Adani seeks to sell stake in cement business for $450mn to reduce debt

Financial Times M&A

MARCH 10, 2023

Indian group has sought lenders’ approval for disposal as it tries to boost investor confidence after fraud claims

Financial Times M&A

MARCH 10, 2023

Indian group has sought lenders’ approval for disposal as it tries to boost investor confidence after fraud claims

A Wealth of Common Sense

MARCH 5, 2023

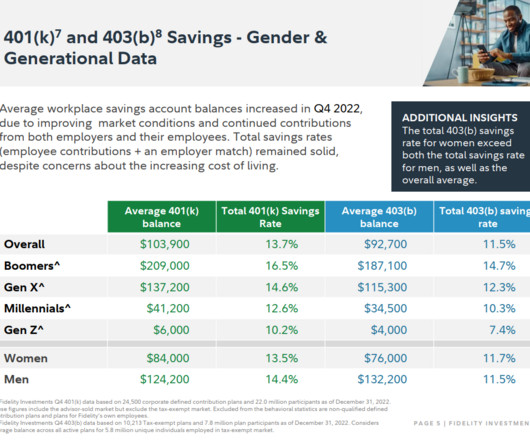

According to the Bureau of Labor Statistics, nearly 70% of private industry workers had access to a workplace retirement plan in 2021. Just 51% of them participated in those plans. It’s estimated more than 100 million Americans are covered by a defined contribution retirement plan. Those plans hold something like $11 trillion. That’s a lot of money but is it enough to retire comfortably?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

MARCH 8, 2023

I love the idea of convergence — those rare times when multiple stories about very different issues seem to all land on the same “Grand Truth,” albeit from very different perspectives. Yesterday brought just such a three-part convergence into focus. It’s about money and happiness, which is very much the intersection of where I spend much of my time: Capital Markets , and Behavioral Finance.

The Reformed Broker

MARCH 10, 2023

The spectacular blow-up currently taking place at SVB and its primary subsidiary, Silicon Valley Bank, is the biggest story in the markets this week. SVB is systemically important for the technology sector and its Northern California ecosystem. As Jim Cramer put it last night, the Federal Reserve has been firing a machine gun at the economy for the last 12 months but it hasn’t hit anything yet.

Financial Times M&A

MARCH 10, 2023

Tech-focused lender had faced deposit outflows and failed in eleventh-hour attempt to raise new capital

A Wealth of Common Sense

MARCH 8, 2023

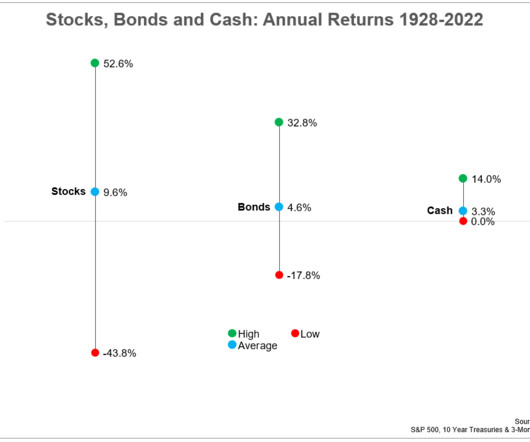

Short-term interest rates continue to charge higher as the economy remains stronger than anticipated. We’re looking at 5% yields across the board for short-term government bonds. Some people will still scoff at these yields by reminding you that inflation is still 6% but let’s be honest — right or wrong, most investors think in nominal terms, not real.

The Big Picture

MARCH 10, 2023

Armchair quarterbacking the decisions of the Federal Reserve long ago became a blood sport. With the benefit of hindsight, we all are genius central bankers. I particularly loathe managers who lay all the woes of the world at the feet of the Federal Reserve. For more than a century, America’s central bank has been a key part of the investing environment, and it’s your job as an active manager to incorporate their probable policy decisions into your strategy.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Financial Times M&A

MARCH 8, 2023

Payments group made $17.

A Wealth of Common Sense

MARCH 9, 2023

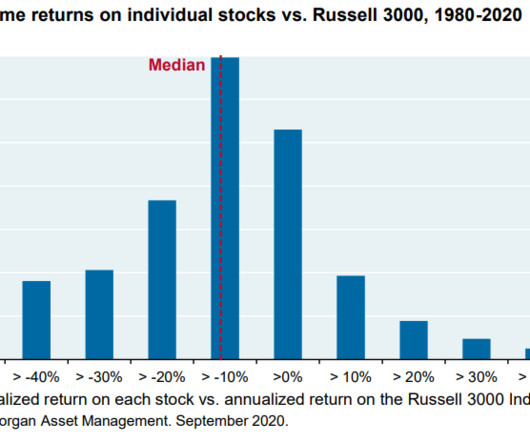

A reader asks: As a retail investor, how does one go about assessing the investment performance of a security or even an index fund beyond looking at the historic performance which Ben Carlson recently described as chasing performance? Linked to this, can you please explain a backtest in simple terms, and what is a good way to do a backtest for an average investor?

