BlackRock quits climate group in latest green climbdown

Financial Times: Moral Money

JANUARY 9, 2025

Worlds largest money manager had staked out position as sustainable investment leader

Financial Times: Moral Money

JANUARY 9, 2025

Worlds largest money manager had staked out position as sustainable investment leader

The Motley Fool

JANUARY 8, 2025

Generative artificial intelligence (AI) has been the first big usage of AI. However, the next major wave may be agentic AI. Generative AI uses generative software models to create text, image, video, or audio content in response to a user prompt. An example would be asking ChatGPT a question and getting a text response. With agentic AI, meanwhile, automated AI agents will go out and complete assigned tasks autonomously without constant human supervision.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Private Equity Insights

JANUARY 9, 2025

True Religion announced on Tuesday that private equity firm Acon Investments has acquired a majority stake in the company. SB360 Capital Partners, chaired by American Eagles CEO Jay Schottenstein, also took part in the deal. True Religion stated that the acquisition would support the expansion of its product range and global presence. The US-based clothing company will maintain its independence following the acquisition.

Financial Times M&A

JANUARY 9, 2025

Bucharest could mirror Spains recent decision to block a takeover on security grounds, says Sebastian Burduja

Private Equity Professional

JANUARY 6, 2025

Guardian Capital Partners has acquired Team LINX , a Denver-based provider of technology-related infrastructure services. LINX delivers a range of technology infrastructure products and services, including structured cabling, wireless networks, audiovisual systems, and security platforms such as access control and surveillance. Its customer base includes data centers, hospitals, financial institutions, and schools.

The Motley Fool

JANUARY 4, 2025

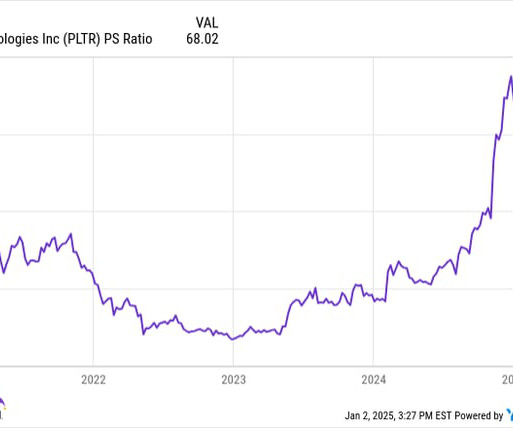

Palantir (NASDAQ: PLTR) was one of the best-performing stocks of 2024. The analytics and software management platform for government agencies, the military, and big business soared 340% for the year and sports a market cap of $167 billion as of this writing. Shareholders of Palantir no doubt appreciated the company's performance in 2024, but investors are likely looking at the new year and asking themselves: Can Palantir keep up this momentum?

Private Equity Insights

JANUARY 7, 2025

A Blackstone-led investor group is acquiring a majority stake in US accounting firm Citrin Cooperman, valuing the company at over $2bn, according to sources cited by the Financial Times on Tuesday. This could mark Blackstones first investment in the accounting sector. The private equity giant, managing $1 trillion in assets, is purchasing the stake from New Mountain Capital, Citrin Coopermans previous majority owner.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Private Equity Professional

JANUARY 8, 2025

Graycliff Partners has acquired Boss Industries , a manufacturer specializing in power take-off and engine-driven air technology, from Wynnchurch Capital. Boss products include integrated air compressors, generators, spray coating and vapor recovery systems that are used in construction, firefighting, military, tire service, mechanics trucks, railroads, and mining applications.

The Motley Fool

JANUARY 9, 2025

The S&P 500 is coming off back-to-back annual gains of more than 25% in 2023 and 2024 (including dividends), something it has only done one other time in its history dating back to 1957. In other words, the bull market is roaring. The S&P 500 is weighted by market capitalization, so the largest companies in the index have a greater influence over its performance than the smallest.

Private Equity Insights

JANUARY 9, 2025

A consortium of private credit funds, including Antares Capital, Blue Owl Capital, KKR, and Goldman Sachs Asset Management, has agreed to take control of Alacrity. BlackRock had previously acquired a controlling stake in the business from private equity firm Kohlberg & Company in February 2023. The acquisition was part of a $4.3bn long-term private capital strategy.

Private Equity Wire

JANUARY 10, 2025

Vistria Group, a private equity firm based in Chicago with ties to former President Barack Obama, has successfully closed a $3bn fund, adding to the growing list of Windy City investors raising capital over the past year, according to a report by BNN Bloomberg. The new fund, Vistria Fund V, will target investments in sectors such as US healthcare and financial services.

Private Equity Professional

JANUARY 6, 2025

Highlander Partners has acquired Ergo Baby from publicly traded Compass Diversified. Ergobaby specializes in ergonomic juvenile products, including baby carriers, strollers, wraps, and nursing pillows. The companys product offerings include the Omni 360 Baby Carrier , which allows for multiple carrying positions, and the Metro+ Stroller , a compact travel stroller that fits in airplane overhead bins and is designed for city streets.

