Elon Musk proposes buying Twitter for originally agreed $44bn

Financial Times M&A

OCTOBER 4, 2022

Tesla chief and social media company were set to take their dispute to trial later this month

Financial Times M&A

OCTOBER 4, 2022

Tesla chief and social media company were set to take their dispute to trial later this month

The Reformed Broker

OCTOBER 3, 2022

I’m going to tell you a quick story in the order in which it happened. You were there. You will be familiar with the sequence of these events. But you may not have reached the shocking conclusion that I have. At least not yet. Wait for it… Our story begins in 2019… It was the best of times, it was the best of times. The tail end of a decade of uninterrupted asset price appreciation for the top decile of.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A Wealth of Common Sense

OCTOBER 7, 2022

One of the worst parts about any bear market is it feels like there’s always something else to worry about that hasn’t even happened yet that could make things even worse. The future risk everyone has had on their market bingo card for months and months now is a recession caused by the Fed. If we do get a recession anytime soon it will certainly be the most obvious recession in history that everyone predicted.

The Big Picture

OCTOBER 7, 2022

One of the really strange things about watching Federal Reserve policy is the excess of deference that is given to the Fed’s judgment. While the Fed deserves credit for when they get things right – e.g., rescuing the credit system from the great financial crisis (GFC) – they also deserve plenty of blame for the multitude of sins they commit. I am not a Fed hater or part of the crew that wants to “End the Fed.

Financial Times M&A

OCTOBER 5, 2022

Carl Icahn, Pentwater and Hindenburg Research among those that predicted the billionaire would close the deal

The Reformed Broker

OCTOBER 3, 2022

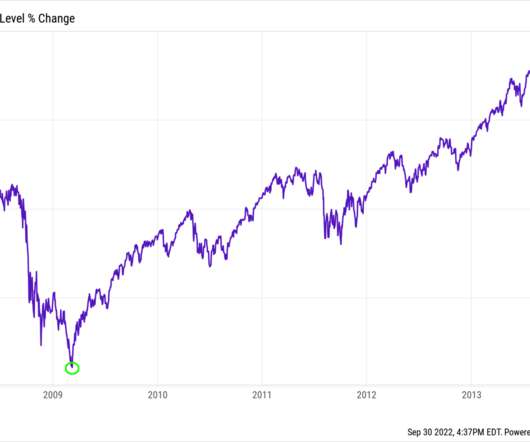

Every bear market has these two things in common: They end Expected returns go up The first thing is self-explanatory. The second thing should be obvious but from my talks with thousands of investors over the years, I have found that it is most certainly not intuitive to most people. When I tell you that expected returns are rising as stock prices fall, this is an overly simplistic way of saying that investors only get.

A Wealth of Common Sense

OCTOBER 6, 2022

A reader asks: I know it’s not feasible to consistently time the stock market. But what about the bond market? It’s expected that the Fed will raise rates throughout 2022 and maybe 2023 and then cut them again in the near future (possibly before the elections). Isn’t the following strategy an easy win: buy when rates get “high”, sell when back to 0%?

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

Investment Writing

OCTOBER 4, 2022

Have you ever struggled to generate topics for your blog posts, white papers, and other publications? You are not alone. I have some solutions to help you brainstorm. 1. Write about your clients’ mistakes and problems. The most powerful brainstorming advice I can give you is to start “ Blogging the mistakes your clients make.” My post on this topic gives you a template for writing this kind of blog post. 2.

A Wealth of Common Sense

OCTOBER 4, 2022

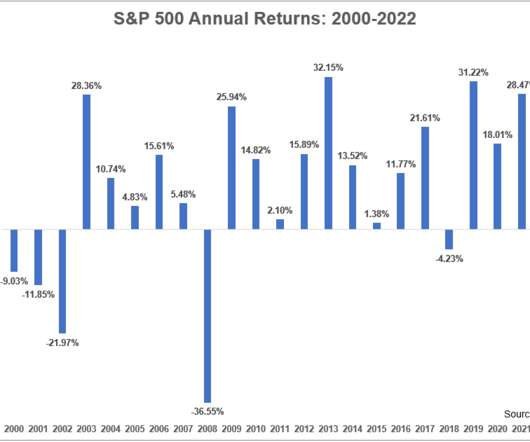

Last week legendary hedge fund manager Stanley Druckenmiller told CNBC his baseline is for U.S. stocks to go nowhere for a decade: I’m just saying we’ve had a hurricane behind us for 30 or 40 years, and it’s reversing, and I wouldn’t be surprised — in fact, it’s my central forecast — the Dow won’t be much higher in ten years than it is today.

