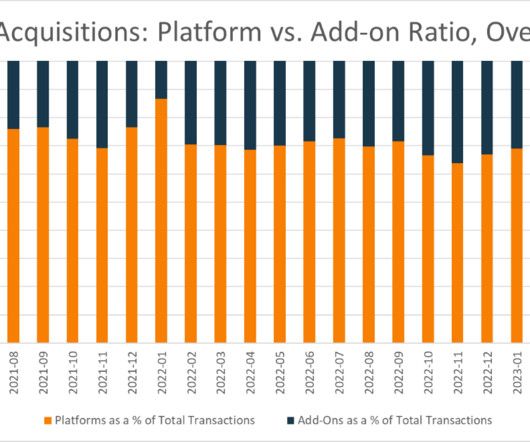

Platform acquisitions drop from 2021 to 2023 as add-ons surge

Private Equity Info

NOVEMBER 14, 2023

Private equity firms are shifting towards smaller M&A deals, with add-ons becoming the dominant investment strategy.

Private Equity Info

NOVEMBER 14, 2023

Private equity firms are shifting towards smaller M&A deals, with add-ons becoming the dominant investment strategy.

The Motley Fool

NOVEMBER 12, 2023

Image source: Getty Images The holidays themselves may not be here quite yet, but it's fair to say that the holiday shopping season is in full swing. And this year, consumers seem to be going all in. Data from RetailMeNot finds that shoppers are planning to spend considerably more this year on the holidays compared to last year -- $932 versus $725. And chances are, a lot of people will do a fair share of their shopping on Black Friday.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Private Equity Insights

NOVEMBER 16, 2023

Argo Group International Holdings, Ltd. (“Argo”) today announced the completion of Brookfield Reinsurance’s acquisition of Argo in an all-cash transaction valued at approximately $1.1bn. Under the terms of the transaction, Brookfield Reinsurance acquired all issued and outstanding common shares of Argo at a price of $30 per share. Argo’s common shares have ceased trading on the New York Stock Exchange.

PE Hub

NOVEMBER 15, 2023

In conjunction with this deal, YPTC founder and President Eric Fraint will be retiring from the company in early 2024. The post Accounting firm Your Part-Time Controller names investment from Pamlico appeared first on PE Hub.

Financial Times - Banking

NOVEMBER 17, 2023

Kate Shiber says Centerview Partners improperly fired her over sleep requirements necessitated by mental illness

The Motley Fool

NOVEMBER 14, 2023

Shares of electric air taxi company Archer Aviation (NYSE: ACHR) soared 10.2% through 10:15 a.m. ET on Tuesday, marking its second straight day of gains after Deutsche Bank predicted the stock would double. On Monday, the German investment bank made headlines when it reiterated its $12 price target on Archer stock -- a more than 130% gain over yesterday's closing price.

Private Equity Insights

NOVEMBER 16, 2023

Blackstone is in the final stages of raising about $400m for its Blackstone Private Credit Fund (BCRED) to secure additional investment advantage, the Financial Times reported on Thursday. The New York-based investment manager is planning to raise funds through collateralized loan obligations (CLOs) secured by the loans held by its flagship $52bn private credit fund, the report added, citing documents viewed by the newspaper.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

A Wealth of Common Sense

NOVEMBER 17, 2023

I saw a chart this week from Bank of America that more or less sums up my entire investment philosophy: In the long run, stock prices go up. I view the stock market as a way to invest in innovation, profits, progress and people waking up in the morning looking to better their current situation. While I love the fact that this chart illustrates my long-term philosophy it’s a bit misleading.

The Motley Fool

NOVEMBER 16, 2023

Shopify (NYSE: SHOP) stock is back. Or maybe it never really faded all that much. But with the logistics business now sold off, it's easier to focus on what Shopify has always done best: software for the e-commerce industry. Of course, not all is perfect, and it's still easy to poke holes in the Shopify investment thesis -- with its current rich valuation among the top concerns.

Private Equity Insights

NOVEMBER 14, 2023

Bahrain-based alternative asset manager Investcorp is aiming to raise 2bn to 4bn yuan ($274m-$548m) for its first private equity fund in the Chinese currency, its executive said, to explore buyout opportunities in the country. Investcorp plans to apply in the next few months for a license with Chinese regulatory bodies that will allow it to start raising funds from domestic institutions next year, Investcorp’s co-chief executive officer Hazem Ben-Gacem said. “I hope over time, we wil

PE Hub

NOVEMBER 15, 2023

USHG's existing backers include Cota Capital, NRD Capital and restaurant group Bobby Cox Companies. The post Enlightened Hospitality Investments backs restaurant tech company Qu appeared first on PE Hub.

A Wealth of Common Sense

NOVEMBER 16, 2023

A reader asks: I keep hearing about the Magnificent 7 stocks are carrying the stock market this year while the rest of the stocks are sucking wind. Does this even matter? I get that these stocks could fall and bring the market down with them but should we be worried about this level of concentration? It’s true the Magnificent 7 stocks — Amazon, Apple, Facebook, Google, Microsoft, Nvidia and Tesla — are.

