Jim Ratcliffe declares interest in buying Manchester United

Financial Times M&A

AUGUST 17, 2022

UK billionaire emerges as potential buyer of struggling football giant if Glazer family want to sell

Financial Times M&A

AUGUST 17, 2022

UK billionaire emerges as potential buyer of struggling football giant if Glazer family want to sell

The Big Picture

AUGUST 17, 2022

Yesterday I spent some time with Eric Balchunas recording a Masters in Business podcast. Balchunas is Senior ETF Analyst for Bloomberg Intelligence and the author of “ The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions.”. It’s a fun conversation I’m sure everybody will enjoy. There are parts of our discussion I thought were obvious, but he convinced me as underappreciated: First and foremost, the intense disruption of low-c

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A Wealth of Common Sense

AUGUST 16, 2022

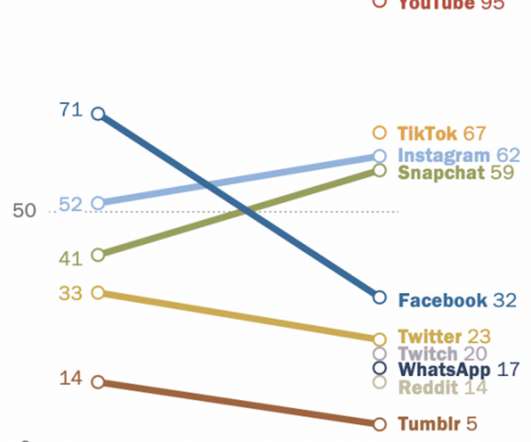

As I’ve gotten older the part of pop culture where I’ve fallen behind the most is music. There aren’t many new artists I like so I mostly end up listening to older music. There could be a get-off-my-lawn nostalgia thing going on here but the data shows I’m not alone. Ted Gioia crunched the numbers and the results are astounding: Old songs now represent 70 percent of the U.S. music market, according.

The Reformed Broker

AUGUST 13, 2022

It’s good to be back! After a much needed vacation, got back into the swing of things this week… And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. These were the most read posts on the site this week, in case you missed it: The post This Week on TRB appeared first on The Reformed Broker.

Financial Times: Moral Money

AUGUST 18, 2022

Naked Lunch meets Goodhart’s law

The Big Picture

AUGUST 15, 2022

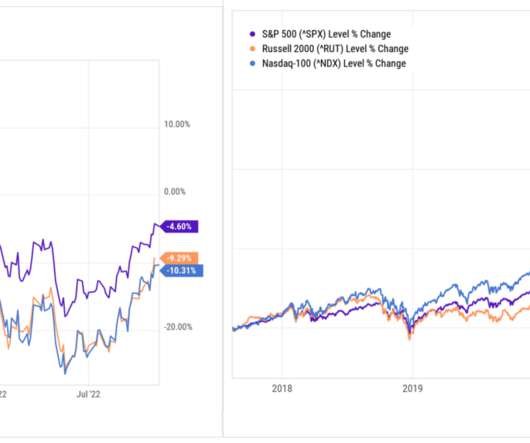

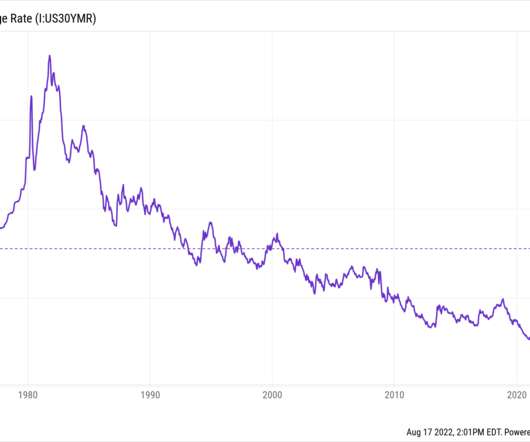

One of my favorite ways to contextualize market trends is to divide long periods of time into secular bull and bear markets. When we look at the past century, we can see decades-long eras where the economy is generally robust, supporting markets trending higher, with expanding multiples. We call these eras Secular Bull Markets. The best examples are 1946-66, 1982-2000, and 2013 forward.

