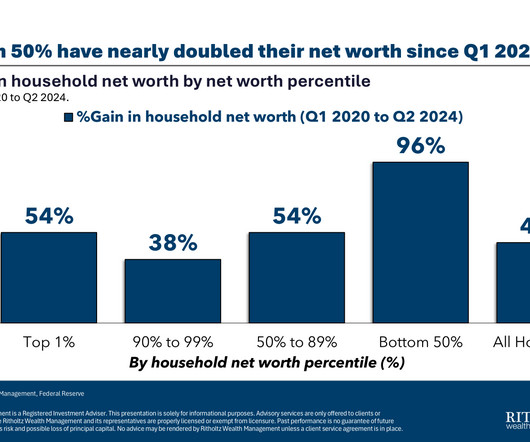

A Staggering Amount of Wealth Creation

A Wealth of Common Sense

OCTOBER 15, 2024

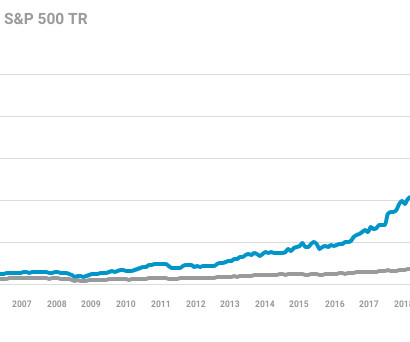

The Great Financial Crisis decimated the balance sheets of most Americans. How could it not? Housing prices were down by nearly 30%. The stock market crashed almost 60%. The unemployment rate hit double-digits. It was the worst economic period most of us have ever lived through. The collective net worth of American households reached roughly $66 trillion by the end of 2007.

Let's personalize your content