The Motley Fool

NOVEMBER 16, 2023

Retailing is a difficult business characterized by high competition levels and low profit margins. But that's not the case for tech companies that help connect retailers with buyers. Done right, the middleman selling approach can translate into predictable sales growth and impressive cash flow -- all with relatively low financial risk. Etsy (NASDAQ: ETSY) and Shopify (NYSE: SHOP) are both set up to take advantage of these favorable economics.

Private Equity Insights

NOVEMBER 17, 2023

GTCR, a leading private equity firm, announced today that it has signed a definitive agreement to acquire Cloudbreak Health, LLC (“Cloudbreak” or “the Company”), a leading provider of tech-enabled, healthcare-focused language interpretation services, in a corporate carve-out transaction from UpHealth, Inc. Under the terms of the agreement, the purchase price is $180m , and the transaction is expected to close in the first quarter of 2024 following the receipt of customa

PE Hub

NOVEMBER 16, 2023

Waud Capital will retain a majority stake in HSI. The post Neuberger Berman takes minority stake in environmental and health compliance software provider HSI appeared first on PE Hub.

The Big Picture

NOVEMBER 16, 2023

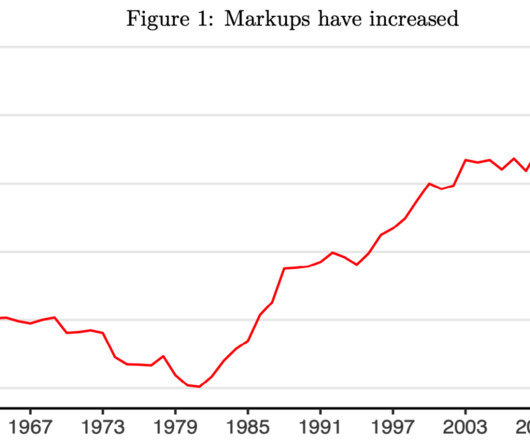

Over at Alphaville , Robin Wigglesworth looks at whether ‘Greedflation’ (aka price-gouging) meaningfully contributed to Eurozone inflation. Specifically, Bank of England research suggests that while they “find no evidence of a rise in overall profits in the UK” they did notice that “companies in the oil, gas and mining sectors have bucked the trend” with “some companies… much more profitable than others.”1 I was pretty skeptical about Greedflation initia

The Motley Fool

NOVEMBER 14, 2023

Fool.com contributor Parkev Tatevosian reviews Plug Power (NASDAQ: PLUG) stock following the massive stock price crash after it announced a quarterly investor update. *Stock prices used were the afternoon prices of Nov. 12, 2023. The video was published on Nov. 14, 2023. 10 stocks we like better than Plug Power When our analyst team has a stock tip, it can pay to listen.

Private Equity Insights

NOVEMBER 16, 2023

BlackRock has achieved the first close of its Evergreen Infrastructure fund, securing nearly $1bn in commitments from European founding partners. Launched in June 2022, Evergreen Infrastructure is an open-ended equity fund focusing on European and North American infrastructure aligned with energy transition and security themes. The fund aims to provide long-term cash yield and resilient inflation-linked, fully-contracted returns through diversified investments in core infrastructure businesses a

PE Hub

NOVEMBER 16, 2023

The deal is expected to close in the fourth quarter of this year. The post CallTower grabs investment from BV appeared first on PE Hub.

The Big Picture

NOVEMBER 15, 2023

Markets screamed higher yesterday after a benign CPI report showed a 0.0% monthly price increase and inflation falling to 3.2% year over year. After a big gap opening, latecomers piled in; many had been sitting on the sidelines following a challenging 2022, while others got panicked out during the 10% October drawdown. It was a classic fear-driven error, a combination of bad market timing and poor impulse control.

The Motley Fool

NOVEMBER 14, 2023

Fool.com contributor Parkev Tatevosian highlights two artificial intelligence (AI) stocks that Warren Buffett owns in his Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) portfolio. *Stock prices used were the afternoon prices of Nov. 12, 2023. The video was published on Nov. 14, 2023. 10 stocks we like better than Apple When our analyst team has a stock tip, it can pay to listen.

Private Equity Insights

NOVEMBER 16, 2023

Aston Martin F1 team sells stake to private equity firm at $1bn valuation. While exact figures have not been disclosed, Aston Martin has reported on the eve of the inaugural Las Vegas Grand Prix that Arctos Partners has acquired a “minority shareholding in AMR Holdings GP Limited, the team’s holding company”. The deal is expected to close by the end of 2023.

PE Hub

NOVEMBER 16, 2023

CQS is a London, UK-based multi-sector alternative credit manager. The post Manulife Investment Management to buy credit shop CQS appeared first on PE Hub.