A Wealth of Common Sense

AUGUST 19, 2022

Magician Gustav Kuhn once performed a simple magic trick to learn why people are so susceptible to sleight of hand. He took a small red ball and threw it in the air, catching it with one hand. He then did it again a second time very quickly. But on the third throw, the ball never came down. It disappeared. It was a mystery. Where did the ball go? It didn’t actually disappear into thin air.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Financial Times: Moral Money

AUGUST 17, 2022

Funds that score highly on some UN Sustainable Development Goals often score low on others

The Big Picture

AUGUST 14, 2022

During the 2022 Abel lectures Jim Simons had a conversation with Nils A. Baas and Nicolai Tangen. The lectures were held at The University of Oslo, May 25th…. A conversation with Jim Simons: Mathematics, Common Sense and Good Luck. Source: The Abel Prize , June 13, 2022. The post A conversation with Jim Simons appeared first on The Big Picture.

A Wealth of Common Sense

AUGUST 14, 2022

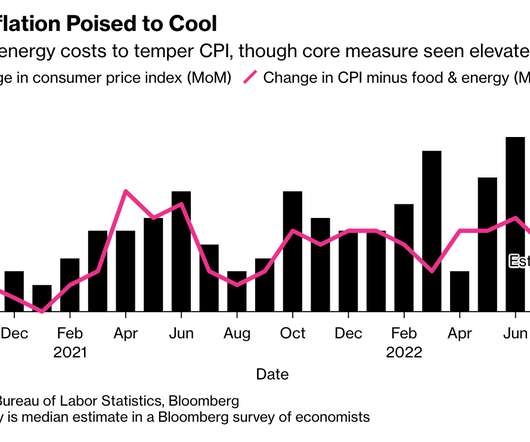

I did a radio interview this week. I don’t do a lot of these things because it’s just easier and more comfortable to talk about stuff on my podcast but this one sent me a great list of questions ahead of time that I liked. Here are 6 of the best questions with some thoughts on each: (1) What is your reaction to the latest CPI report and your outlook on inflation?

Financial Times M&A

AUGUST 19, 2022

World’s second-biggest cinema chain has warned it is in discussions to restructure the business

A VC: Musings of a VC in NYC

AUGUST 15, 2022

In about a month, an important moment will happen in the world of crypto/web3. The Ethereum blockchain will move from a proof of work consensus mechanism to a proof of stake consensus mechanism. This event is known as “The Merge” in Ethereum land. There are many reasons why this is an important moment for the world of crypto/web3, but to my mind the most important reasons are: 1/ The Merge reduces the carbon footprint of the Ethereum blockchain very significantly.

The Big Picture

AUGUST 19, 2022

There is a link in yesterday’s reads that I violently disagreed with but found quite interesting nonetheless. Just as retweets aren’t endorsements, my AM reads include things I find fascinating, important, and well-written — regardless of whether or not they reflect my beliefs. If anything, finding contrary pieces helps reduce confirmation bias and curtails my time in a limited information bubble of my own construction.

A Wealth of Common Sense

AUGUST 18, 2022

A reader asks: I have a house with a low interest rate (2.75%) I refinanced a year ago. My family has grown (3 kids) and might be time to get a bigger house. My problem is of course mortgage rates have skyrocketed (now could probably get a 5.75% rate). Is there anything I can do with this low rate asset? Or am I stuck selling my house at 2.75% and financing at the higher rate.

Financial Times M&A

AUGUST 19, 2022

Dutch investment group Prosus acquires remaining third of Latin American delivery business it does not own

Walkner Condon Financial Advisors

AUGUST 18, 2022

Employee stock grants can be an excellent benefit, but they can also be complicated, especially when they involve restrictions and vesting schedules. Stock grants also come with significant tax consequences that, depending on the situation, can leave you with large tax bills. However, you do have some control over when those tax bills are paid and, in the right circumstances, you can lower your total tax bill significantly if you elect to pay taxes upfront.

The Big Picture

AUGUST 13, 2022

This week, we speak with Kenneth Tropin, chairman and founder of Graham Capital Management , a multi-strategy quantitative hedge fund with $18 billion in assets under management. Prior to founding GCM in 1994, Tropin was president and chief executive officer of hedge fund John W. Henry & Company, and has worked with such legendary traders as John Henry and Paul Tudor Jones.