The Big Picture

MARCH 6, 2023

This week, we get to hear from Federal Reserve Chairman Jerome Powell twice – tomorrow in the Semiannual Monetary Policy Report to Congress before the Senate Banking Committee and the next day in the House Financial Services Committee. We can expect a series of useless questions, posturing for sound bites, and self-aggrandizing speeches that pretend to be questions.

Million Dollar Round Table (MDRT)

MARCH 5, 2023

By Matt Pais, MDRT Content Specialist Whether you’re a new or a veteran advisor, you know that a thriving business relies on a combination of a lot of moving parts. In his 2014 Annual Meeting presentation “Essence of excellence,” John Spence, who at 26 oversaw projects in 20 countries as CEO of an international Rockefeller foundation, identified business achievement as the product of a formula: (T+C+ECF) X DE = success.

The Reformed Broker

MARCH 7, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Powell to Congress – “Fed chief Powell is set to begin two days of congressional testimony Tuesday, where he’ll have the chance to explain the central bank’s planned response to a more resilient e.

A Wealth of Common Sense

MARCH 10, 2023

According to the U.S. Census Bureau, the median income in the United States is a little more than $70,000 a year. There is a sizable range of results around the median so it can help to break things down even further by percentiles. DQYDJ has a good breakdown of the data that shows the bottom 10% of earners, the bottom 25%, median, top 25%, top 10% and top 1%: You can also see these breakdowns by age: These figures can.

The Big Picture

MARCH 5, 2023

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • The age of the Silicon Valley ‘moonshot’ is over :Big Tech’s cost-cutting and layoffs are another nail in the coffin for the industry’s most ambitious and costly projects. ( Washington Post ) • Rupert Murdoch’s deposition in $1.6 billion defamation case is ‘a nightmare’ for Fox News, legal experts say : First Amendment scholars say defamation case against Fox News is “unusually strong.” ( Grid ) see also

Financial Times: Moral Money

MARCH 10, 2023

Also in today’s newsletter, China delivers a blunt message on coal

The Reformed Broker

MARCH 4, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week On TRB appeared first on The Reformed Broker.

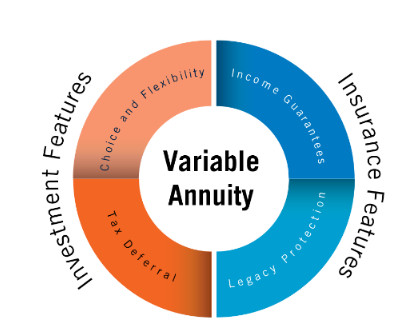

A Wealth of Common Sense

MARCH 4, 2023

Today’s Talk Your Book is brought to you by Prudential: See here and here for more information on annuities and lifetime income benefits On today’s show, we discuss: How yields have helped income-based strategies Common misconceptions about annuities What annuities make the most sense for retirees When does it make sense to purchase an annuity? How does pricing work with annuities?

The Big Picture

MARCH 10, 2023

My end-of-week morning train WFH reads: • Crypto Bank Had a Boring Collapse, Also Silicon Valley Bank : Elsewhere in boring maturity mismatches and a lack of deposit diversification. ( Money Stuff ) • Why daylight saving is so hard on the body — and what to do about it : Every process within the body, from sleep to metabolism, runs on an internal clock, known as circadian rhythm.

Financial Times M&A

MARCH 10, 2023

Abu Dhabi conglomerate’s profits almost triple as emirate’s new regime consolidates power

Financial Times: Moral Money

MARCH 7, 2023

Presidential veto will allow pension funds to take sustainability into account

A Wealth of Common Sense

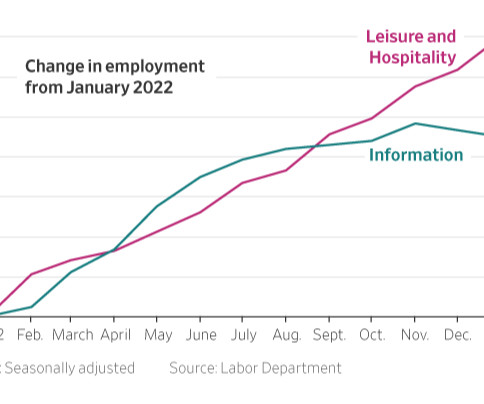

MARCH 8, 2023

Today’s Animal Spirits is brought to you by YCharts: Enter your information here to get 20% off YCharts (new clients only) On today’s show, we discuss: Why so bearish? The Exchange from the desk of Kelly Evans I spent two years revenge spending, it was hard to stop Bars, hotels and restaurants become the economy’s fastest-growing employers Net Interest on Goldman Sachs, Silvergate, Revolut, and Klarna .