A Wealth of Common Sense

NOVEMBER 12, 2023

Jesse Livermore once said, “Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.” Fair point. Human nature is the one constant across all market environments. On the other hand, Warren Buffett once said, “If past history was all that.

The Motley Fool

NOVEMBER 14, 2023

Image source: Getty Images The Supplemental Nutrition Assistance Program (SNAP) is a federal initiative to help families cover their monthly food costs. SNAP has some specific income and work eligibility requirements , but in general, the program can significantly help lower-income families who need extra help buying food. More than 22 million U.S. households -- 12.5% of the population -- receive SNAP benefits, according to Pew Research Center.

Private Equity Insights

NOVEMBER 15, 2023

Allfunds Group Plc has started gauging takeover interest from private equity firms as the European fund distribution platform considers a possible sale, people with knowledge of the matter said. The Amsterdam-listed company is in the early stages of approaching buyout firms including Cinven, CVC Capital Partners and Permira, according to the people.

PE Hub

NOVEMBER 14, 2023

Based in Fort Myers, Florida, Juniper is a commercial landscaping platform. The post Bregal-backed Juniper Landscaping buys landscaping maintenance firm Shooter and Lindsey appeared first on PE Hub.

A Wealth of Common Sense

NOVEMBER 14, 2023

By the end of the 1970s inflation was out of control. The New York Times wrote a front-page story where they interviewed a bunch of normal people to see how inflation was impacting their lives. By that point CPI was up a cumulative 73% in the decade or nearly 7% per year. Inflation had been raging on long enough that it was finally starting to impact people’s habits: In interviews across the country, The New York T.

The Motley Fool

NOVEMBER 14, 2023

Solar energy stocks had a great day on Tuesday as the market reacted to the potential for lower interest rates in the future. Stocks were up across the board, but Sunrun (NASDAQ: RUN) led the way, climbing as much as 19.6%; SunPower (NASDAQ: SPWR) jumped 12.9%; Enphase Energy (NASDAQ: ENPH) rose 14.4%, and SolarEdge Technologies (NASDAQ: SEDG) popped 11.4%.

Private Equity Professional

NOVEMBER 17, 2023

L Squared has held the final closing of its fourth private equity fund with $840 million of capital. The firm’s earlier fund closed in September 2020 with $505 million of capital. L Squared invests from $50 million to $125 million of equity in North America-based companies that have revenues of $20 million to $125 million… This content is for members only.

PE Hub

NOVEMBER 16, 2023

The capital infusion will be used for Cambrian's growth. The post Wastewater treatment firm Cambrian nets $200m from Pennybacker appeared first on PE Hub.

Private Equity Insights

NOVEMBER 16, 2023

Thoma Bravo agreed to buy corporate communications and compliance services firm EQS Group AG for about €400m ($434m), marking its first takeover of a listed German company. EQS shares soared. The tech-focused buyout firm will offer €40 a share, representing a 52.7% premium to EQS’s Wednesday closing price, according to a statement Thursday. Bloomberg News reported Wednesday that the two were in talks and near a deal.

The Motley Fool

NOVEMBER 14, 2023

"It's the economy, stupid," is a maxim of long-standing in the political world. It's also front of mind for many investors in real estate investment trusts (REITs), as evidenced by the dramatic upswings of many stocks in the sector on Tuesday. There was some highly encouraging news about inflation, and the market reacted accordingly and strongly. Many REITs booked notable gains on the day, no matter what niche or niches they specialize in.

Private Equity Professional

NOVEMBER 17, 2023

Granite Creek has acquired NYP, a manufacturer and distributor of packaging materials. NYP sources, processes, and distributes a portfolio of textile-based packaging products used in the nursery, agricultural, and industrial markets. NYP’s products include treated and plain burlap bags; wire baskets; twine, rope and strapping; cotton bags; grain and feed bags; emergency sandbags; consumer shopping… This content is for members only.

PE Hub

NOVEMBER 15, 2023

Based in Des Plaines, Illinois, Data Clean is a specialized facility maintenance services firm. The post Angeles Equity Partners-backed Data Clean buys environment cleaning business Sealco appeared first on PE Hub.

Private Equity Insights

NOVEMBER 16, 2023

Global Blue Group Holding AG, the leading strategic technology and payments partner powering retailers’ improved performance and enhancing shoppers’ experience, is pleased to announce it has entered into a share purchase and investment agreement with Tencent, a world leading internet and technology company. Tencent has agreed to invest $100m in Global Blue common equity at a price of $5.50 per share, which is generally in line with the volume-weighted average price over the past 3 months.

The Motley Fool

NOVEMBER 12, 2023

The past several years have been a roller coaster ride for Palantir Technologies (NYSE: PLTR) investors. The stock has gained an impressive 193% so far this year, but those gains essentially served to return the stock to where it traded just before its 64% plunge in 2022. Palantir has faced macroeconomic headwinds, but it hasn't been sitting idly by waiting for the storm to clear.

Let's personalize your content