Financial Times: Moral Money

AUGUST 17, 2022

Plus, hedge fund lobbyists attack the SEC’s disclosure drive

Financial Times M&A

AUGUST 19, 2022

This appetiser will keep investors satisfied for now, but they will soon get hungry for the main course

A Wealth of Common Sense

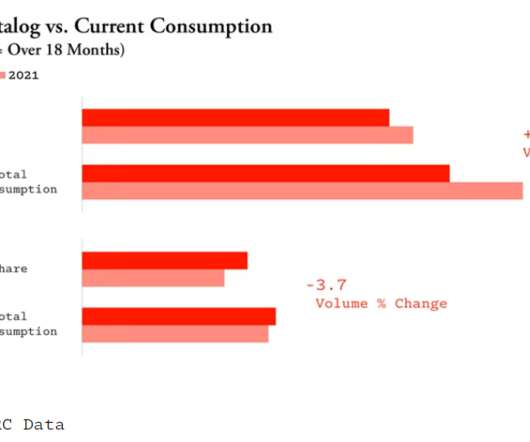

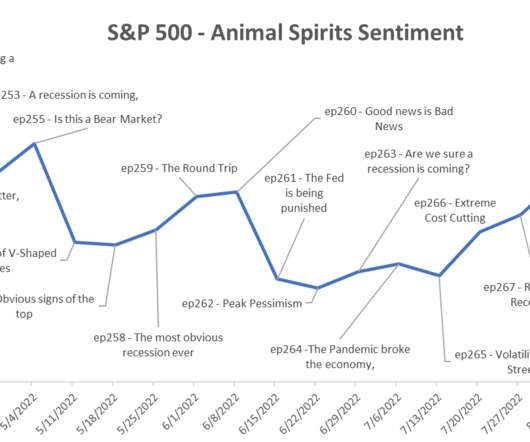

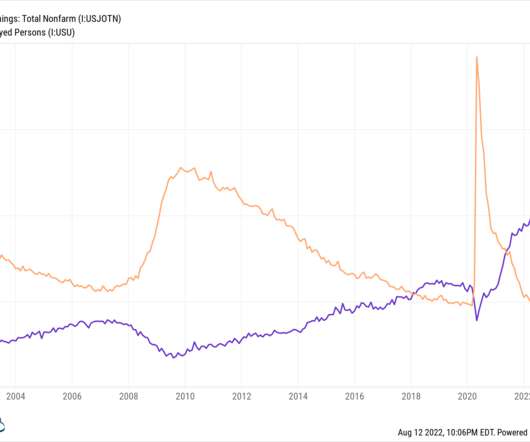

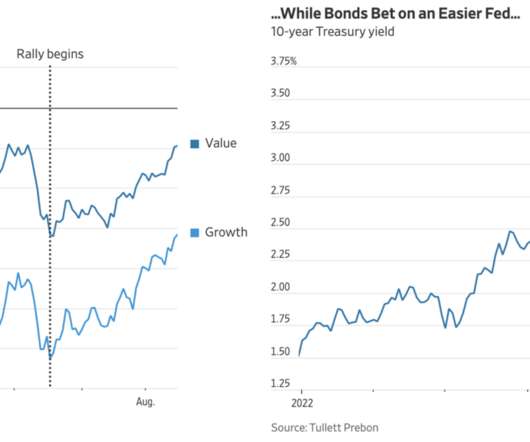

AUGUST 17, 2022

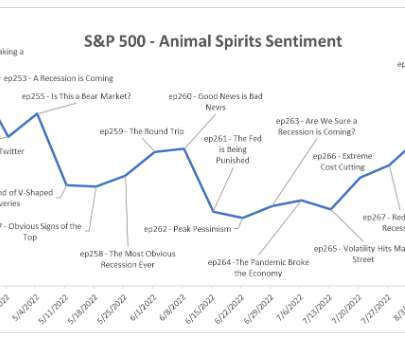

Today’s Animal Spirits is brought to you by YCharts: See here for YCharts Highlights, Lowlights, and insights from 1H 2022 On today’s show we discuss: AQRs New Rules of Diversification JPMs Guide to the Markets Is labor hoarding causing the low layoff numbers? Empire State manufacturing survey Is America’s job market too good? Insights into the inflation print Disney inflation Home price correction by geog.

The Big Picture

AUGUST 19, 2022

Yet another lovely open-air driver to enjoy during the summer months: The famed Mercedes-Benz 300SL Gullwing pioneered many new technical innovations, such as fuel injection and a tubular space frame. It may have been gorgeous, but it was an expensive coupe. Enter the 190SL. Built on a shortened sedan platform, it was powered by a carbureted 1.9-liter inline-four making 120 HP paired with a four-speed manual transmission.