The Motley Fool

JANUARY 6, 2025

Image source: The Motley Fool. Commercial Metals (NYSE: CMC) Q1 2025 Earnings Call Jan 06, 2025 , 11:00 a.m. ET Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks: Operator Hello, and welcome, everyone, to the fiscal 2025 first quarter earnings call for CMC. Joining me on today's call are Peter Matt, CMC's president and chief executive officer; and Paul Lawrence, senior vice president and chief financial officer.

Private Equity Insights

JANUARY 10, 2025

Prada is evaluating a potential acquisition of Versace from Capri Holdings, with Citi acting as its adviser. Capri Holdings has engaged Barclays to identify potential buyers for Versace, attracting interest from private equity funds and other fashion groups. This development follows Tapestry’s decision in November to abandon its $8.5bn acquisition deal for Capri, the parent company of Michael Kors.

Financial Times: Moral Money

JANUARY 10, 2025

Case over pension scheme management highlights rising risks of legal challenges over environmentally-focused policies

Private Equity Professional

JANUARY 8, 2025

Roman Products , a portfolio company of Salt Creek Capital , has been acquired by Matrix Adhesives Group , a portfolio company of Goldner Hawn. Roman Products is a manufacturer of wallcovering adhesives, primers and sealers, removers, and related tools used by professionals and do-it-yourselfers. According to the company, it is largest producer of wallpaper adhesive, primer, and removers in North America.

The Motley Fool

JANUARY 4, 2025

Thanks to its soaring stock last year, quantum computing specialist IonQ (NYSE: IONQ) is a company that has people talking. Up more than 225% in 2024, the shares have clearly attracted a ton of interest from investors. But it's a new year, and the question is this: Is IonQ a long-term buy? Let's dig into that right now. Image source: Getty Images. Start Your Mornings Smarter!

Private Equity Insights

JANUARY 9, 2025

Global healthcare private equity reached an estimated $115bn in 2024, marking the second-highest annual deal value on record, driven by a rise in large-scale transactions. The year saw five deals exceeding $5bn, up from two in 2023 and one in 2022. North America led the market, accounting for 65% of global deal value, followed by Europe at 22% and Asia-Pacific at 12%.

Private Equity Wire

JANUARY 6, 2025

Lim Hyoung-seok, a former Vice President at KKR Korea, has left the global private equity firm after nine years to establish his own private equity fund, Neos Equity Partners, according to a report by the Korea Economic Daily. Lim joined KKR Korea in 2016 as a Managing Director and played a leading role in numerous high-profile investments across South Korea during his tenure, helping position KKR as a prominent player in the countrys private equity market.

Private Equity Professional

JANUARY 8, 2025

The State of the Game The private credit arms race has taken the industry landscape by storm, with Ken Moelis citing the shift as the greatest change in the history of transactional finance. [1] Already enjoying years of measured growth, when banks and the broadly syndicated loan market stepped back from lending in 2023 due to market volatility, private credit stepped up, cementing private credits position as a force in financing markets.

The Motley Fool

JANUARY 7, 2025

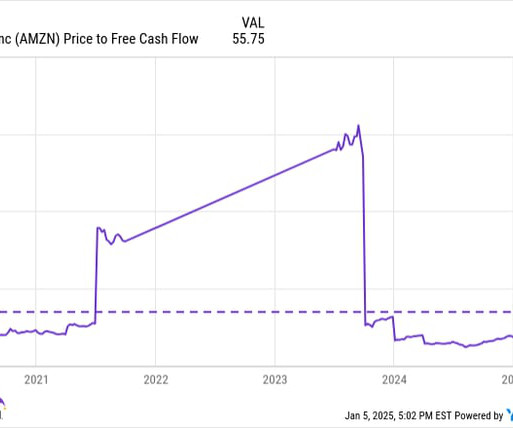

Since artificial intelligence (AI) emerged as the capital market's next big obsession a couple of years ago, the term " Magnificent Seven " began to gain steam. That name is used to collectively describe the world's largest technology businesses, each of which is carving out a unique pocket within the broader AI market. Here are the returns of each Magnificent Seven stock in 2024: Start Your Mornings Smarter!

Private Equity Insights

JANUARY 9, 2025

OnPay, a prominent provider of payroll, HR, and benefits solutions, has raised over $100m in new funding. The funding comprises a $63m Series B round led by Carrick Capital Partners, with additional backing from AB Private Credit Investors, AllianceBernstein’s middle-market private capital platform, and existing investors. OnPay also secured a debt facility from MC Credit Partners.