The Big Picture

OCTOBER 1, 2022

“ Are we there yet? ” is not just a line from the kids the in the back of the car. It’s a question that investors, speculators, and professional traders have been asking themselves. The tl:dr is almost. We are almost there – down ~25% this year (so far). I wouldn’t call this an orderly sell-off, but it also hasn’t been the sort of collapse associated with true crashes like the 2000 tech wreck or the subprime mortgage/derivatives crisis.

The Reformed Broker

OCTOBER 3, 2022

TONIGHT AT 5:30PM EST! Skylar Olsen joins Michael Batnick and I on a special episode of Live from The Compound! Dr. Skyler Olsen is the Chief Economist at Zillow. Previous to her current position, Skyler founded a consultancy supporting public-facing economic data program, was head of economics at a digital mortgage start-up, and spent 8 years supporting the Zillow economic research department.

Mr. Money Mustache

OCTOBER 1, 2022

Have you ever noticed that as a whole, our society has its daily habits almost completely backwards? We’re generally so “busy” that we don’t have time to get much exercise. And then we spend countless sedentary hours sitting in our cars each week because we think that car driving saves us time. To fuel our bodies during these chaotic days, we pack ourselves with whatever convenient or tasty food we happen to crave at the moment, then add in additional snacks between meals, while watching TV, and

A Wealth of Common Sense

OCTOBER 1, 2022

I’ve been wrong a lot in my life. I was wrong to think Joey Harrington and Charles Rogers were going to be the saviors for the Detroit Lions. I was wrong when I let my brother drive my 1989 Honda Accord from Michigan to Martha’s Vineyard to visit friends when I was in high school (it broke down immediately when he brought it back). I was wrong to stock up on boot-cut jeans right before the slim look was abou.

The Big Picture

OCTOBER 1, 2022

. This week, we speak with science journalist David McRaney, who investigates the psychology of reasoning, decision-making and judgment on his blog “ You Are Not So Smart.” The blog, which he launched in 2009, spawned a bestselling book, now available in 17 languages, as well as a podcast. McRaney’s most recent book, “ How Minds Change: The Surprising Science of Belief, Opinion, and Persuasion ,” came out this year.

Financial Times M&A

OCTOBER 7, 2022

Negotiations will aim to resolve intellectual property dispute and examine future of French group’s stake

Tobias Financial

OCTOBER 6, 2022

Acting plays a major part in Alex’s life and her journey toward her career. When she was younger, she wanted to pursue an acting career seriously and auditioned for a few roles in the theater at Belmont University. Growing up, Alex was very shy and for the most part kept to herself. The only place where she felt comfortable expressing her true self was the theater stage.

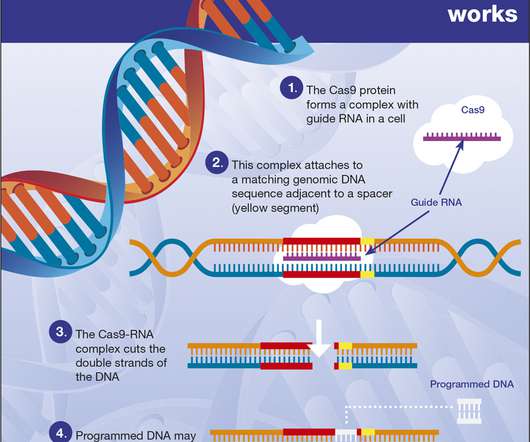

A Wealth of Common Sense

OCTOBER 3, 2022

Today’s Talk Your Book is presented by Kelly Intelligence: On today’s show, we spoke with Kevin Kelly, Founder and CEO of Kelly Intelligence about the use cases for gene editing, how biotechs perform in difficult environments, and much more. On today’s show we discuss: How Kelly Intelligence was started What CRISPR is Use cases for CRISPR The future of gene editing Incentives for gene editing How Ke.

The Big Picture

OCTOBER 3, 2022

Click for audio. I sat down with Jon Luskin of Bogleheads to record episode #18: We focus on the cognitive & behavioral side of investing, as well as different ways of approaching risk. The post Bogleheads Live appeared first on The Big Picture.