Million Dollar Round Table (MDRT)

AUGUST 18, 2022

By Bryson Milley, CFP, CIM One of the questions I’m most asked by retiring clients is, “How do I manage my investments once I’m retired?” While I could give them all the technical information and thought processes behind it, that may not help the client understand. I find that stories and analogies are much more useful in explaining concepts. Yet for many years I struggled to find a good analogy for my clients.

Financial Times M&A

AUGUST 18, 2022

Profits may be down but buying spree should pay off for most international of China’s carmakers

Sara Grillo

AUGUST 15, 2022

In this savage, take-no-prisoners debate, Igor Smolyanskiy, Michael Kotarinos, Scott Salaske and I debate whether or not direct indexing is worth it. Pull up a chair and get ready to rumble! But first! For those of you who are new to my blog, my name is Sara. I am a CFA® charterholder and financial advisor marketing consultant. I have a newsletter in which I talk about financial advisor lead generation topics which is best described as “fun and irreverent.

The Big Picture

AUGUST 19, 2022

My end-of-week morning train WFH reads: • Holes in the Recession Story. With surging inflation and a new war in Europe, the first half of 2022 was understandably gloomy for economies and financial markets around the world. But recent developments offer some hope that the prevailing pessimism may no longer be as warranted as it was a few months ago. ( Project Syndicate ). • This Year, the Boss Is in the Office While Employees Hit the Beach : Managers hoping to coax workers back to the office are

Financial Times: Moral Money

AUGUST 15, 2022

Plus, an interview with Jonathan Reynolds, UK shadow secretary for business, energy and industrial strategy

Financial Times M&A

AUGUST 17, 2022

Chapter 11 process widely used by overleveraged companies

Million Dollar Round Table (MDRT)

AUGUST 14, 2022

By Matt Pais, MDRT Content Specialist How do you keep your staff members motivated? For Adam Llewellyn Morse, CFP , a nine-year MDRT member from Melbourne, Victoria, Australia, that means verbalizing the things he is going to do and giving team members a chance to articulate what they need him to do. “As a business owner and leader of the team, it’s difficult to hold other staff members accountable when you’re not actually performing at a high level yourself,” he said.

The Big Picture

AUGUST 15, 2022

My back-to-work morning train WFH reads: • When is a Bear Market Over? Like many things in the market, there aren’t any hard and fast rules for this kind of thing, especially in real-time. Let’s look at the 2008 scenario as an example. The S&P 500 topped out in early October 2007 and bottomed in March 2009. On a price-only basis, the index didn’t reach those 2007 highs again until March 2013: ( Wealth of Common Sense ). • How Remote Work is Shifting Population Growth Across the U.S.

Financial Symmetry

AUGUST 15, 2022

If you have received a diagnosis of advanced stage cancer or another terminal illness, first, we are very sorry to hear that you are going through this. Feelings of overwhelm, fear, panic and anger are all normal during this time. … Continued. The post Terminal Illness Checklist appeared first on Financial Symmetry, Inc.

Financial Times M&A

AUGUST 18, 2022

Plus, sweet shops invade Oxford Street and South Korea’s love affair with private equity

Financial Times: Moral Money

AUGUST 18, 2022

Recent launches focus on clean energy and sustainable factors

Million Dollar Round Table (MDRT)

AUGUST 16, 2022

By Gary DeMoss People love the word “smart.” We have smart water, smart cars and smart phones, for example. We also tell clients that we want to be smart with their money, and we do it in a very specific way. For example, this is our 30-second smart statement when a client asks about fees: “So, Jim, first of all, thanks for asking about our cost. It’s important to me that we’re smart with your money.

XY Planning Network

AUGUST 15, 2022

6.5 MIN READ. The notice for an upcoming regulatory examination. It’s the call that an advisor always dreads. It can evoke a certain amount of nerves on its own (especially if it’s your first time!) Double that stress if you are not well organized. Let’s dive into several ways to keep your compliance organized beyond the filing cabinet.

Financial Times M&A

AUGUST 15, 2022

Australian miner benefits as war in Ukraine crimps Russian fuel exports

Financial Times: Moral Money

AUGUST 19, 2022

Plus, the climate implications of Pelosi’s Taiwan visit

Elevating Your Business

AUGUST 16, 2022

Every business starts with a founder who has a vision—a mental image of hopes and dreams—for the company's success. If the vision is not written down and used, over time, it gets lost in daily routines, life’s emergencies, and 60-hour-plus work weeks. A Business Vision Statement (BVS) answers these questions: What are you building? Where. The post Why Does Your Firm Need a Business Vision Statement?

Let's personalize your content