institutions? We’ve been discussing this for a while, and then with SVB, it’s definitely brought the discussion back to the kitchen table.

Dear Mr. Market

MARCH 11, 2023

Dear Mr. Market: March Madness is back! And so are we… The world stopped pretty much everything at one point during the pandemic and sports were of course no exception. For true sports fans there was nothing more depressing than watching cornhole tournaments or empty arenas void of fans, sounds, and energy. Even if you don’t like or follow college basketball, we think you’ll enjoy what we pioneered and have put together.

Walkner Condon Financial Advisors

MARCH 16, 2023

Over the weekend, we learned that Silicon Valley Bank and two other banks failed and were taken over by the Federal Deposit Insurance Corporation (FDIC). These are the first bank failures since 2020 and three of the 563 that have taken place since 2001 ( [link] ). This caused a fear over the weekend that we might see a repeat of 2007-2009. As the week has gone on, fear has spread to larger regional banks such as First Republic in California and international banks such as Credit Suisse.

Financial Times M&A

MARCH 16, 2023

Owner of UK’s Three says it is also close to an agreement with Vodafone

A Wealth of Common Sense

MARCH 13, 2023

On today’s show, we spoke with Dr. David Kelly, Chief Global Strategist and Head of the Global Market Insights Strategy Team for J.P. Morgan Asset Management about the SVB drama and knock-on effects in the economy. On today’s show, we discuss: Silicon Valley Bank drama Will the Fed break something else? What does SVB mean for interest rate hikes?

Financial Times: Moral Money

MARCH 12, 2023

Two business school professors prepared this exercise for students to focus on the strategic dilemmas for fossil fuel groups

Million Dollar Round Table (MDRT)

MARCH 16, 2023

By Matt Pais, MDRT Content Specialist So much of life is about perspective, and a successful advisor is an upbeat advisor. In his 2013 Annual Meeting presentation “Measuring what matters,” Ralph Antolino Jr., J.D., CLU, reiterates this by identifying nine secrets of ultra-happy people, many of which hinge on your outlook.

Financial Times M&A

MARCH 15, 2023

British lender could not analyse 30% of loan book but thought start-up clients were worth the gamble

A Wealth of Common Sense

MARCH 15, 2023

Today’s show is sponsored by Invesco QQQ: See here for more information on investing in the Nasdaq 100 On today’s show, we discuss: The demise of Silicon Valley Bank Thoughts on the bank bailouts NYPD called to Silicon Valley Bank branch as depositors attempt to pull cash S&P SPIVA US Scorecard The hotel cabanas that cost more than most rooms Three million US households making over $150,000 are still.

Financial Times: Moral Money

MARCH 11, 2023

USS and Borders to Coast’s plan follows companies backtracking on emissions targets

Indigo Marketing Agency

MARCH 14, 2023

The collapse of a bank is a significant event—one that can cause shockwaves throughout the financial industry. In the case of the Silicon Valley Bank failure, it can be particularly alarming for those invested in the technology sector. As a financial advisor, it’s crucial to effectively communicate this event to your clients to help them understand the potential impact it may have on their investments and overall financial well-being.

Financial Times M&A

MARCH 13, 2023

US pharma group to pay $229 a share in cash deal that signals rebound in M&A activity

Million Dollar Round Table (MDRT)

MARCH 14, 2023

By Ed Tate You can’t connect with prospects or clients if they’re not focused on what you’re saying. You can capture your audience’s attention, though, whether it’s in a client meeting or in front of a crowd of thousands, with these simple tips. The power of stories Use stories as opposed to statistics whenever possible. Substitute statistics for stories about people because stories are sticky.

Integrity Financial Planning

MARCH 16, 2023

Somewhere around 1999 and 2000, television started to change. Sitcoms were still very popular, and weekly dramas were also big, but several shows revolutionized how we think of television. They turned television into a medium for long-form, poetic storytelling. Before Netflix and streaming services pumped out shows as 8-hour binges, the following shows of the early 2000s began to set the groundwork for popular shows like Game of Thrones and Stranger Things.

Covisum

MARCH 14, 2023

Advisors ask me for help with marketing all the time. They want to know how to grow their businesses. Most of the time, what they really want is a quick fix, and I don't have that. But getting started in the right place can be a big help. Keep reading; you'll find free templates you can copy, paste, and edit. Feel free to use these as a launching point for your practice.

Financial Times M&A

MARCH 13, 2023

HoldCo Asset Management said two years ago that SVB’s valuation was inflated

XY Planning Network

MARCH 13, 2023

3.5 MIN READ “ Make Financial Advicers better, and more successful! “ This is the Nerd’s Eye View mission. This is also the personal mission of the man with the Nerd’s Eye View himself: Michael Kitces. He has a unique knack for continuously learning, compiling his knowledge, and sharing it with everyone so that financial advising is more accessible for all.

Integrity Financial Planning

MARCH 13, 2023

Over the course of your life, you have probably acquired several different retirement accounts, and you have likely considered many kinds of retirement strategies. The key now, if you have recently retired or you are about to retire, is to start putting those different pieces together to form a complete picture of what you have and what you may need going forward. 401(k) This is the most common kind of retirement account.

Ballast Advisors

MARCH 15, 2023

When working with a Registered Investment Advisor (RIA), investors may have heard the term “custodial relationship.” This refers to a partnership between the RIA and a financial institution that acts as the custodian of the client’s investment assets. For example, Ballast Advisors uses Charles Schwab as custodian for client investment assets.

Financial Times M&A

MARCH 12, 2023

Buyout with Canada’s largest pension fund is expected to be one of biggest this year

Financial Times: Moral Money

MARCH 13, 2023

Also in today’s newsletter, carbon software businesses raise eye-catching funds

The Big Picture

MARCH 15, 2023

I spent some time with my buddy Pete Dominick on Monday talking about all of the things we don’t know about SVB. As always, its a fun conversation — I pop in at the 19 minute mark. The post Discussing Bank Contagion with Pete Dominick appeared first on The Big Picture.

Dear Mr. Market

MARCH 17, 2023

Dear Mr. Market: SVB (Silicon Valley Bank) logo is seen through broken glass in this illustration taken March 10, 2023. REUTERS/Dado Ruvic/Illustration A part of us cringes as we succumb to the pressure of having to write about the most recent worrisome headline. Why? It’s sort of like the Kardashians or trashy television personalities in general; the more you talk about it the more it gives some the perception that it’s worth talking about.

Financial Times M&A

MARCH 13, 2023

Company’s shares jump after activist investor launches proxy battle

Let's personalize your content