Financial Times M&A

OCTOBER 6, 2022

Billionaire asks judge to stop legal proceedings while he and social media company hash out how to close transaction

Financial Times: Moral Money

OCTOBER 5, 2022

Alphabet soup of LDI and ESG puts BlackRock and others in the financial hot seat

Walkner Condon Financial Advisors

OCTOBER 4, 2022

As fall falls and the temperatures signal a new season, we are reminded why we love this time of year in Wisconsin. We are replacing our shorts and swim trunks with flannel shirts and hooded sweatshirts. Even though most of us have been through the Midwest seasonal pattern for decades, every season feels new and different from last year or the year before.

The Big Picture

OCTOBER 4, 2022

My Two-for-Tuesday morning train WFH reads: • Washout : If the leaders are falling, you know the rest of the bunch already got washed out. Indeed, only 8% of the Nasdaq-100 is above the 200-day moving average. ( Irrelevant Investor ) see also Getting Long-Term Bullish : My general investment philosophy is the more bearish things feel in the short run the more bullish I should be over the long run.

Financial Times M&A

OCTOBER 5, 2022

South Korean group’s key task would be to fix the US company’s much-maligned search engine

Financial Times: Moral Money

OCTOBER 3, 2022

World’s largest asset manager has come under fire for its stakes in large companies and ESG strategy

The Reformed Broker

OCTOBER 2, 2022

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

The Big Picture

OCTOBER 1, 2022

The new BMW XM Hybrid is a lot of things: a high horsepower, very expensive, top-of-the-line SUV, that is the first hybrid from BMW Motorsports GmbH, aka “M” sports division. The specs on the Plug-in hybrid powertrain are impressive: -TwinPower Turbo, 4.4-liter V-8 engine. -644HP + 590lb-ft of torque. -0-60 mph in 4.1 seconds. -8-speed M Steptronic transmission. -194-hp electric motor. -317-volt battery pack 25.7-kWh battery pack (30 miles e-driving range).

Financial Times M&A

OCTOBER 5, 2022

Plus, Arm’s troubles in the UK intensify and Ray Dalio abdicates the throne for the third time

Financial Times: Moral Money

OCTOBER 3, 2022

Hedge fund increases stake in British company after previous scepticism of extraction method

Financial Symmetry

OCTOBER 3, 2022

Have you ever been offered a non-qualified deferred compensation plan as part of your benefits package? Do you know someone who has, but wasn’t sure exactly what it was? If either of these fits you, then you won’t want to … Continued. The post Should You Use a Non-Qualified Deferred-Compensation Plan for Your Retirement Savings? Ep #174 appeared first on Financial Symmetry, Inc.

The Big Picture

OCTOBER 1, 2022

Welcome to October! The weekend is here, so pour yourself a mug of Porto Rico Import coffee, grab a seat on the sofa, and get ready for our longer-form weekend reads: • The Great Bluff: How the Ukrainians Outwitted Putin’s Army : Russia’s army was thought to be vastly superior. But Ukraine has nevertheless managed to secure an almost unbelievable coup, taking back huge swaths of territory in the northeast.

Financial Times M&A

OCTOBER 6, 2022

Lenders’ commitment to finance Elon Musk’s buyout may cost them hundreds of millions of dollars

Financial Times: Moral Money

OCTOBER 2, 2022

Ex-Fed official says blacklisting of companies over climate policies encourages risky investment

Integrity Financial Planning

OCTOBER 3, 2022

With market volatility and inflation affecting people’s finances, talk about investment strategies and portfolio longevity seems to dominate retirement planning conversations. But one of the most important aspects of retirement is often overlooked in these conversations: healthcare costs. There are many unexpected costs in retirement, but healthcare is one of the largest spending categories on average for retirees, so having a cohesive plan to cover these necessities can go a long way, regardles

The Big Picture

OCTOBER 6, 2022

My morning train WFH reads: • Is the Era of Low Interest Rates Over? There were fundamental reasons interest rates were so low three years ago. Those fundamentals haven’t changed; if anything, they’ve gotten stronger. So it’s hard to understand why, once the dust from the fight against inflation has settled, we won’t go back to a very-low-rate world. ( New York Times ). • What to Buy?

Financial Times M&A

OCTOBER 4, 2022

Tesla boss puts original offer back on table just days before trial but the social media group’s lawyers are wary

Financial Times: Moral Money

OCTOBER 3, 2022

Plus, what the EU’s scope 3 rules mean for the auto industry

Let's personalize your content