The Big Picture

MARCH 6, 2023

My back-to-work morning train WFH reads: • Silicon Valley Confronts the End of Growth. It’s a New Era for Tech Stocks. Silicon Valley could use a reboot. The biggest players aren’t growing, and more than a few are seeing sharp revenue declines. Regulators seem opposed to every proposed merger, while legislators push for new rules to crack down on the internet giants.

Integrity Financial Planning

MARCH 9, 2023

If you are planning on retiring or you have just retired, this might be the perfect time to get a pet! Now that you have more time to focus on the things you want, you may find that you finally have time to take care of a pet. Pets are like companions and hobbies all rolled into one cute package! They can also be a great way to liven up your home if your kids have moved away and you feel like the house could use another friend around.

Financial Times M&A

MARCH 6, 2023

Deal for survey software group would be one of largest this year

A Wealth of Common Sense

MARCH 6, 2023

Today’s Talk Your Book is brought to you by Direxion: On today’s show, we spoke with Ed Egilinsky, Managing Director and Head of Alternatives to discuss the use of leverage in a portfolio and thematics for 2023. On today’s show, we discuss: How leveraged strategies work Direxion’s various leveraged strategies How inverse v leveraged inverse funds work in down markets What leveraged funds are used for Cos.

The Big Picture

MARCH 7, 2023

My Two-for-Tuesday morning train reads: • A 120-Year-Old Company Is Leaving Tesla in the Dust : Tesla had me convinced, for a while, that it was a cool company. fundamentally, its cars had no competition. If you wanted an electric car that could go more than 250 miles between charges, Tesla was your only choice for the better part of a decade. ( New York Times ) see also Tesla Offers an Unprecedented Look at the Bench Behind Elon Musk : In a clear response to investor criticism, the CEO shared t

Million Dollar Round Table (MDRT)

MARCH 9, 2023

By Matt Pais, MDRT Content Specialist It’s safe to say that motocross athletes are in control of their fear. But Tiago De Castro Barbosa Melo , an 11-year MDRT member from Belo Horizonte, Brazil, worried that a client in that line of work was underinsured due to the dangerous nature of his profession. “I proposed increasing his insurance to maintain at least 10 years of income in case of an accident that prevented him from working.

Financial Times M&A

MARCH 10, 2023

How the tech world’s top banker buckled under pressure

Financial Times: Moral Money

MARCH 5, 2023

Huawei is lobbying to build a 5G network in south-east Asia

The Big Picture

MARCH 4, 2023

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • You Are Not a Parrot And a chatbot is not a human. And a linguist named Emily M. Bender is very worried what will happen when we forget this. We go around assuming ours is a world in which speakers — people, creators of products, the products themselves — mean to say what they say and expect to live with the implications of their words.

Million Dollar Round Table (MDRT)

MARCH 8, 2023

By Jeremy Mark Wellington, Dip PFS, Dip Cll The concept of overnight success is a myth. Hard work, consistency and grit are the key ingredients in achieving our goals, allowing us to do more and be happier while doing so. Furthermore, making small, continuous improvements every day will be compounded over time and will give us our desired results. Here are some of the areas I focus on.

Financial Times M&A

MARCH 6, 2023

Apollo and Blackstone among those poised to provide $5.

Integrity Financial Planning

MARCH 5, 2023

Are you unsure of how much money you will need in retirement? This is a very common concern for Americans as they approach retirement age. This blog will give you some tips on how to begin estimating your needs in the future, as well as some tips on how to increase the longevity of your savings. How Much Should I Spend? One of the easiest ways to judge how much money you will need in retirement is to take stock of how much money you need right now. [1] Track your expenses and see how much money

XY Planning Network

MARCH 6, 2023

8.5 MIN READ Engaging with outsourced support can be a boon for your business and your life. The investment can expand your opportunities and your client offerings. It can buy you time and peace of mind to know you don’t have to do it all and know it all. In short, it can allow you to be a solo fiduciary financial advisor without being alone. And it turns out that not doing it all alone makes sound business sense.

Financial Times: Moral Money

MARCH 6, 2023

Also in today’s newsletter, French asset managers lead on biodiversity-focused funds

Financial Times M&A

MARCH 8, 2023

Plus, Yannick Bolloré steps into his power at Vivendi and The Restaurant Group resists activist pressure

A VC: Musings of a VC in NYC

MARCH 6, 2023

Last Thursday, three new blog posts hit USV.com announcing our three new analysts: This is our tradition at USV. When someone starts at USV, we ask them to write a post on the USV blog introducing themselves. This helps founders who come to talk to us about their companies understand the folks they will be talking to. Grace joins us from Silver Lake where she was working on their ESG strategy.

Let's personalize your content