Financial Times M&A

JANUARY 8, 2025

Alacritys restructuring puts it under control of private credit lenders including Antares, Blue Owl, KKR and Goldman

Private Equity Wire

JANUARY 10, 2025

Indias private credit market is seeing robust growth with two key players, Neo Asset Management and Avendus PE Investment Advisors, prepare to launch funds targeting a combined $1bn-plus in assets, according to a report by Bloomberg. The report cites unnamed sources as revealing that Neo Asset Management, a relatively young firm founded in 2021, is looking to raise up to NIR60bn ($699m) for its second private credit fund, according to sources familiar with the matter.

The Motley Fool

JANUARY 5, 2025

Jensen Huang is the CEO of Nvidia (NASDAQ: NVDA) , a company whose chips power the vast majority of artificial intelligence (AI) systems. At a technology conference last year, Huang made a bold declaration: "The next wave of AI is here. Robotics, powered by physical AI, will revolutionize industries." Elon Musk, CEO of Tesla (NASDAQ: TSLA) , made a related prediction last year: "I think by 2040, probably there are more humanoid robots than there are people.

Private Equity Insights

JANUARY 9, 2025

Mashura, a leading healthcare inventory intelligence platform, has announced a $300m strategic partnership with a newly established financing vehicle backed by Warburg Pincus, a pioneer in private equity growth investing. The partnership will support Mashura’s efforts to expand its customer base in the US and internationally, drive innovation in its solutions, and strengthen integration partnerships.

FinSMEs

JANUARY 10, 2025

Panama, Panama, 10th January 2025, Chainwire The post SEED secures investment from Sui Foundation to build a 100M-user Web3 Gaming Ecosystem on Sui appeared first on FinSMEs.

Private Equity Wire

JANUARY 10, 2025

Private investment house Ardian has closed its newly formed and inaugural continuation fund for Syclef, a European firm specialising in the installation and maintenance of refrigeration and air conditioning systems. According to a recent release, the fund will be managed by Ardian and following a competitive auction process will be capitalised by Eurazeo as senior lead investor and Astorg as co-lead investor.

The Motley Fool

JANUARY 10, 2025

UiPath (NYSE: PATH) hasn't had a great run over the past few years. The stock was down nearly 50% last year when many tech stocks were up significantly. The reason? Many investors are worried that generative AI models will destroy UiPath's business. But the company isn't going to go silently into the night. It has a strategy that could save the business.

Private Equity Insights

JANUARY 8, 2025

The founder of Newbury Partners, Richard Lichter, has started a new venture to support small private equity firms struggling with fundraising gaps. Causeway has introduced a fund aimed at capitalizing on a unique opportunity. This is due to the sluggish fundraising environment, which has impacted even strong firms with excellent track records. Known as Seasoned Primaries, these funds are 25% to over 50% committed at final closing, closely resembling traditional secondaries.

Blackstone

JANUARY 9, 2025

The post 2025 Macro Outlook: Policymakers Have the Pen appeared first on Blackstone.

Private Equity Wire

JANUARY 9, 2025

Private investment giant Blackstone, in partnership with smaller investors, is acquiring a majority stake in Citrin Cooperman, a US accounting firm, in a deal that values the company at over $2bn, according to a report by the Financial Times. The stake is being purchased from New Mountain Capital, which originally acquired Citrin Cooperman in late 2021 for an enterprise value of about $500m, and marks the first time a major accounting firm has changed private equity hands twice, signalling a ris

The Motley Fool

JANUARY 8, 2025

Nvidia (NASDAQ: NVDA) already has soared in the first stages of the artificial intelligence (AI) story. The company designs the most sought-after graphic processing units (GPUs), or chips that power crucial AI tasks, like the training and inferencing of models. Nvidia's GPUs take the No. 1 spot in the industry because they're the fastest around, helping customers save time and, eventually, money.

Private Equity Insights

JANUARY 10, 2025

BEO Investments LLC, a Miami-based private equity firm, has launched three investment funds tailored to meet the needs of its accredited clients. These funds are going to address diverse investor preferences and capitalize on strategic opportunities in the real estate market. Particularly, the three funds focus on stabilized multifamily properties, opportunistic real estate, and luxury development.

Financial Times: Moral Money

JANUARY 6, 2025

Rob Bauer calls on banks, pension funds and rating agencies to change outdated policies in face of rising threats

Private Equity Wire

JANUARY 8, 2025

Point72 Asset Management, the hedge fund founded by Steve Cohen, is entering the booming private credit market with a new strategy headed by Todd Hirsch, a former senior managing director at Blackstone, according to a report by Reuters citing an internal company statement. The move signals Point72s ambition to tap into the growing demand for private credit, which has become a key focus for alternative asset managers.

The Motley Fool

JANUARY 6, 2025

Generally speaking, when businesses generate excess profits, they may choose to invest in areas such as research and development (R&D), bolster marketing budgets, or increase hiring efforts in certain departments. However, from time to time, a company may invest in other businesses and acquire a small equity stake. In 2024, a 13F filing revealed that semiconductor giant Nvidia has ownership positions in six publicly traded companies -- Applied Digital , Arm Holdings , Nano-X Imaging , Recurs

Let's personalize your content